STUMP BEZOS

Valentine’s Day is Saturday. How much are consumers expected to spend on Valentine’s gifts this year in the United States?

[ Answer at bottom of email ]

👀 CHINESE FACTORIES GOING DIRECT - TIK TOK is LAUNCHPAD

For decades, Chinese manufacturers were invisible. They made the products, slapped someone else's label on them, and shipped containers to Amazon warehouses. The factory never knew the customer. The customer never knew the factory.

That changed on Amazon several years ago, and now its happening again on TikTok.

A recent KrASIA deep dive profiles several Chinese manufacturers who are bypassing the traditional middleman playbook and selling directly to global consumers through TikTok Shop. And the numbers are hard to ignore, TikTok Shop hit nearly $100 billion in GMV in 2025 with 400 million+ active shoppers across 17 markets.

Here's what's happening on the ground:

A Christmas tree factory in Dongguan sold $500K worth of collapsible trees in four months. It was a product that would've been buried on Amazon because nobody searches for "foldable Christmas tree." But a short video showing it pop open in seconds? That sells itself.

A nut milk maker company couldn't get traction on Amazon because the category was dominated by established blender brands. Then a TikTok creator with 300K followers posted a demo video.

It pulled 2.2 million views and drove monthly sales to $1.4 million. And here's the kicker: it lifted their Amazon sales too by 60% with the halo effect, as people discovered the product on TikTok then searched for it on Amazon.

A wig manufacturer in Xuchang is now iterating on products in real-time based on TikTok comments and live stream feedback. Customers said the glueless wigs felt unstable? They added detachable clips within days.

A plus-size clothing factory that was doing $16.8M/year as an anonymous OEM supplier built their own brand called Finjani through TikTok Shop. One viral dress sold 120,000 units in five months. Now every garment leaving that Dongguan factory carries the Finjani tag.

This isn't just a TikTok story. It's a structural shift in how Chinese manufacturers think about their businesses.

For years, these factories were content being behind the scenes, filling your POs, making your private label products, competing on price. Now they're discovering they can build their own brands, collect their own customer data, and own the relationship with the end consumer.

The implications are significant. If your Chinese supplier is watching TikTok comments to figure out what customers want next, they don't need your product roadmap anymore.

They have their own. And they're getting real-time market intelligence that most Amazon sellers who are looking at keyword data and BSR rankings simply don't have access to.

The other big takeaway: TikTok Shop is proving especially dangerous for products that are best understood through demonstration. If your product has a "wow" moment that a static Amazon listing can't capture, someone in Shenzhen is probably already filming it.

This doesn't mean Amazon is dying. The nut milk maker example actually shows how TikTok discovery drives Amazon search traffic. But it does mean the competitive landscape is evolving. The factories that used to be your supply chain are becoming your competition, and they're building audiences, not just listings.

🔭 YOU GOTTA SEE THIS

If you’re managing Amazon PPC, you need to check out this PPC Den Podcast episode. Mike walks you through how to audit your campaigns using bulk files and pivot tables, step by step.

What’s really valuable is how he highlights where ad spend might be wasted, which campaigns or products are performing best, and how to optimize match types like broad, phrase, and exact.

Mike even covers pivot table examples, double pivots, and placement analysis, giving you a practical workflow you can start using right away.

🌎 INTERESTING STATS

🛍️ MID-TICKET BEAUTY & APPAREL PRINT MONEY on TIKTOK

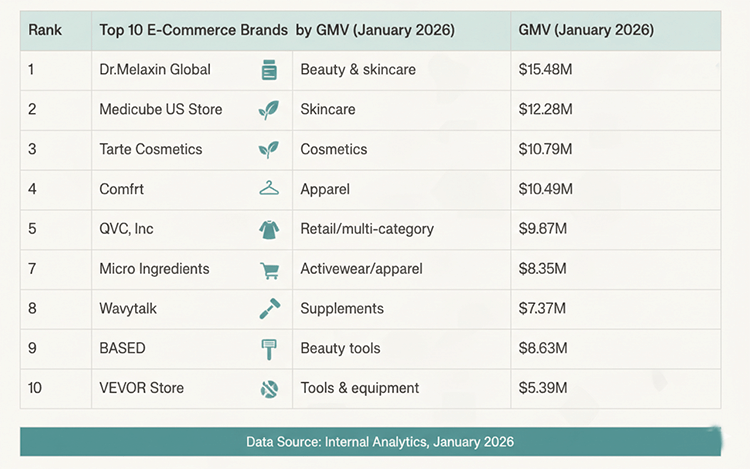

TikTok Shop’s January leaderboard shows beauty, skincare, and affordable fashion dominating social commerce, with most top players seeing post-holiday declines but still pushing eight-figure monthly revenue.

Fast stats Amazon sellers should note

Top shop: Dr.Melaxin Global at $15.48M revenue, moving 452K units at a premium ~$35 AOV.

Only 4 of the top 10 shops grew month over month; the rest saw pullbacks after Q4.

Seven of the ten shops held their December rank, signaling a more stable TikTok Shop hierarchy.

Average price points cluster in the mid-ticket tier (roughly $25–$60), not impulse-only pricing.

Who’s winning and why

Dr.Melaxin Global (beauty/skincare): Holds #1 for the second month despite a 17% dip, proving repeatable demand and strong live-selling or UGC funnels.

Medicube US Store (skincare): $12.28M and the only positive grower in the top three, with the highest AOV among beauty players at ~$40.67.

Tarte Cosmetics: Breakout winner, jumping from #9 to #3 with 103.8% growth to $10.79M by pairing lower AOV (~$26) with huge volume (413K units).

Comfrt and Halara US (apparel/activewear): Both still large, but trending down, showing that fashion is competitive and sensitive to seasonality and promo cycles.

QVC, Inc and VEVOR Store: Traditional/utility retail formats can still win, with QVC at $9.87M and VEVOR commanding the highest AOV at ~$59.65.

Category and pricing signals

Beauty, skincare, and cosmetics account for 4 of the top 10 (Dr.Melaxin, Medicube, Tarte, Wavytalk), reinforcing creator-friendly, demonstrable products as TikTok-native winners.

Apparel/activewear (Comfrt, Halara) and niche verticals like supplements (Micro Ingredients) and men’s grooming (BASED) show that repeat-consumption, demonstrable benefits, and identity-driven brands get traction.

Price bands cluster in the “affordable but not cheap” range: ~$25–$40 for most, with outliers like VEVOR near $60 AOV, proving that higher ticket can still move if content and utility are strong.

🛠️ BDSN SOFTWARE TOOL of the DAY 🛠️

What if you could talk to your Amazon Ads data inside ChatGPT or Claude — and have it actually do things?

That's what Hector just shipped. They call it Hector MCP, and it connects your Amazon Ads, Seller Central, and Vendor Central data directly into the AI tools you're probably already using.

The setup takes about 60 minutes, and once it's live, you can ask questions in plain English like:

"Why did my ROAS drop in the last 7 days?" "Which campaigns are out of budget right now?" "Show me search terms with zero orders and over $100 in spend." "Calculate ideal bids for my top 200 targets based on my target ROAS."

But here's the part that makes this more than just a reporting trick: you can also take action directly from the conversation. Create campaigns. Change bids in bulk. Adjust budgets. Add negative keywords. All without leaving ChatGPT or Claude.

The thinking behind it is smart: instead of building yet another dashboard you have to learn, they brought your Amazon data to where a lot of sellers are already experimenting with AI.

It's currently in beta. If you want to try it, message Hector's team and they'll get you set up.

🎨 YOUR BRAND LOGO MAY BE COSTING YOU SALES

If your logo doesn't hint at what you sell, you could be leaving money on the table , especially if you're still building brand recognition on Amazon.

Research across 7 experiments with over 4,000 people found that logos which visually describe what a company does (vs. abstract or unrelated designs) made people rate brands up to 27.7% more authentic and 18.7% more positive, and they were more likely to buy.

What this means for your Amazon brand:

Your logo shows up on your storefront, A+ Content, packaging, and sponsored brand ads. It's one of the first things shoppers see, and most of them have never heard of you.

That makes this finding even more relevant. The research showed the effect is strongest for new or unfamiliar brands, which is exactly what most Amazon brands are to most shoppers.

How to apply this:

Sell kitchen products? Work a subtle utensil or flame into your logo.

Sell pet supplies? A paw print or animal silhouette instantly communicates what you're about.

Sell supplements? Clean lines, a leaf, or a capsule shape can signal health and wellness before anyone reads a word.

Use colors and shapes that connect to your category too. Earth tones for organic products. Blues for wellness. Bold colors for kids' products.

Why it works: Shoppers scrolling through Amazon results are making snap judgments. A descriptive logo is easier to process, so people immediately understand what your brand is about. That clarity signals honesty and transparency, which builds trust, which then drives clicks and conversions.

One caveat: The research found this effect reverses for products people find undesirable (think: lice treatment or wart remover). If your product solves an embarrassing problem, a more abstract logo actually performs better. Nobody wants a giant wart on their shampoo bottle.

For most Amazon sellers, a logo that clearly connects to your product category is a small change that can meaningfully impact how shoppers perceive your brand, especially in Sponsored Brand ads where you're competing for attention in a split second.

👥 AI SHOPPING WARS: BIG TECH TEAMS UP to FIGHT AMAZON

A wave of partnerships is forming among AI companies, retailers, and payment processors, all aimed at loosening Amazon's grip on e-commerce.

What's happening: Google, OpenAI, Shopify, PayPal, Stripe, Walmart, Target, and Etsy are forming an unusual web of alliances to enable shopping directly through AI chatbots like ChatGPT and Google's Gemini. The goal is to let consumers discover and buy products without ever visiting Amazon.

Key moves:

Walmart, Target, and Etsy have partnered with Google to sell through Gemini and AI Mode search results, and are also listing products through OpenAI's ChatGPT.

Shopify has partnered with nearly everyone except Amazon, Walmart, Target, and Etsy, and taking a cut of payments when its merchants sell through AI apps.

PayPal has AI commerce deals with virtually every major player except Amazon, leveraging its 430 million user wallets for frictionless checkout.

Amazon's response: True to form, Amazon is going it alone right now, blocking shopping bots from OpenAI and Google, while building its own agentic AI shopping assistant Rufus that can shop other retailers' sites on behalf of customers. Amazon also continues to grow its $60B ad business and tighten control over its ecosystem.

The wildcard: Amazon is reportedly in talks to invest $50 billion in OpenAI, which could include a ChatGPT shopping partnership. CEO Andy Jassy has said he's "excited" about AI shopping partnerships but wants the terms to be right.

Why this matters for sellers: The way consumers discover and buy products is shifting. If AI chatbots become a meaningful shopping channel, optimizing for AI-driven product discovery (think Answer Engine Optimization) becomes critical—not just traditional Amazon SEO.

Sellers should be watching how these partnerships evolve and considering whether multichannel presence through platforms like Shopify gives them access to these emerging AI shopping surfaces.

🔥 MORE HOT PICKS 🔥

🥃 PARTING SHOT

“Chase the vision, not the money; the money will end up following you.”

✌🏼 Have a great weekend.

See you again on Monday.

The answer to today’s STUMP BEZOS is

A record $29.1 billion is expected to be spent on Valentine’s.