UNLOCKING LIFE’S SECRET FORMULAS to SUCCESS

STUMP BEZOS

What is the name of Amazon’s official mascot, shown here?

[ Answer at bottom of email ]

Need a wall calendar to keep you organized in 2024? This one on Amazon might keep you cool all year.

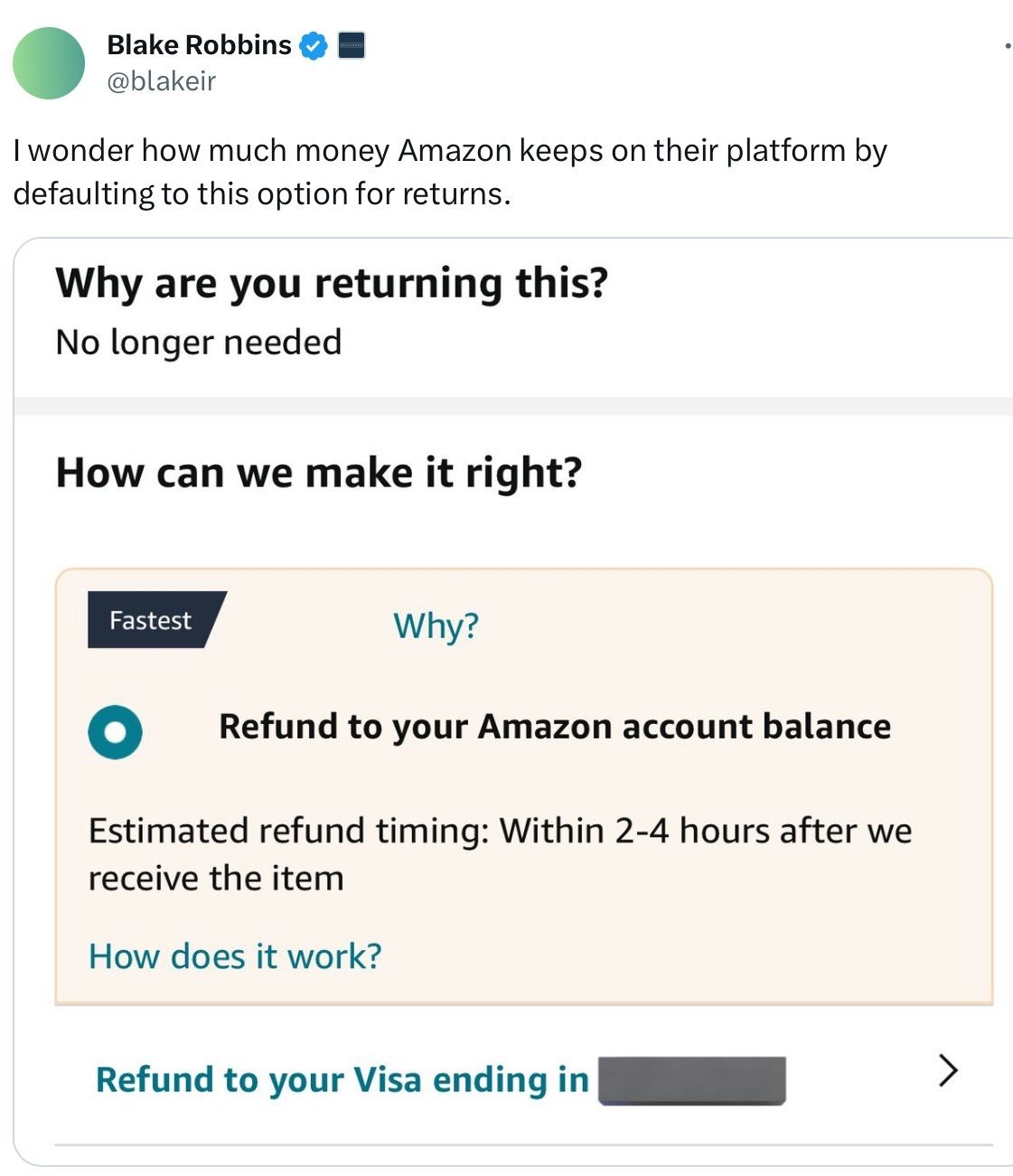

💰 CUSTOMER CLAW BACK PROFITS TIME

The post-holiday season in e-commerce is often marked by a surge in returns, a phenomenon that sellers have come to anticipate and strategize around. The 'Refund Effect' encapsulates a unique consumer behavior where customers, upon receiving a refund, are more likely to repurchase, viewing the refunded money as already spent.

Retailers are capitalizing on this by cross-selling during the return process, offering alternative products that better meet customer needs, thereby transforming potential losses into new sales opportunities.

The logistical and financial burdens of handling returns have led to a significant shift in strategies. This year, 59% of retailers have adopted a 'keep it' policy, where customers are issued refunds without the need to return the item, especially for low-value goods.

This approach is a response to the staggering forecast that U.S. shoppers will return approximately $173 billion worth of holiday purchases in the next month.

Sellers are increasingly recognizing that the cost of processing returns (on average $30 in cost each) can outweigh the value of the returned item, prompting a reevaluation of return policies to balance customer satisfaction with operational costs.

Amazon has a comprehensive returns process, emphasizing customer support and convenience with over 8,000 drop-off locations. The company inspects returned items to determine their next life, whether it be resale, liquidation, or donation through its partnership with Good360.

However, Amazon has also adjusted its policies, introducing return fees at certain locations and shortening the holiday return period by one month (from Nov 1 to Jan 31 instead of Oct 1 to Jan 31), reflecting a broader industry trend towards more stringent return policies.

Several action items can help reduce returns and mitigate losses:

Provide Detailed Product Descriptions: Ensure that all listings have accurate and detailed descriptions along with high-quality images to set the right customer expectations.

Enhance Customer Support: Offer comprehensive support, including product setup, use, or troubleshooting to resolve issues that might otherwise lead to returns.

Implement Quality Control Measures: Regularly check and improve the quality of products to reduce the incidence of returns due to defects or damage.

Encourage Exchanges or Store Credit: Instead of refunds, offer customers the option to exchange the product or receive store credit, keeping the sales within the business.

Analyze Return Data: Regularly review return reasons and patterns to identify and address common issues, leading to improvements in product offerings and customer satisfaction.

🏦 MAXIMIZE YOUR Q5

Q5 Defined: Q5, the period between late December and mid-January, is a crucial time to capitalize on post-holiday consumer activity, including sales, returns, and gift card redemptions.

Gift Card Impact: With 44% of consumers giving gift cards and an anticipated $29.3 billion to be spent on them this holiday season, leveraging gift card-focused marketing can be particularly effective during Q5.

Gen Z is Lazy and Loves Gift Cards: Gen Z purchased 70% more gift cards than older generations during this holiday season, who typically get 3 to 4 gift cards and spend on average $49.43 per card. Gen Z, on the other hand, averaged 10 physical gift cards and 7 digital cards.

Cost-Effective Marketing: Advertising costs typically drop during Q5, offering a more economical opportunity for marketers compared to the high prices of the holiday season, with an average 20% decrease in CPA compared to Q1 and Q4.

Advantages of Q5: The period sees reduced competition, sustained high purchase intent, more time spent on platforms due to time off work, and an influx of new devices, making it an ideal time for targeted advertising.

Strategic Moves for Success: To make the most of Q5, adapt your ad creatives to continue engaging customers with targeted promotions and messaging.

🌎 LIFE FORMULAS YOU SHOULD KNOW

⚖️ PEAK INSIDE BENTIAGO’S BANKRUPTCY

Bentiago was started by two young computer science majors at Dartmouth. By 2018 they had hit 8 figures in sales on the Amazon European marketplaces selling pillows and other items (5 brands).

Based on their success as sellers, they formed Bentiago to buy and acquire Amazon businesses during the height of the aggregator boom. This fall, they filed bankruptcy.

Here are some interesting tidbits of what happened:

E-commerce Brand Incubator: Benitago started as a dorm room project at Dartmouth College and grew into a large e-commerce brand incubator and aggregator, selling nearly 1,000 products across dozens of brands covering a wide range of products.

Rapid Growth and Reversal: Benitago experienced rapid growth, especially during the early stages of the COVID-19 pandemic, growing into an approximately $20 million run-rate revenue company by March 2021. However, as consumer preferences shifted post-pandemic, the company faced a dramatic reversal due to shrinking e-commerce sectors.

Amazon Optimization: The company's business model was hyper-optimized for Amazon, using proprietary calculations to identify search trends and consumer sentiment data.

Inventory Contribution for Liquidity: In 2022, Benitago contributed approximately $9 million in inventory to its subsidiary, Acrux LLC, and the Acrux Subsidiaries to fund advances under a loan agreement used to finance acquisitions of additional brands.

Special Manager Appointment: In July 2023, a "special manager" was appointed for Acrux LLC and the Acrux Subsidiaries with sole and exclusive authority regarding certain bankruptcy and restructuring transactions.

Complex Capital Structure: Benitago had a complex capital structure with various types of preferred stock issued to investors at different times, including Series Seed Preferred, Series A Preferred, and Series A-1 Preferred stock, each with specific rights and preferences.

Fulfillment by Amazon (FBA): All of Benitago's brands were sold on the Amazon platform and were specifically designed for compatibility with Amazon's FBA service.

Significant Debt and Financing Facilities: Benitago Inc. and its subsidiary, Acrux LLC, had separate secured financing facilities, with neither entity guaranteeing the other's debt. This included a revolving loan facility with an initial commitment of more than $2 million for Benitago Inc. and a separate loan agreement for Acrux LLC.

Aggressive Brand Acquisitions: The company took on significant debt to fund the acquisitions of additional brands. These acquisitions, particularly during the height of the pandemic, may not have performed as expected, leading to a discrepancy between the valuations and actual performance.

Finances, Creditors and Debt Amounts:

SellersFunding: Benitago Inc. owed approximately $9.6 million under the Parent Loan Agreement with SellersFunding (now SellersFi). This debt was secured by certain assets.

CoVenture Bento Credit Opportunities GP: Owed $85 million.

A couple in Romania: $1.5 million, presumably for product photography, development and marketing

Cash on Hand: As of the Petition Date, Benitago Inc. had approximately $7.5 million in cash across various bank accounts.

Inventory: The company reported having approximately $17 million in inventory. This inventory was primarily held at Amazon FBA facilities or third-party warehouses.

Revenue: The average monthly revenue for 2022 was approximately $6.3 million. For the first six months of 2023, the average monthly revenue was approximately $7.5 million.

🚢 EXPECT DELAYS and FREIGHT COST INCREASES

Shipments headed to the UK or EU traversing the Red Sea and Suez Canal, and shipments crossing the Panama Canal are seeing delays and increased costs.

One large seller recently posted in the BDSS Whatsapp Group that his forwarder just gave him a heads up that starting January 1, there will be a $4,000-$5,000 surcharge and 10-12 day delay on FCLs going through the Suez Canal.

Rates from China are following suit, with $1,000 extra for FCLs according to Barak Yolga of Unicargo. He says there are space problems and 7-10 day departure delays before Chinese New Year, which is February 12th.

The global shipping industry is navigating a sea of challenges as the Suez Canal, a critical artery for international trade, faces threats from Houthi-led attacks in the Red Sea.

Major carriers are rerouting vessels, with some opting for the longer Cape of Good Hope route, leading to increased transit times and higher freight costs.

This shift is a response to the escalating conflict in the region, where Saudi Arabia is striving to maintain a low profile to avoid further entanglement in the Yemeni conflict.

The US and a few other nations have offered to provide some protection for cargo vessels, but how much is not clear.

About 50 vessels a day go through the Suez Canal, and recent data suggested that 32 per day were being diverted, says Chris Rogers, head of supply chain research at S&P Global Market Intelligence. He notes that nearly 15 percent of European imports were transported by sea from Asia and the Persian Gulf, most of which go through the Suez.

The situation is further complicated by the Panama Canal's ongoing drought restrictions, adding layers of delay and logistical hurdles for shippers worldwide.

On the European front, UK and EU FBA sellers are adjusting their strategies to accommodate higher operational costs. The ripple effects of these fee adjustments are expected to influence pricing, competitiveness, and market dynamics in e-commerce.

The Panama Canal is also facing ongoing restrictions due to persistently low water levels at Gatun Lake, significantly reducing transit capacity.

The number of booking slots has been steadily decreasing, with further reductions planned, impacting trade routes, particularly between northeastern Asia and the U.S., which relies heavily on the canal for container movement.

📈 DATA + AI = more profits faster

Data Dive and Escala have teamed up to create a totally free set of 4 SOPs that can help you sell more on Amazon and avoid costly product research mistakes.

Download them for free here:

📹 AMAZON SUED for SELLING SPY CAMERA

The is a true story unfolding now …

Shocking Spy Cam Scandal Rocks Amazon: Two years ago, a Brazilian foreign exchange student discovered her West Virginia host secretly filmed her with a "Hidden Clothes Hook Camera" bought on Amazon. The aspiring actress found herself the unwitting star of her host's creepy recordings.

Amazon in Hot Water as she files Lawsuit: The plot thickens as the lawsuit against Amazon, accusing them of peddling spy gear for shady purposes, recently dodged a dismissal by a judge. Amazon sells an array of these sneaky gadgets, with some pretty questionable marketing hinting at their illicit uses.

Legal Showdown Looms for Amazon: As the judge trashed most of Amazon's defense, the stage is set for a courtroom showdown. The case could spell disaster for the sneaky spy camera market and lead to more product restrictions on the marketplace.

The listing has been removed by Amazon, but I found it on the Wayback Machine.

🔥 MORE HOT PICKS 🔥

🥃 PARTING SHOT

“The best way to predict the future is to create it.”

✌🏼 Happy New Year! See you again in 2024!

The answer to today’s STUMP BEZOS is

His name is “Peccy.”