STUMP BEZOS

How much in loans has Amazon Lending issued to sellers since its launch in 2011 to help them grow?

[ Answer at bottom of email ]

BDSS 13 Virtual is January 20-22

BDSS 13 Virtual is just 5 days away - all online (no travel necessary).

21 top speakers all focused on AI for e-commerce tactics and strategies, from creating images to listing optimization to crushing it with PPC using AI and much more ( full schedule at https://www.bdss13.com )

Two ways to join us:

#1 Secure your ticket at bdss13.com. (there’s a replay option too)

#2 Join the Billion Dollar Sellers Club for $9 and get a free LIVE ticket

See you on Tuesday, January 20th!

P.S.

There’s an option to get the recordings if you can’t attend everything live.

P.S.S.

Check out the full event schedule and agenda here

P.S.S.S.

There’s a backdoor way to get the live BDSS event for free ($497.00 value). Go to BDSS13.com and scroll about half way down the page to the BDSC section (Billion Dollar Sellers Club) to see how.

👀 WHAT READING 1,000 PATENTS REVEALS ABOUT RUFUS

NOTE: For the latest Rufus optimization tactics, don’t miss Andrew Bell’s talk at BDSS 13 Virtual next week. Andrew is one of the foremost experts in the world on Rufus.

After analyzing 1,000 patents in 2025, here's what Rufus expert Andrew Bell sees coming for AI-powered shopping and search optimization.

Rufus Evolution

Agentic shopping becomes reality: Rufus will enable screen-level control based on customer preferences. Andrew has confirmed this capability in controlled testing: the technical challenge is scaling it, which Amazon has already proven they can handle.

Alexa+ integration without merger: Rufus maintains its identity as a standalone agent while increasingly powering Alexa+ shopping experiences with its product intelligence layer.

Commerce-specific AI dominance: Domain-trained intelligence built on actual marketplace behavior will consistently outperform general-purpose AI systems trained primarily on synthetic data and theoretical benchmarks.

Search augmentation, not replacement: Traditional Amazon search and Rufus will coexist and complement each other throughout 2026 and beyond, with each system amplifying the other's strengths.

AI Industry Shifts

Specialized models overtake generalists: Smaller, domain-focused language models will outperform massive general-purpose models in real-world applications. After extensive testing and validation, the conclusion is clear: deep expertise in a defined problem space beats raw scale.

New optimization paradigm emerges: GEO, SEO, and AEO are merging into a unified framework that optimizes content for how people actually search now. I expect Omni-Search Optimization to emerge as the natural response to this convergence.

AI engineering becomes multidisciplinary: Tomorrow's AI engineers will blend prompting skills, contextual design, traditional coding, and deep subject matter expertise. The most undervalued skill? Reading and analyzing the reasoning chains behind AI outputs, especially with reasoning models where tracking thought processes accelerates iteration.

Human oversight remains critical: AI systems without human judgment, curation, and strategic intervention become fragile. The best AI architects know precisely when and where to step in.

Market Leadership

OpenAI maintains momentum: They'll hold the lead through 2026. Google continues narrowing the gap, but mindshare advantage matters. Long-term winners will be determined by distribution reach and workflow integration depth rather than model parameters.

Turn your Amazon PPC into a PROFITABLE GROWTH ENGINE in 5 days with The Profitable PPC Challenge - the largest digital Amazon PPC training event in the world.

Here’s the agenda for Day 3 of The Profitable PPC Challenge:

10 example breakdowns of AI PPC Video ads that outperform human ads

Step by step how to use Nano Banana Pro to CTR-hack through mass-split testing

Rufus optimization checklist

How to rank for cheap using Sponsored Brand Video

Full PPC campaign walkthrough on 5 profitable 8 figure Amazon brands

Secure your $27 early bird ticket here now (every prior event has sold out)

🔭 UTOPIA DEALS: From YELLOW TOWELS to TOP 10 SELLER

Jabran Niaz and his brother built Utopia Deals into one of Amazon's top 10 sellers (~$770-780M in revenue) through 100% bootstrapping, aggressive pricing, vertical integration, and breaking conventional e-commerce wisdom while reaching 20% of all US shoppers.

They never raised outside capital (they did take loans and credit lines), built 15,000-employee manufacturing operations in Pakistan while living in the US, and succeeded by doing the opposite of what most "experts" recommend.

🚀 The Bootstrap Story

Started: Liquidating yellow towels on eBay while working software jobs at Bank of America, earning $15-20/hr packing boxes (vs. $100-150/hr consulting)

2014: Hit $10M revenue - Jabran went full-time, brother stayed 3 more years

Funding: Zero outside capital until 2019 (first debt), pure cash flow reinvestment

Philosophy: Volume + best value = sustainable moat (inspired by Walmart/IKEA)

How they did it:

Vacuum sealing innovation - Pioneered compact packaging for pillows/comforters/apparel, saving $0.50/unit in FBA fees matters at scale

Volume negotiations - Better China pricing, then moved to own manufacturing

Relentless cost optimization - Every penny counts in competitive categories

🏭 The Manufacturing Gamble (Everyone Said Don't Do It)

The Problem: Spent 6-12 months designing products, launched successfully, then within 6 months all 10 Chinese suppliers offered IDENTICAL products to competitors. R&D became free for competition.

The Solution (5 years ago):

Built manufacturing in Pakistan with 15,000 employees

Jabran visited only 4 DAYS in 5 years (100% remote management)

Never used outside funding - all bootstrapped

Unexpected Benefits:

1. Supply Chain Agility (The Game Changer)

China: 60-75 day lead times, inflexible

Own manufacturing: 1 week turnaround when needed

Never stock out = protect Amazon rankings

Can respond to 3x demand spikes instantly

2. Competition Protection

Slowed copycats by 5-10x

Competitors must develop through trial/error with small orders at higher costs

📦 Breaking the "Niche Down" Rule

Conventional wisdom: Focus on one category

Utopia's approach: 400-500 active products across dozens of categories (bedding, electronics, apparel, patient gowns, cookware, luggage, mattresses). Total launched: 1,000+ products over 15 years.

Philosophy: Amazon is big enough to sell anything. Chase better margins and trending products, don't lock into one category.

🏷️ Why Brand is "Overrated"

Jabran's daughter test: Can name 100 apparel brands, barely 10 bedding brands.

Brand works for: Visible/social products (apparel, drinkware, athletic wear)

Brand doesn't matter for: Hidden products (bedding, kitchen items, bathroom items)

Reality: Brand recall needs 50-60 exposures/year. Utopia reaches 1 in 10 buyers annually - would need 20x growth for meaningful brand recall.

Amazon's two-tier system: Premium brands ($25-35) vs. factory-direct ($12-15). No middle class. Utopia wins in volume/value tier.

📈 The 5% Revenue Decline Strategy

Core assumption: Existing products will lose 5% revenue annually to competition

Math: To grow 20%, must launch 25% new revenue to offset decline

Why: 10 million Amazon sellers, constant innovation, suppliers replicate successful products instantly

💡 Is Amazon Still Worth It?

Jabran: Would probably still choose Amazon, but if starting fresh would try TikTok (seeing huge success there)

The Reality:

Then (2014-2017): Golden years - 70-80% launch success, could scale to 1,000 units/day in a month, just needed good product + price

Now:

Competition fierce (10M sellers)

Need real competitive advantage

Launch success dropped to 40-50% during peak

Longer ranking time (Amazon wants proven sellers)

Some categories closed to new sellers

🎯 10 Key Takeaways

Love competition - Someone's coming for you daily. Make it a feature, not a bug.

Master ONE thing - Product design, operations, manufacturing, marketing, or supply chain

Self-disruption is mandatory - Growth comes from new launches, not protecting old products

PPC is not a strategy - Works only with excellence in everything else

Brand matters (sometimes) - Depends on category. Don't over-invest where it won't matter.

Never stock out - Algorithm punishes severely. Supply chain reliability > lowest cost.

HR compounds - Bad hires cost 10x+ more than good hires save

Cost control enables volume - Every $0.50 = competitive advantage at scale

Innovation has huge gaps - Room for US-based designers who understand customers

Success = Competitive Advantage × Execution - No shortcuts

Bottom line: Amazon is still worth it - but only if you're willing to compete at world-class level in at least ONE dimension and execute consistently for years. The golden days of easy money are gone. The golden days of building massive, impactful businesses through innovation are still here.

🌎 INTERESTING STATS

🦾 AI CITES DIFFERENT SOURCES than GOOGLE RANKS

Anthony Lee ran a fascinating experiment comparing Google's top search results with what AI platforms actually cite, and the overlap is surprisingly small.

The Numbers:

Only 7.8% of Google's top 3 results get cited by ChatGPT

29.7% get cited by Perplexity

ChatGPT pulls 89.9% of citations from outside Google's top 10

Key Findings:

Reddit's Paradox: Despite ranking #1 on Google 138 times across queries, Reddit received zero citations from both ChatGPT and Perplexity. Your Reddit SEO strategy won't help with AI visibility.

Traditional SEO Losers: Major sites like PCMag, NYT, Shopify, Amazon, and Home Depot ranked in Google's top 3 but were completely ignored by AI platforms.

The AI Winners: YouTube, Wikipedia, NerdWallet, TechRadar, Forbes, and Healthline dominate AI citations, even when they're not on Google's page 1. AI prefers explainer content and established editorial brands.

Commercial vs. Informational: The gap widens for commercial queries ("best X for Y"). AI actively avoids the affiliate/listicle content that dominates commercial search results.

Bottom Line: Ranking #1 on Google gives you just an 8% chance of being cited by ChatGPT. If you're optimizing for AI discovery, Google rankings aren't a reliable proxy. You need a different strategy focused on editorial authority and explainer content.

Read Anthony Lee's full analysis and methodology on LinkedIn →

🛠️ BDSN SOFTWARE TOOL of the DAY 🛠️

Pebblely is an AI product‑photo creator that turns plain product shots into high‑converting lifestyle images in seconds, without any Photoshop skills or studio setup needed.

What Pebblely Does

Uses AI to remove plain backgrounds from product photos and replace them with professional, on‑brand scenes tailored for ecommerce and ads.

Lets Amazon sellers turn a single white‑background image into multiple lifestyle, social, and ad creatives sized for marketplaces, websites, and email.

Helps brands move from static catalog shots to story‑driven imagery that improves click‑through rates and engagement on ads and listings.

Core Features For Sellers

One‑click background removal plus 40+ ready‑made themes (studio, lifestyle, seasonal, etc.) or fully custom text prompts.

Bulk generation to create images for up to 25 products at once, ideal for large Amazon catalogs.

Canvas editor to move, resize, and rotate products, with separate product and background layers for quick adjustments.

Branding And Creative Control

Option to describe the desired scene or use a reference image so images match existing brand colors and visual style.

Ability to reuse favorite backgrounds across different SKUs to keep storefronts visually consistent.

Tools to add logos or badges directly onto images, supporting promotions, trust badges, and limited‑time offers.

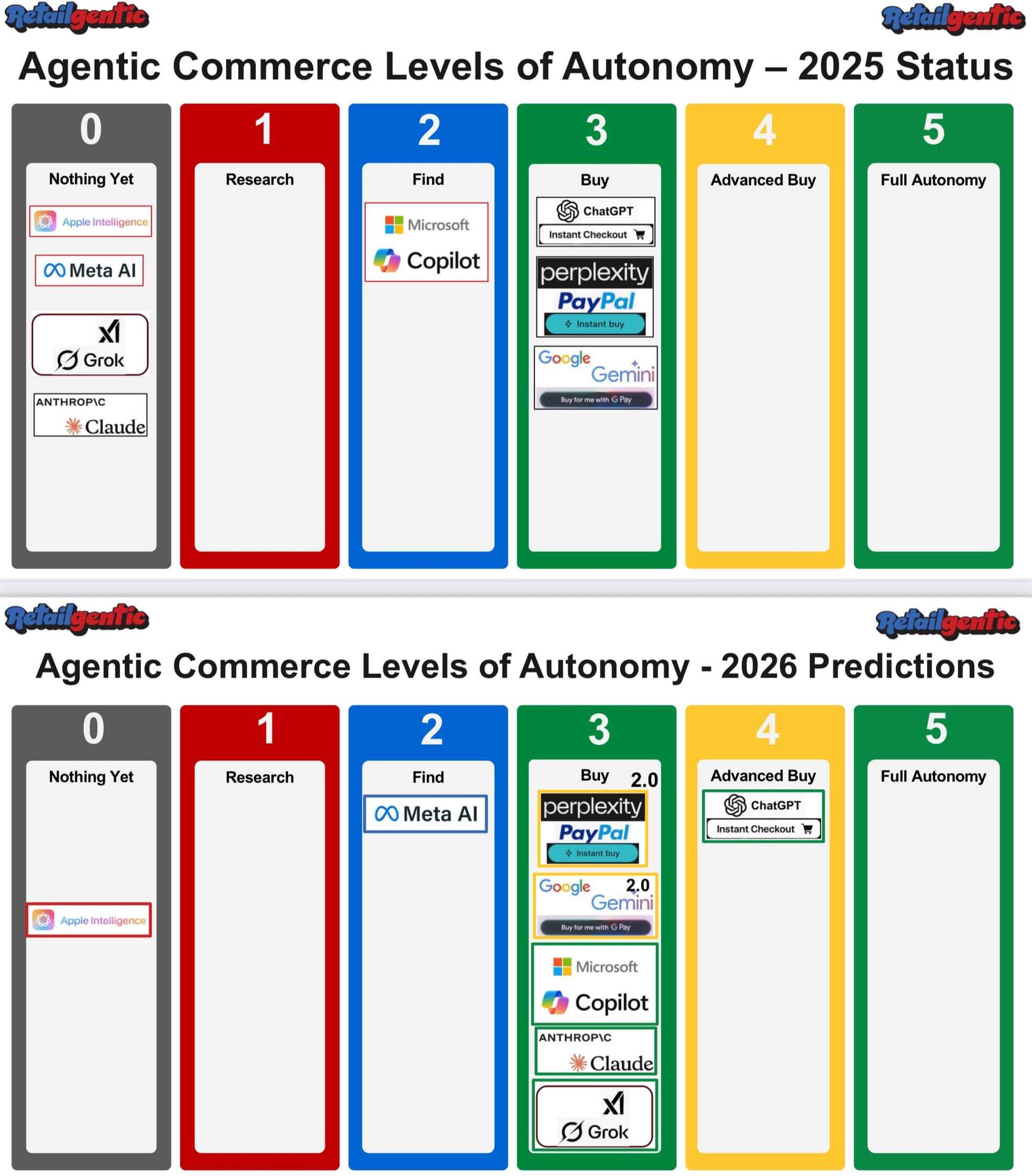

👩💻 MICROSOFT JOINS AI SHOPPING RACE w/ COPILOT

Microsoft launched Copilot Checkout last week, letting users browse and buy products directly in its AI chatbot without leaving the conversation.

Key details for sellers:

Payment processing: Handled through PayPal, Shopify, and Stripe

First merchants: Etsy sellers are among the first available

Shopify auto-enrollment: Shopify merchants will be automatically enrolled after an opt-out window (similar to Amazon's controversial "Buy for Me" rollout)

Merchant control: Unlike competitors, retailers remain the merchant of record and handle fulfillment and customer service

Why Microsoft thinks it has an edge:

Microsoft is positioning itself as the seller-friendly option. Since they don't operate their own marketplace like Amazon or Google, they're not competing with retailers for customers. The company emphasizes that sellers own the customer data and relationships.

The competitive landscape:

This puts Microsoft behind OpenAI (launched ChatGPT shopping in September) and Google (launched in November), but ahead in one critical area: existing enterprise relationships. Many major retailers already run on Azure and Microsoft 365.

AI shopping assistants are now a four-way race between ChatGPT, Google, Amazon, and Microsoft. If you're on Shopify, watch for that opt-out notification: you'll be enrolled automatically unless you decline.

The question remains whether consumers will actually prefer buying through chat over traditional e-commerce, but these platforms are betting big that they will.

🔥 MORE HOT PICKS 🔥

🥃 PARTING SHOT

"Neither your peers nor your critics pay your mortgage. Your audience and customers do that, quite independent of judgement of peers or critics. This is magical if you'll allow it to be."

✌🏼 Have a great weekend.

See you again on Monday.

The answer to today’s STUMP BEZOS is

Amazon Lending has facilitated over $15 billion in loans