This issue sponsored by

HERE’S WHAT’S FRESH on TAP TODAY

🇨🇳 Amazon REALLY wants more Chinese Sellers

💰 Recover even MORE money Amazon owes you

💡 EBITDA explained like you were a 4th grader

🪧 What’s a good ACoS for your category?

🪪 What is the value of a brand?

🥮 TikTok honeymoon period ending

🍷 Thanks Amazon - you truly are a buzzkill

STUMP BEZOS

Jeff Bezos founded Amazon in 1994. What percentage of Amazon does he still own (making him the third richest person in the world)?

[ Answer at bottom of email ]

💰 AMAZON WANTS MORE CHINESE SELLERS

In a strategic pivot, Amazon is actively courting Chinese merchants after previously banning many of the biggest ones in a 2021 crackdown.

The e-commerce giant's decision comes amidst fierce competition from Chinese-based platforms like Shein and Temu. Amazon's multifaceted approach includes establishing an innovation center in Shenzhen, offering enhanced supply chain services, and leveraging AI to streamline operations.

Why Amazon is Recruiting Banned Chinese Sellers Back: Amazon's crackdown on fake reviews in 2021 led to the closure of over 3,000 merchant accounts associated with around 600 Chinese brands. This action significantly reduced the presence of Chinese sellers on the platform, with their share among Amazon's top sellers dropping from 40% to 33%.

As these sellers sought alternative platforms, Amazon's competitive edge waned, especially against the likes of Shein and Temu, which have shown remarkable growth and market penetration.

Recognizing the pivotal role these sellers play in its ecosystem, Amazon is now keen on bringing them back, albeit with a focus on legitimate and efficient business practices.

How Amazon is Wooing Them Back: Amazon's strategy to re-attract these sellers is multifaceted. The company is setting up an innovation center in Shenzhen, known for its technological prowess and e-commerce activity. This center aims to assist sellers with product launching, brand building and digitalization.

Additionally, Amazon is opening its comprehensive supply chain service to Chinese sellers, allowing them access to its warehousing, distribution and couriers. The company is also exploring AI to enhance its selling platform, making the process more efficient and user-friendly for Chinese speakers.

What Amazon Expects to Happen: Amazon anticipates that these efforts will not only bring back the Chinese sellers but also strengthen its global market position.

By providing advanced tools and services, Amazon expects to see an increase in the number and sales volume of Chinese merchants on its platform, thereby regaining lost market share and setting a new standard for cross-border e-commerce.

The company also hopes that these initiatives will deter sellers from moving to or continuing with competitors, ensuring Amazon remains a dominant player in the global e-commerce landscape.

Contrast with Indonesia’s Approach: Amazon's strategic initiative to re-engage Chinese sellers starkly contrasts with the Indonesian government's approach to e-commerce regulation for its 270 million citizens.

While Amazon is expanding its global e-commerce footprint by inviting more international sellers and streamlining their operations, the Indonesian government has taken a protective stance.

In October it implemented a ban on e-commerce transactions, especially sellers from China, on social media platforms to shield local small businesses from international competition and the influx of cheap foreign products. Indonesia was TikTok's second-largest global market after the U.S.

This regulatory move aims to create a more controlled and a fair market environment for domestic sellers, contrasting with Amazon's open, competitive and expansive global market strategy.

TikTok and Indonesian players GoTo and Tokopedia changed their approach and are trying to create a work around, saying "more than 90 percent of the combined business’ merchants are micro, small and medium enterprises and the companies will undertake a series of joint initiatives to support them.

"Going forward, TikTok, Tokopedia and GoTo will transform Indonesia’s e-commerce sector, creating millions of new job opportunities over the next five years."

Hmmm.

It’s not very often that you see a service provider really change the game.

TrueOps is the new go to solution for Amazon reimbursements.

With only 10% commission and an exclusively North American audit team, they are already making a huge impact.

The audit team is led by licensed CPA & 8-figure e-com CFO Joel MacPherson. He brings the discipline of a real audit team and it shows in the results.They frequently find $10’s of thousands left behind by the offshore teams of other reimbursement companies.

A couple examples:

Jonathan, CEO of Kewlioo switched to TrueOps from a leading audit company and recovered an additional $20k within a week.

TrueOps was invited to partner with Saul's TheBuyBox.io community. They audited a growing list of 30+ Amazon brands from the community and have been able to recover $10’s of thousands left behind by other tools.

They’ve fine tuned their onboarding process to the point where you can connect your accounts in under 3 minutes.

If you've never had an auditor before or you just want a second set of eyes to make sure you are catching it all, click here & get your first 10K of reimbursements for free.

🪧 WHAT is a GOOD ACoS on AMAZON?

A good Advertising Cost of Sale (ACoS) on Amazon can vary widely depending on the category of products, the market’s competitiveness and the seller’s goals.

ACoS = (ad spend ÷ ad revenue) x 100

Openbridge used Amazon’s Brand Metric Reports to create reference values for a variety of categories (check your category below).

A few ACoS benchmark examples:

Baby

Top 25%: 23%

Typical: 35%

Bottom 25%: 55%

Home & Kitchen

Top 25%: 18%

Typical: 25%

Bottom 25%: 35%

Sports & Outdoors

Top 25%: 12%

Typical: 22%

Bottom 25%: 34%

Openbridge eliminates manual file downloads to calculate TACoS, ROAS, ACoS, and other Amazon KPIs. They collect, catalog, and unify private, trusted industry-leading cloud data warehouses and lakes like Azure, Snowflake, BigQuery, AWS, and Databricks.

Once your Amazon data is unified, you can use your favorite analytic tools like Power BI, Looker, Tableau and others for data-driven insights.

To see all the categories they compiled ACOS benchmark data for, as well as 10 good tips on how to reduce your ACOS, click here.

🪪 WHAT’S THE VALUE of a BRAND?

Seth Godin is the Godfather of Marketing. In this video every e-commerce seller should watch, Godin distinguishes sharply between mere logos and true brands, emphasizing that a real brand embodies a promise and fosters distinct expectations.

He delves deep into the strategy of identifying the right audience ("people who care"). Godin stresses the importance of balancing direct and brand marketing, utilizing the former for immediate results while investing in the latter for long-term relationships and sustained value.

Branding vs. Logo: Seth distinguishes between having a brand, which promises and delivers distinct value, and merely having a logo, which many companies mistake for a brand.

Value of a Brand: The real value of a brand is quantified by how much extra customers are willing to pay for the promise and expectations it sets.

Marketing’s Misconception: Godin emphasizes the need to dispel the belief that marketing is inherently selfish or a scam, redefining it as a tool for making impactful change.

Balance of Marketing Types: The need to balance direct marketing, which is immediate and measurable, with brand marketing, which builds long-term relationships and value, is highlighted.

Personal and Strategic Growth: He discusses the importance of being truthful and strategic in personal and business growth, advocating for focusing on creating value and making an impact.

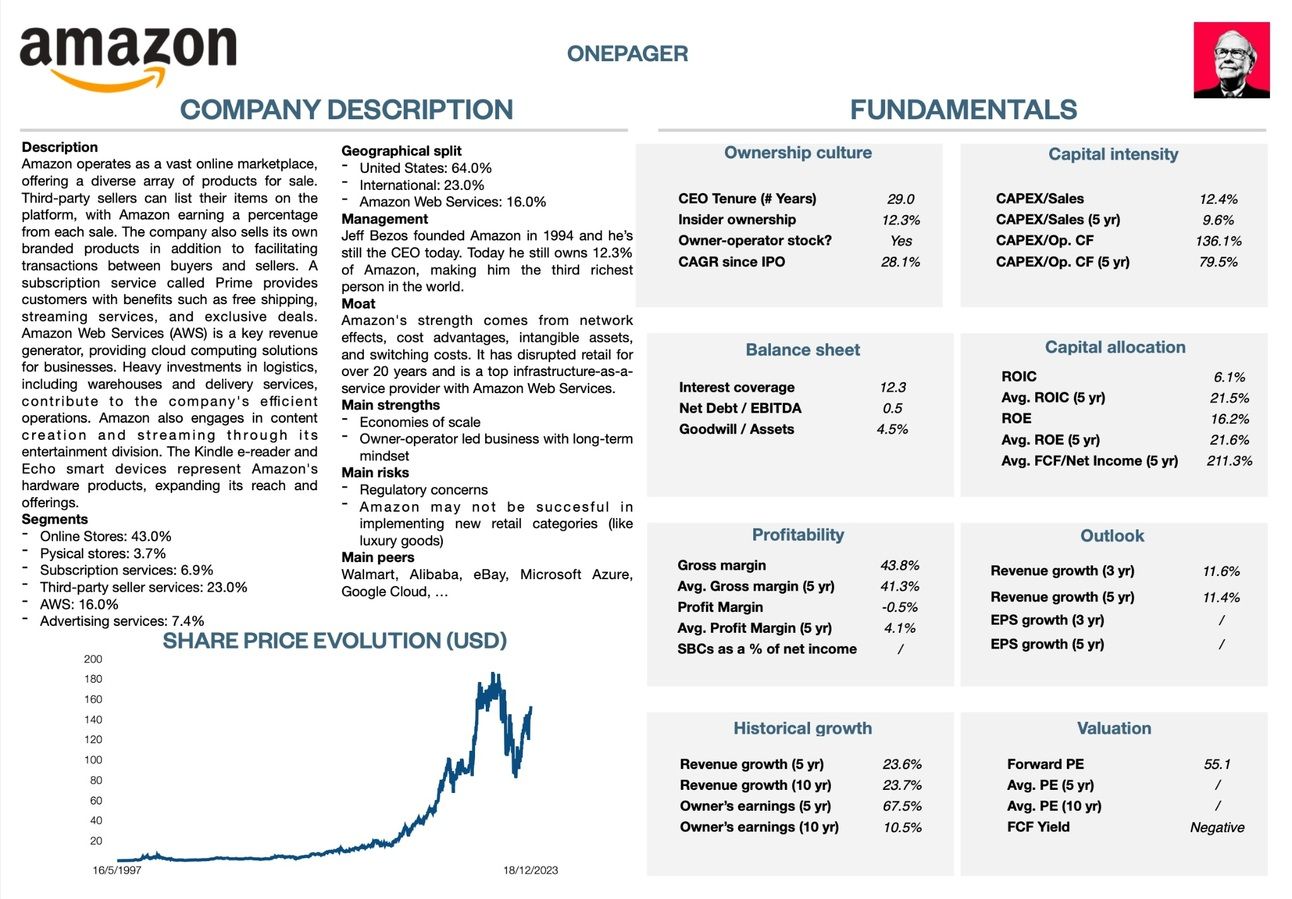

🖥️ AMAZON ONE-PAGE SUMMARY

🥮 TIK TOK HONEYMOON PHASE ENDING

TikTok disputes it, but internal Lark message say otherwise: TikTok moderators were recently told to avoid flagging potential problems on videos linking to over 60 specific Amazon accounts since Amazon is the platform’s highest spending advertiser.

The competition between TikTok, Amazon, Shein and Temu is heating up in 2024. Amazon recently reduced their referral fees for apparel priced under $15 to 5% from 17%, and for clothing prices between $15-$20 to 10% from 17% in an effort to compete specifically against Shein.

TikTok Shop’s fees are 2% + 30 cents per order, but that is changing to 6% on April 1 and adjusting to 8% on July 1, 2024.

But it’s not just e-commerce Temu is disrupting. In November, Temu accounted for nearly 17% of market share in the United States within the discount stores category, according to data analytics firm Earnest Analytics. That compares to 8% for the dollar chain Five Below, 43% for Dollar General and 28% for Dollar Tree.

Also, South Korea's e-commerce purchases from companies in China such as AliExpress and Temu surpassed online purchases from the U.S. this year for the first time.

In the first three quarters of 2023, South Koreans made online purchases worth more than $3.5 billion from sellers outside the country. China accounted for 46.4% of those purchases, while the U.S. accounted for 29.1%, according to South Korea's Customs Services.

📖 AMAZON AGENCY SUMMIT

If you are an agency owner, Steven Pope and gang have created a special summit for you next week.

They have brought together industry leading experts to help agencies, freelancers and service providers grow their businesses while creating scalable systems to better service clients.

You’ll learn things like …

📝 Actionable strategies and tactics to implement in your agency

🎯 How to attract and retain ideal clients

📆 Blueprint for a successful and profitable agency

📊 Leverage data to confidently get control

💰 Set up your agency for an 8-figure exit

Want to be featured in this section? Use your referral link in this email to refer at least 10 active subscribers, then email me to get your event, course, webinar or tool “Shouted-Out” free to 6,700+ subscribers.

🍷 THANKS AMAZON - YOU TRULY ARE a BUZZKILL

Welcome to the world of selling on Amazon’s marketplace Molly Fedick!

Molly has been facing a significant challenge with her Buzzkill Wine business. For over nine months, she’s been successfully selling non-alcoholic Sauvignon Blanc on Amazon, often ranking between #1-3 in the white wine bestsellers.

In December, she expanded her product line with two new varietals: Non-alcoholic Cabernet and sparkling Blanc de Blancs, both "alcohol-removed" with an alcohol content of less than 0.5% ABV.

According to the FDA, this categorizes them as "non-alcoholic" and, therefore, as food products, not alcohol. Many brands with products that are <.5% ABV, including Athletic Brewing Co. sell on Amazon without issue.

Confident from her past experience with the Sauv Blanc, she shipped several pallets of these new products to Amazon FBA. However, to her dismay, Amazon rejected the shipment for "containing alcohol," despite the FDA's classification. She’s been in a frustrating loop with Amazon seller support for weeks trying to resolve the issue.

Unfortunately these kinds of problems are all too common on Amazon and getting a competent person at Amazon to help is not any easy task. There are for-pay a la carte services, like ecommerceChris, that can try to help sellers.

Sometimes Amazon Strategic Account Services (SAS) reps can help, but it really depends on their experience and access. Amazon requires a 3-month commitment and charges around $1,600 per month plus 0.3% of your sales (up to a max of $5,000 per month in fees) for you to have a dedicated person inside Amazon for your account.

The best solution I have seen is a sort of “Amazon Genius Bar” type of set-up. Helium 10 had one at its Sell and Scale event in September 2022, and Amazon had a similar one at Amazon Accelerate this past September in Seattle.

Competent staff from Amazon could often solve problems in a matter of minutes with a few button clicks for distressed and frustrated sellers. At Sell & Scale, one of the BDSS 8 speakers from Puerto Rico was literally in tears after an issue was solved with a couple clicks of a mouse. She had been fighting to get it fixed with her brand for two years!

In Seattle, another large seller who represents several brands told BDSN he would fly back from Asia next year to attend Accelerate for the sole purpose of being able to speak to competent humans at Amazon that can fix client issues.

I (Kevin) feel Molly’s pain. In 2020-21 myself and partners literally lost over $1.4 million selling on Amazon for similar reasons, even with someone much higher up than a SAS rep inside Amazon on personal cell phone speed dial.

It’s flat out ridiculous and messes with people’s livelihoods and businesses, but it is a hard cold fact you must prepare to deal with at some point if you want to sell on Amazon’s marketplace - one of the greatest opportunities ever created for entrepreneurs to create life-changing wealth (or lose everything).

🥃 PARTING SHOT

“Marry the niche, date the product. You can give up on a product, but don’t give up on a niche you believe in.”

✌🏼 Hope you learned something today!

Would love to hear from you! Hit reply and let me know what you enjoyed.

See you again on Monday …

The answer to today’s STUMP BEZOS is

Jeff still owns 12.3% of Amazon