STUMP BEZOS

In April, Netflix was responsible for 7.5% of all television viewing. But YouTube, which is an overlooked opportunity by Amazon sellers, is more. What % does it command?

[ Answer at bottom of email ]

💰 TACTICAL WISDOM from the BDSS DREAM 100

Here at BDSN we surface what’s working right now from the smartest minds in the game.

Today, we’re spotlighting 3 BDSS Dream 100 legends whose tactical wisdom could unlock serious upside for your brand if you implement right now.

🚀 Tip #1: Go “Amazon and Beyond” — Destaney Wishon

“The brands that win on Amazon are the ones creating their own demand.”

Destaney Wishon recently dropped a truth bomb every seller needs to hear:

Amazon Advertising is no longer just for Amazon.com.

Your ads are already showing up across:

iHerb

SayWeee

Oriental Trading

Pinterest

BuzzFeed

Mashable

... and that’s just the start.

What to do now:

✅ Reevaluate your ad goals. Are you only optimizing for bottom-funnel purchases, or are you building top-of-funnel demand?

✅ Test Amazon’s “Amazon & Beyond” placements using Sponsored Display or DSP—especially if you’re launching or scaling.

✅ Build creative that works outside the Amazon PDP—native-style hooks, UGC, and benefit-led headlines.

💡 Remember: The future of Amazon Advertising is full-funnel, off-platform, and customer-obsessed. Get ahead of it now—or risk getting left behind.

📈 Tip #2: Match Platform to Product Stage — Liran Hirschkorn

“Walmart is for search. TikTok is for discovery.”

If you're doing less than $5M/year on Amazon, don’t assume every platform is worth your time if you are looking for next place to expand.

Liran’s tactical playbook:

🟩 Go TikTok if:

Your product has “wow” or impulse appeal

You’re looking for viral, discovery-driven growth

You want to create halo sales on Amazon

🟥 Go Walmart if:

You sell meds, generics, or household consumables

You’re already over $10M/year and want brick-and-mortar placement

Your product solves a “need” not a “want”

Real Talk: TikTok Shop might outperform Walmart for 90% of emerging brands. Don’t waste time pushing where traction isn’t built for your type of offer.

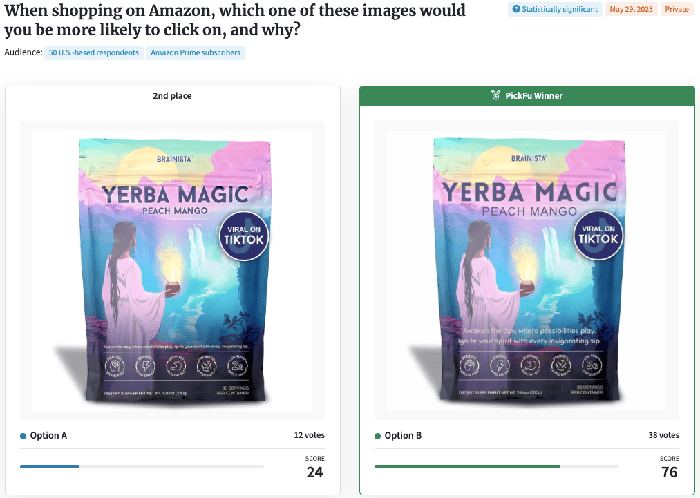

🧠 Tip #3: Your First Image = Your First Impression — Jon Derkits

“When in doubt, make it BIGGER.”

Jon ran a PickFu test on two main images for the tea product above. The only difference?

📸 Image B had larger font on the packaging.

Result? It won by a landslide.

Why it works:

🧠 Our brains process larger text faster—especially on mobile.

👀 Big fonts grab attention mid-scroll.

📈 Higher visibility → better click-through → better ranking.

Tactical move:

Run a PickFu test on your current main image vs. one with bigger, bolder text.

Use mobile view to judge readability and impact.

Test before you launch—or if your CTR is sagging.

Subscribe to Jon’s weekly newsletter

🌎 INTERESTING STATS

Just over 50% of the world’s population lives in Asia (4 billion people). It is a rapidly rising region in e-commerce to pay attention to.

🕹️ AMAZON NOW LETS YOU TARGET JUST BIZ BUYERS

Amazon just rolled out a powerful new beta feature: the ability to run Sponsored Product campaigns exclusively targeting Business Accounts.

Why does this matter?

👉 Early testers are seeing 3X higher returns from Business buyer placements compared to standard consumer traffic.

👉 Business buyers often order in bulk, convert faster, and are less price-sensitive.

👉 This exclusive targeting option is particularly beneficial for sellers in categories such as office supplies, industrial equipment, pet supplies, and bulk goods.

With this update, you can now:

Create campaigns that target ONLY Business customers

Optimize ad spend for high-volume, high-intent orders

Layer in B2B pricing, quantity discounts, or product bundles

🔍 Start tracking what % of your sales come from businesses at the ASIN level. Products with strong B2B performance should get their own tailored campaigns ASAP.

This beta feature differs from the existing Amazon Business bid adjustment. While the bid adjustment allows boosting bids across all Sponsored Products campaigns on Amazon Business placements, the exclusive campaign targeting allows creating entirely separate campaigns with budgets and settings tailored specifically for the B2B audience.

📌 Note: This feature is still in beta and rolling out gradually—so not all accounts will see it yet. But when you do, test it immediately.

🔗 BDSN MYSTERY LINK of the DAY 🔗

🛋️ HOW JEFF BEZOS PUTS FURNITURE in his PENTHOUSE

@nypost Doesn't everyone move their furniture the Jeff Bezos way, with giant cranes and roadblocks? 😵💫 More details at the link in bio.

How to get to $100K+ monthly revenue

this Amazon July Prime Day

by simply gifting products

To beat out your competitors this upcoming Amazon Prime Day try gifting products to Micro-Influencers and driving external traffic. One of the gifting platforms is Stack Influence which uses A.I. and a dedicated community to automate thousands of gifted collaborations per month.

One of their clients launched a campaign last May and improved their BSR by 5.8X before July Prime Day (position 9536 to 1650) which led to a 5X increase in recurring sales hitting $100K+ monthly recurring revenue which maintained beyond Prime Day (see chart below):

Top Amazon brands like Magic Spoon, Unilever, and MaryRuth Organics are using this strategy to get to #1 page positioning on Amazon and receiving the following benefits:

Pay influencers only with products (stop negotiating fees)

Increase external traffic Amazon sales (get to top page rankings)

Get full rights UGC (build your brand with authentic content)

100% automated management (don’t lift a finger to get influencer collabs at scale)

Still don't believe it?

Check out the results from another Prime Day campaign which generated a 14X ROI scaling up influencers on Amazon. Increase your Amazon listings ranking by simply gifting products and multiply your organic recurring revenue this upcoming July Prme Day!

😱 TIKTOK is CUTTING BACK on ORGANIC TRAFFIC

According to a recent data from IndexBox, TikTok is phasing out organic traffic boosts for US merchants—a major shift that could disrupt sellers who’ve relied on TikTok to drive low-cost discovery and spark the "halo effect" back on Amazon.

Here’s what’s changing:

🔒 Comped visibility? Gone. Merchants will now need to pay for ads to maintain exposure.

📦 Perks like $0 shipping are being slashed, and only select products will get organic boosts.

🚫 Small businesses that once thrived on viral, unpaid traffic will now have to compete with ad budgets.

💰 TikTok’s new monetization model mimics trends from Uber and Airbnb—attract users cheaply, then raise the price as the platform matures.

Why now?

TikTok had a rough 2024 and a shaky start to 2025. Like many tech companies, they’re chasing profitability through aggressive cost-cutting, layoffs, and ad revenue expansion.

But it’s not all doom and gloom. TikTok is rolling out new discovery and ad tools to help sellers adapt:

🛠️ New Tools for Sellers:

Insight Spotlight: Uncover what your ideal customer is watching, filtered by niche and demographic, with AI-powered creative suggestions.

Content Suite: Seamlessly turn UGC into high-performing ads—TikTok handles the permissions and formats.

Manage Topics: Lets users customize what they see in their feed, giving your niche a better chance of standing out.

Smart Keyword Filters: AI now filters by synonyms too, helping your content match more relevant search behavior.

If TikTok has been your secret traffic weapon, it’s time to re-strategize.

Paid ads are now the toll booth to traffic. But with the right tools, it’s still possible to win—and those who master the new system may have less competition than before.

✂️ AMAZON JUST PURGED BILLIONS of ASINs

Amazon has quietly rolled out a sweeping internal initiative—code-named “Bend the Curve”—designed to delete billions of deadweight listings from the marketplace.

The goal? Cut total ASINs from ~74 billion down to under 50 billion, while still growing real product selection.

According to internal documents. Amazon is targeting:

Inactive ASINs

Out-of-stock items

Listings untouched in years

The project is driven by a few big levers:

✅ Cleaner search results for customers

✅ Lower AWS server costs (already saved $22M in 2024 and $36M in 2025)

✅ Better catalog health across categories

🚫 New Restrictions for High-Volume, Low-Performance Sellers

One big change catching sellers off guard: "creation throttling".

Amazon is now blocking large but underperforming seller accounts from bulk-adding new listings. Over 12,000 sellers have already been restricted—stopping 110 million ASINs from being added.

Amazon claims the restriction only affects "low-value" accounts. They’ve promised better communication and enforcement clarity moving forward.

Amazon says it’s still expanding its active catalog and added millions of new items last year—this is about quality, not quantity.

Answer engine tracking chart to optimize for AI search

REMINDER: CONTEST to WIN an AUDIENCE TICKET to BDSS MARKET MASTERS 3 in NOV. ENDS THURSDAY!

1) Person who refers most and 2) one random person who refers at least 3 subscribers

Use the button or your unique tracking link below

📛 AMAZON ROLLS OUT CX SCORE that AFFECTS RANK

On a recent restless night, I scrolled through X and stumbled across a post from Joe at The Amazon Guy (@AdsAficionado) that turned my world upside down.

He broke the news: Amazon had just rolled out a new Customer Experience (CX) Score system, quietly shaking up how we sellers get ranked and snag that coveted Buy Box.

As an Amazon seller, this hit me hard. I realized this wasn’t just another update—it’s Amazon doubling down on what they’ve always been known for: top-notch customer satisfaction.

This morning, I rallied my team. We weren’t just tweaking prices anymore—now, it’s all about nailing our operations. Better packaging, faster shipping—these were the new keys to boosting our visibility and rankings. It felt like a whole new game, and I was determined not to fall behind.

Then came the silver lining. With competition fiercer than ever, I learned Amazon’s rewarding us for driving external traffic. The recent Google Ads integration with Amazon Attribution? It’s a goldmine! As I sit here at 2:34 AM CDT on June 9, 2025, planning my next move, I can’t help but feel this is the start of a new chapter for my business—if I play it smart.

Here’s how it impacts you:

✅ Better CX score → Higher Buy Box win rate

✅ Better CX score → Less penalty during peak seasons

✅ Better CX score → Higher organic visibility (especially mobile)

Most sellers think reviews and pricing are the biggest ranking signals. In 2025, Customer experience is gonna play a big role in rank.

Get ahead now—or Amazon will bury you under competitors who do.

🔥 MORE HOT PICKS 🔥

🥃 PARTING SHOT

“Your brand is what people say about you when you are not in the room.”

✌🏼 See you again Thursday …

The answer to today’s STUMP BEZOS is

YouTube commands 12.4% of all television viewing.