STUMP BEZOS

How much in unused gift cards was Amazon sitting on as a liability at the end of the last holiday season?

[ Answer at bottom of email ]

💰 THE 5TH QUARTER: JAN is ECOM’s HIDDEN PEAK SEASON

The holiday rush is over. Inventory shipped, ads paused, team catching their breath.

But for your customers, and increasingly, for ecom operations, the real peak is just beginning.

Welcome to the reverse logistics surge: the season when returns transform from a customer service afterthought into a revenue-defining operation that rivals Black Friday in complexity and scale.

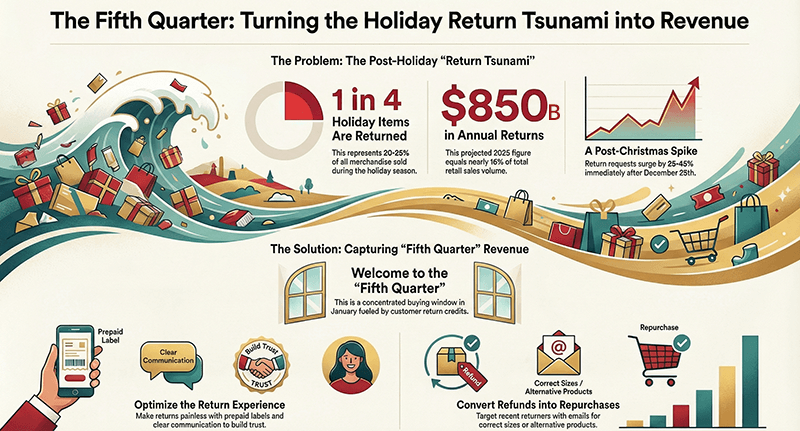

The Numbers Behind the Return Tsunami

Here's what e-commerce sellers are facing right now:

20-25% of all holiday merchandise gets returned. That's one in four items coming back through your supply chain. For apparel and footwear sellers, that percentage climbs even higher.

Return requests spike 25-45% immediately after Christmas compared to pre-holiday levels. The surge starts December 26 and peaks in early January, compressing what would normally be weeks of gradual returns into days of operational chaos.

In some European markets, return volumes grew 139% year-over-year during the 2025 holiday period. Returns aren't just high, they're accelerating faster than sales growth.

The financial reality: The National Retail Federation projects $850 billion in total returns across retail for 2025. That's nearly 16% of total retail sales volume flowing backward through the supply chain.

During peak days, some operations process returns every 30 seconds. This isn't a trickle, it's a continuous inbound stream that demands the same operational intensity as fulfillment.

Why January Is Actually Your Fifth Quarter

But here's what most sellers miss: returns aren't just a cost center. They're a liquidity event.

When customers return products, they typically receive store credit or refunds that turn into immediate purchasing power. Survey data shows 40% of consumers expect to return at least one holiday gift, and many of those returns convert into replacement purchases.

This creates what industry insiders are calling the "fifth quarter": a concentrated buying window in January and early February fueled by return credits rather than new budgets.

Customers who return the wrong size hoodie buy the right size. The unwanted board game becomes the board game they actually wanted. Gift card refunds turn into self-purchases.

Smart sellers recognize this isn't just damage control, it's a second shot at conversion with customers who are already engaged with your brand.

The Reverse Logistics Reality

The operational challenge is significant. Major carriers like UPS maintain demand surcharges deep into January because they're still dealing with peak-season volume just flowing in the opposite direction.

For sellers, this means:

Shipping costs eat into already-thin holiday margins

Warehouse teams need to be staffed for receiving, not just fulfillment

Customer service queues spike just when you thought you could scale back

Inventory management becomes exponentially more complex as returned products need inspection, restocking, or liquidation

The complexity explains why return fraud now impacts roughly 9% of all returned items, with merchants deploying AI-driven tools just to flag suspicious patterns in the reverse flow.

The Consumer Side: Returns as a Service

The returns burden has grown so significant that an entire gig economy has emerged around it.

Services like ReturnQueen and platforms like Taskrabbit have seen explosive growth in return-related bookings. Taskrabbit reported a 62% year-over-year increase in return-related tasks during November and December. ReturnQueen expects 15-20% growth during January and February.

Consumers now hire "taskers" at an average of $34/hour (with two-hour minimums) just to handle the physical logistics of standing in return lines and driving to UPS stores. One ReturnQueen driver described picking up everything from half-built baby carriers to rubber speed bumps, fake Christmas trees to "clothes in aspirational sizes."

What E-Commerce Sellers Should Do Now

Optimize your return experience. The brands that make returns painless are the ones that capture fifth-quarter revenue. Extended return windows, prepaid labels, and clear communication turn returns from relationship-killers into trust-builders.

Staff for reverse logistics. January isn't downtime. Your warehouse and customer service teams need to be ready for volume that rivals Q4.

Watch your data. Track return rates by product, category, and reason. High return rates signal listing problems, sizing issues, or quality concerns that need immediate attention.

Plan for the refund-to-repurchase conversion. Email sequences targeting recent returners with better alternatives, correct sizes, or complementary products can turn refund credits into fifth-quarter sales.

Consider your return policy as a competitive advantage. In a world where consumers expect friction-free returns, your policy isn't just customer service, it's positioning.

Peak selling no longer ends on Christmas Day. It just changes direction.

The sellers who treat January's reverse logistics surge as seriously as they treat Black Friday preparation, who staff for it, optimize for it, and convert it into a second revenue window, will emerge with both preserved margins and captured fifth-quarter sales.

The sellers who view it as cleanup duty will watch their holiday profits erode while competitors turn returned products into repurchases.

The boxes are already heading back. The question is whether you're ready for them.

🌎 INTERESTING STATS

🕹️ WALMART TRYING to CLOSE AMAZON ONLINE SALES GAP

For over a decade, Amazon sellers operated in a world where one question dominated: "How do I win on Amazon?" That singular focus made sense: Amazon wasn't just the leader in eCommerce, it was essentially the entire game.

But 2025 data reveals a seismic shift that every sophisticated seller needs to understand:

Walmart isn't just playing catch-up anymore. It's fundamentally reshaping the competitive dynamics of American online retail.

Amazon's Dominance (But Slowing Momentum)

Amazon captured 56% of all U.S. online retail spending in Q3 2025, an almost incomprehensible achievement representing 3.7% of total consumer spending across America. To put this in perspective, more than half of every dollar spent online goes through Amazon's marketplace.

In certain categories, Amazon's grip borders on monopolistic:

Sporting goods, hobbies, music, and books: 75.3% eCommerce market share

Consumer electronics and appliances: 60.5% market share

These fortress categories have proven nearly impenetrable for competitors, built on years of customer trust, review ecosystems, and fulfillment infrastructure.

However, the velocity tells a different story. Amazon's eCommerce growth rate in Q3 2025 was 9.6% year-over-year. Respectable? Yes. But this represents the maturation of a marketplace approaching saturation in its core categories.

Walmart's Explosive Acceleration

While Amazon controls more than half the online retail pie, Walmart's slice is currently 9.6% of total U.S. eCommerce and is expanding at a blistering pace that should command every seller's attention.

The growth metrics are staggering:

Q3 2025 eCommerce growth: 27.2% year-over-year (nearly 3x Amazon's growth rate)

Since Q1 2022: Walmart's eCommerce sales surged 115.6% vs Amazon's 63.2%

Digital now represents 19.9% of Walmart's total U.S. business, up from just 11.4% in early 2022

This transformation is unprecedented for a retailer of Walmart's scale. With $569 billion in total U.S. sales and over 5,200 physical locations, Walmart has successfully executed what few thought possible: converting America's largest brick-and-mortar operation into a hybrid digital powerhouse without sacrificing its store foundation.

Category-Specific Opportunities

Where Amazon Still Reigns Supreme: If you're selling electronics, sporting goods, hobbies, books, or specialty items, Amazon remains your primary battlefield. The review density, customer trust, and search behavior in these categories are deeply entrenched.

Where Walmart Presents Opportunity:

Food and beverage (obvious, but extends to food storage, kitchen gadgets, meal prep items)

Household essentials and cleaning supplies

Health and personal care

Baby and toddler products

Pet supplies

Home goods and basics

Seasonal and everyday consumables

The key insight: If your product naturally belongs in a shopping cart alongside milk, eggs, and toilet paper, Walmart's growth trajectory makes it a must-test channel.

Different Rhythms, Different Strategies

One of the most revealing insights from the data is how differently these two giants pulse with consumer demand.

Amazon: The Event-Driven Marketplace

Amazon's sales pattern resembles a heartbeat on a monitor: dramatic spikes during Prime Day (now twice yearly), Black Friday/Cyber Monday, and the Q4 holiday rush, followed by relative valleys. This seasonality creates specific seller dynamics:

Intense competition during peak periods

Need for heavy promotional spending during events

Inventory management challenges around compressed timelines

"Always-on" PPC pressure just to maintain visibility

Walmart: The Steady Drumbeat

Walmart's growth pattern is remarkably consistent throughout the year, reflecting its role as America's provider of daily necessities. This creates different seller opportunities:

More predictable demand patterns

Less extreme promotional pressure

Inventory can be managed with greater consistency

Lower competition for visibility (for now)

Strategic implication: If you're exhausted by Amazon's event-driven hamster wheel, Walmart's steadier rhythm might allow for more sustainable business operations and better cash flow predictability.

What This Means for Your Amazon Business

1. The Multi-Channel Imperative Just Became Urgent

For years, smart sellers talked about channel diversification as a "nice to have" or future plan. Walmart's acceleration changes this calculation. With growth rates nearly triple Amazon's, Walmart represents the clearest path to meaningful revenue diversification available today.

Action item: If you're doing $500K+ annually on Amazon, allocate resources now to test Walmart. The platform is still building its seller ecosystem, meaning less competition and potentially better early-mover advantages than you'll find in 12-18 months.

2. Rethink Your Product Strategy Through a Dual-Platform Lens

Products optimized exclusively for Amazon's ecosystem may need adjustment for Walmart's customer base and shopping behavior.

Consider:

Walmart customers are more value-conscious (though not necessarily "cheap"—they want quality at fair prices)

Bundle and multi-pack strategies often perform better on Walmart

Walmart's integration with physical stores creates unique fulfillment options (ship-to-store, pickup, same-day delivery)

Walmart's advertising platform is less saturated, meaning lower customer acquisition costs

3. The Grocery Halo Effect Is Real

Even if you don't sell food, Walmart's grocery dominance creates cross-shopping opportunities. When customers order their weekly groceries through Walmart.com or the app, they're already:

In purchase mode

Logged in and payment info entered

Thinking about household needs

Planning for the week ahead

Your complementary products can capture this high-intent traffic.

4. Geographic and Demographic Considerations

Walmart's strength isn't uniformly distributed. The retailer over-indexes in:

Suburban and rural markets

Middle America

Households with children

Multi-generational shopping

If your products serve these demographics, Walmart alignment is even stronger.

5. The Amazon Saturation Signal

Amazon's slowing growth rate (9.6% vs previous years of 15-30%+) signals marketplace maturation. For sellers, this means:

Increasing competition for the same pool of customers

Rising advertising costs as more sellers fight for visibility

Pressure on margins as differentiation becomes harder

Need for either premium positioning or volume plays

Walmart's 27.2% growth represents fresh, less-saturated customer demand.

The Competitive Dynamics Ahead

Amazon's Response

Don't expect Amazon to cede ground without fighting back. Watch for:

Continued investment in grocery (Amazon Fresh, Whole Foods integration)

More aggressive Prime benefits to increase switching costs

Potential acquisition strategies in physical retail

Enhanced AI shopping experiences (Rufus evolution)

Walmart's Advantages

Walmart enters this next phase with structural benefits:

Massive store footprint for omnichannel fulfillment

Deep grocery relationships driving purchase frequency

Lower cost structure in some categories

Growing Walmart+ subscription base

The Platform War

Both companies are racing to become platforms, not just retailers. Amazon leads here with:

AWS cloud infrastructure

Advertising ecosystem

Third-party seller marketplace maturity

Walmart is building its own platform play:

Walmart Connect (advertising)

Walmart Fulfillment Services (competing with FBA)

Walmart Marketplace expansion

Data and retail media capabilities

The eCommerce landscape is experiencing its most significant structural shift since Amazon's marketplace dominance was established.

Walmart's 115.6% growth over three years isn't a fluke, it's a fundamental reordering of American retail that creates both opportunity and competitive pressure for Amazon sellers.

The window is now. Walmart's marketplace is still building its seller ecosystem, competition is lower, and advertising costs are more favorable. In 18-24 months, these advantages will likely diminish as more sellers recognize the opportunity.

Amazon remains the dominant force and will continue to be the primary revenue driver for most sellers. But the era of Amazon-only strategy is ending. The data is clear: Walmart's digital transformation is real, accelerating, and creating a genuine two-platform reality for serious eCommerce operators.

🛠️ BDSN SOFTWARE TOOL of the DAY 🛠️

Inboox.ai is an AI-powered email intelligence platform that lets e-commerce marketers study over 1 million real emails from top Shopify and DTC brands to improve their own campaigns.

2It focuses on turning competitor and inspiration emails into clear, strategic insights you can apply directly to your flows, promos, and launches.

What Inboox.ai Does

Gives you a searchable database of 1M+ real marketing emails from fast-growing ecommerce brands (Shopify/DTC focus).

Lets you “peek into” other brands’ inbox strategies across welcome, nurture, promos, and lifecycle flows instead of collecting screenshots manually.

Uses AI to break down each email so you see what worked, what didn’t, and how to make the idea fit your brand.

Core Features

Deep filters & search: Filter by brand, campaign type, journey stage, tone, audience, promotion type, and more to find exactly the kind of email you want to model.

AI breakdowns: Every email comes with analysis of subject lines, hooks, structure, CTAs, offers, and psychological triggers, plus suggestions for improving or adapting it.

Brand tracking: Follow specific brands (e.g., Fenty Skin, Ridge, Casper) and compare how they do nurturing vs. urgency, launches vs. evergreen flows, etc.

Reach page 1 on Amazon simply by sending free products to Micro-Influencers

Use the platform Stack Influence to automate Micro-Influencer product seeding collaborations at scale (get thousands of collabs per month) and increase your Amazon ranking, generate UGC, and boost up your recurring revenue like never before.

Top Amazon brands like Magic Spoon, Unilever, and MaryRuth Organics have been able to get to #1 page positioning on Amazon and increase their monthly revenue as high as 13X in as little as 2 months.

Pay influencers only with products (stop negotiating fees)

Increase external traffic Amazon sales (get to top page rankings)

Get full rights image/video UGC (build your brand with authentic content)

100% automated management (don’t lift a finger to get influencer collabs at scale)

Don't believe it? Check out the results from the Blueland Micro Influencer campaign which generated a 13X ROI scaling up influencers on Amazon.

After successfully raising investment on Shark Tank, Blueland turned to Stack Influence to boost their Amazon sales and become a top selling listing using Micro Influencer marketing.

Increase your Amazon listings ranking for targeted keywords and multiply your organic recurring revenue in 2025!

Get 10% OFF by signing up this month

🗜️ AMAZON LAUNCHES SEVERAL NEW FEATURES

Amazon is testing several new features sellers should be aware of:

Shop Direct Links (Beta) Amazon is testing brand search redirects to DTC websites—meaning strong brand presence off-Amazon could now impact your Amazon visibility. This signals Amazon positioning itself as a discovery platform, not just a marketplace.

AlexaPlus.com Launch Amazon's AI assistant goes web-based with conversational shopping capabilities. Alexa+ can handle complex purchase requests and trigger automated buying—expect AI-driven product discovery to become more central to how customers shop.

AI-Powered A+ Content Analysis New tool evaluates your A+ Content weekly using AI trained on top performers in your category. You'll get specific, actionable recommendations (not generic templates) with quality labels showing where you stand and what to improve.

Rufus Auto-Opens in Search Amazon's aggressively pushing Rufus by auto-launching it in search results—even for Google traffic. AI-assisted discovery is becoming the default shopping experience, not optional.

Amazon's betting heavily on AI shopping interfaces and brand strength beyond the marketplace. Optimize for conversational discovery and strengthen your brand presence everywhere, not just in Seller Central.

🔥 MORE HOT PICKS 🔥

🥃 PARTING SHOT

"AI agents won't simply make recommendations; they'll help you act on them."

✌🏼 See you again Thursday …

The answer to today’s STUMP BEZOS is

Amazon’s unused gift card liability was $5.4 billion