STUMP BEZOS

According to Pew Research, 71% of U.S. adults use Facebook. What percentage of U.S. adults go on Youtube daily?

[ Answer at bottom of email ]

💰 AMAZON’S NEW PROMPT ADS YOU DIDN’T KNOW YOU HAD

Amazon just quietly rolled out one of the biggest changes to Sponsored Products and Sponsored Brands this year, and most sellers still don't even know it's running on their accounts.

They're called "prompt ads," and they're already live in your campaigns.

What Are Prompt Ads?

Think of prompts as a 24/7 AI product expert that sits inside your existing ad campaigns. When a shopper browses your product detail page (and likely competitor PDPs soon), these AI-generated prompts automatically surface relevant product information in a conversational format, helping shoppers get answers before they even think to ask the question.

The key difference from traditional ads? Instead of just showing your product, prompts actively engage shoppers with specific details pulled directly from your listing to help them make faster, more confident buying decisions.

Who Can Use Them?

All U.S. Amazon advertisers running Sponsored Products and Sponsored Brands campaigns except authors and publishers.

Here's the thing: you're already using them. Amazon automatically enrolled all existing SP and SB campaigns into prompts. You didn't opt in. It just happened.

Where to Find Them

To see your prompt performance, navigate to: Campaign → Ad Group → Ads → Prompts tab

You'll see all prompts that have received at least one click, along with the prompt text, associated ad, and metrics like impressions, clicks, and orders. Performance data is also available through downloadable reports and API.

Why This Matters More Than You Think

Early data shows shoppers are adopting AI-guided shopping faster than Amazon expected. Amazon CEO Andy Jassy revealed that customers using Rufus during shopping trips are 60% more likely to complete a purchase, with the AI assistant on track to deliver over $10 billion in incremental annualized sales.

Here's what makes prompts different: you only pay CPC on the first click. After that, the entire conversation between the shopper and the AI is free. During this beta phase, prompts are completely free while Amazon's systems learn and optimize.

But there's a catch, and it's a big one.

Your Listing Is Your Only Source

The AI pulls exclusively from your first-party content:

Product title

Bullet points

Description

Backend search terms and attributes

Brand Store

Campaign keywords

That's it. Reviews and Q&A are excluded. Whatever semantic signals you put in your PDP is exactly what the AI has to work with.

If your listing is weak, your prompt ads will be weak. Period.

5 Specific Ways to Optimize for Rufus Prompts

1. Rewrite titles and bullets as noun-phrase stacks

Rufus and prompts rely heavily on clear, structured phrases. Instead of "Made with premium stainless steel," try "Premium stainless steel construction | rust-resistant | dishwasher-safe."

2. Fill backend attributes to 100%

Amazon's COSMO system uses backend attributes heavily to generate responses. Every empty field is a missed opportunity for the AI to surface your product.

3. Add short text phrases to product images

The AI reads and reuses text embedded in images. Callouts like "BPA-Free" or "500-Thread Count" become part of the prompt vocabulary.

4. Write your description as Q&A

Since prompts answer questions, give them answers. Structure your description to address common concerns: "Is this dishwasher safe? Yes, all components..."

5. Map features → benefits → use cases

Don't just list specs. Connect each feature to a benefit and a specific use case. "Collapsible design" becomes "Collapsible design saves 70% storage space—fits in apartment pantries and RV cabinets."

This isn't just another ad format. It's a fundamental shift in how shoppers interact with products on Amazon. The retailers who treat their PDPs as comprehensive product databases, not just keyword-stuffed listings, are going to win in this new environment.

And with competitors like Walmart already testing similar formats in their Sparky AI assistant, this is clearly where the entire industry is headed.

The good news? You've got a free beta window to experiment and optimize before CPC kicks in.

The question is: what's your listing actually telling the AI about your product?

🌎 INTERESTING STATS

🕹️ A BLACK FRIDAY WEEKEND LIKE NO OTHER

This holiday weekend marked a seismic shift in how consumers shop online, and it's all powered by AI.

In a coordinated blitz that can only be described as a strategic arms race, the biggest names in tech launched sophisticated AI shopping tools just in time for peak season.

OpenAI, Perplexity, Amazon, Target, and others rolled out features designed to fundamentally change product discovery and purchasing. For Amazon sellers, understanding these platforms isn't optional anymore, it's essential.

OpenAI's ChatGPT Shopping Research: Discovery Meets AI

Launched: Just before Black Friday

What It Does: Transforms product research from a manual slog into an interactive conversation

ChatGPT's new Shopping Research feature represents OpenAI's most aggressive move into commerce yet. Here's how it works:

Interactive Quiz: When you ask about a product, ChatGPT generates questions to clarify your priorities—budget, size, features, specific needs

Swipe Interface: As products appear, you swipe right on items you like, left on those you don't (think Tinder for toasters)

Personalized Recommendations: Using your preferences and chat history, it delivers tailored product recommendations with prices, specs, images, and reviews

No Checkout (Yet): Currently focused on discovery; deeper integration with instant checkout coming later

Instant Checkout Rollout: Select Shopify stores (Glossier, SPANX, SKIMS) are now live with one-click purchasing inside ChatGPT, joining Etsy and Walmart. More coming soon.

Target Joins the Fight: A Dedicated ChatGPT App

Launched: Last week

What It Does: Full shopping experience inside ChatGPT with multi-cart checkout

Target took a different approach, launching a dedicated app within ChatGPT that enables:

Conversational product search ("Help me plan my 2-year-old's bee-themed birthday party")

Curated product recommendations

Multi-item cart building (unlike the single-item limitation of Instant Checkout)

Checkout through Target account with options for shipping, in-store pickup, or curbside

Same-day delivery and Target Circle integration coming soon

Perplexity x PayPal: The Boldest Launch of the Weekend

Launched: November 25 (two days before Black Friday)

What It Does: Complete end-to-end shopping with instant checkout powered by PayPal

Calling this launch bold might be an understatement. Perplexity completely rebuilt its shopping experience 48 hours before the biggest shopping weekend of the year—and they're giving away 50% off (up to $50) on first purchases through December 1.

Launch Partners: Abercrombie & Fitch, Ashley Furniture, Fabletics, Adorama, NewEgg

Perplexity threw shade at both Google ("not what advertisers want to sell first") and ChatGPT ("not just regurgitating generic top-ten lists"). The gloves are officially off.

Adobe’s Black Friday Early Read:

GenAI Shopping Traffic: Up 600% YoY—the clearest signal yet that AI shopping has gone mainstream

Black Friday Growth: 9.4% YoY (beating the 8.3% forecast)

Revised Forecast: Adobe bumped projections from $11.7B to $11.7-11.9B based on strong performance

Peak Hours: 10am-2pm drove top spending

The 600% surge in GenAI traffic is the headline here. Consumers aren't just experimenting, they're actively using AI to make purchasing decisions.

Salesforce Thanksgiving & Black Friday Combined Agentic Highlights:

Third-Party AI Agent Traffic: Up 300% on Black Friday vs. last year (both globally and in the U.S.)

Retailers with AI Agents: 9% YoY sales growth on Thanksgiving vs. 2% growth for retailers without AI agents

AI Customer Service: Conversations with AI agents surged 28% in the first three days of Cyber Week (Nov 25-27) vs. the week prior

Cyber Week Performance:

Thanksgiving Global Sales: $35.6B (up 6% YoY); $8.4B in U.S. (up 3% YoY)

Black Friday First Half: $30.8B globally (up 9% YoY); $5.7B in U.S. (up 4% YoY)

Black Friday Projection: $80B globally (up 7% YoY); $18.2B in U.S. (up 4% YoY)

Amazon Rufus: The Real Story of the Weekend

While everyone else was launching new tools, Amazon was accelerating the one they already had. And the data from Sensor Tower, the first third-party verification of Rufus performance, tells a remarkable story.

Sensor Tower Data: Rufus Usage Surges 70% in Two Weeks

Methodology: Sensor Tower tracks mobile app usage through a consumer panel. This data is mobile-only (not desktop), representing 55-60% of Amazon's overall traffic.

Chart 1: Shopping Sessions with Rufus Engagement

The Headline: Rufus usage exploded starting November 15, accelerating through Black Friday.

Before Nov 15: Rufus and non-Rufus sessions tracked relatively flat

Nov 15-Black Friday: Rufus sessions surged 86% vs. baseline; non-Rufus sessions only increased 16%

Net Acceleration: Rufus adoption grew 70% in just two weeks

Chart 2: Share of Sessions With/Without Rufus

The Headline: Rufus now represents 38% of all shopping sessions on mobile.

Oct 1 Baseline: ~30% of sessions included Rufus engagement

Black Friday: 38% of sessions now include Rufus (an 8-percentage-point gain)

Projection: At this pace, Rufus will cross 50% of sessions by end of Q1 2025

Think about that: In less than six months, Rufus could be the primary interface for more than half of Amazon's mobile shoppers.

Rufus: Key Takeaways

Rufus usage surged 70% from Nov 15 to Black Friday

Now used in 38% of mobile shopping sessions (up from 30%)

Significantly higher conversion rate vs. non-Rufus sessions

Projected to hit 50%+ session share by Q1 2025

What This Means for Amazon Sellers

Rufus Is the New Search: With 38% session penetration and growing, Rufus is no longer experimental, it's mainstream. Optimize for conversational queries, not just keyword stuffing.

AI Favors Quality Signals: Reviews, A+ Content, detailed specs, and authentic imagery matter more than ever. AI shopping assistants rely on this data to make recommendations.

Amazon May Sunset Traditional Search: If Rufus converts 60% better, why wouldn't Amazon make it the default? That $70B advertising business might be the only thing slowing this down, but eventually, better conversion wins.

External Traffic Diversifies: ChatGPT, Perplexity, and others are driving traffic to Walmart, Shopify, and DTC brands. If you're Amazon-only, you're missing out on this wave.

The Battlefield Has Expanded: This isn't just Amazon vs. the world anymore. It's Amazon (Rufus) vs. OpenAI (ChatGPT) vs. Perplexity vs. Google Shopping vs. whoever launches next week.

The Takeaway: Adapt or Get Left Behind

This Black Friday weekend wasn't just about sales, it was about the future of shopping. AI-powered discovery and purchasing tools went from experimental to essential in a matter of days.

For Amazon sellers, the message is clear:

Optimize for Rufus like your business depends on it (because it increasingly does)

Build quality signals that AI assistants can interpret: reviews, detailed listings, rich content

Diversify beyond Amazon to capture traffic from ChatGPT, Perplexity, and other emerging channels

Watch the data as these tools evolve; early movers will have a massive advantage

The AI shopping wars have officially begun. The question isn't whether to participate, it's how fast you can adapt.

🛠️ BDSN SOFTWARE TOOL of the DAY 🛠️

Jay Magaliot has assembled a directory of 71 AI tools ideal for e-commerce sellers. Check out his list of curated AI tools designed for maximum impact on your ecom business. Each tool has been carefully selected and tested.

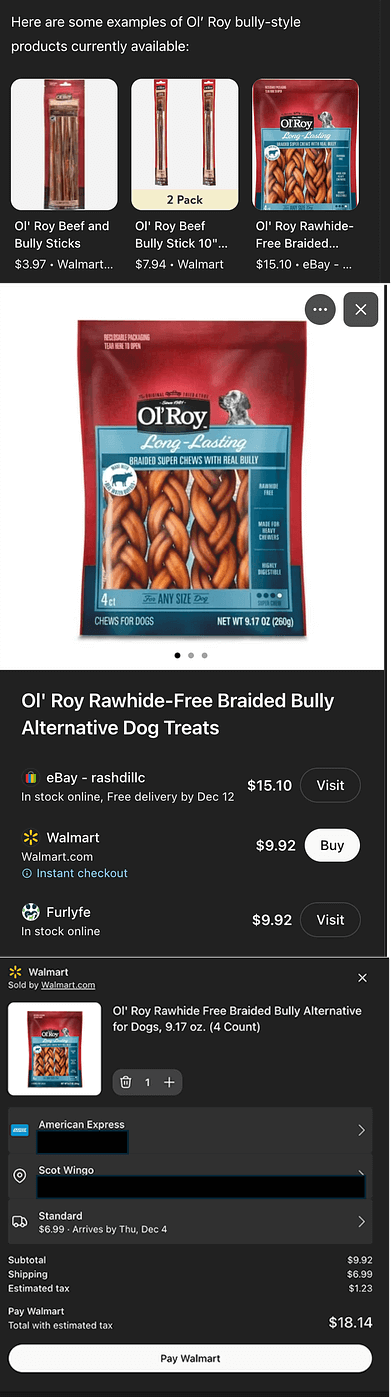

🚀 WALMART LAUNCHES CHATGPT INSTANT CHECKOUT

Walmart just went live with direct purchasing through ChatGPT on November 30th, joining Target and Perplexity in the AI commerce race.

What's Working: The basic checkout flow is live - search for products in ChatGPT, click "Buy," enter payment details, verify via text code, and complete purchase. Walmart branding is prominent throughout, and they've added two-factor authentication (SMS verification comes from "ChatGPT").

What's Broken: Product variants aren't functional yet. Items with multiple sizes or colors show options but don't let customers select them during checkout - a significant limitation that suggests this rolled out incomplete.

What's Missing: Despite Walmart's announcement, Sam's Club integration isn't live, and Walmart+ membership benefits (like free shipping) don't appear to be connected yet. The implementation feels rushed ahead of Cyber Monday.

Example from Scot Wingo and Retailgentic

Bottom Line for Sellers: This is Amazon's biggest competitor moving aggressively into AI-powered shopping during peak season. While the execution is rough, the strategic intent is clear - Walmart is betting big on conversational commerce.

We're still watching for Microsoft Copilot and Salesforce Commerce Cloud to launch similar capabilities.

The AI commerce land grab is accelerating, and it's happening outside Amazon's ecosystem.

Reach page 1 on Amazon simply by sending free products to Micro-Influencers

Use the platform Stack Influence to automate Micro-Influencer product seeding collaborations at scale (get thousands of collabs per month) and increase your Amazon ranking, generate UGC, and boost up your recurring revenue like never before.

Top Amazon brands like Magic Spoon, Unilever, and MaryRuth Organics have been able to get to #1 page positioning on Amazon and increase their monthly revenue as high as 13X in as little as 2 months.

Pay influencers only with products (stop negotiating fees)

Increase external traffic Amazon sales (get to top page rankings)

Get full rights image/video UGC (build your brand with authentic content)

100% automated management (don’t lift a finger to get influencer collabs at scale)

Don't believe it? Check out the results from the Blueland Micro Influencer campaign which generated a 13X ROI scaling up influencers on Amazon.

After successfully raising investment on Shark Tank, Blueland turned to Stack Influence to boost their Amazon sales and become a top selling listing using Micro Influencer marketing.

Increase your Amazon listings ranking for targeted keywords and multiply your organic recurring revenue in 2025!

Get 10% OFF by signing up this month

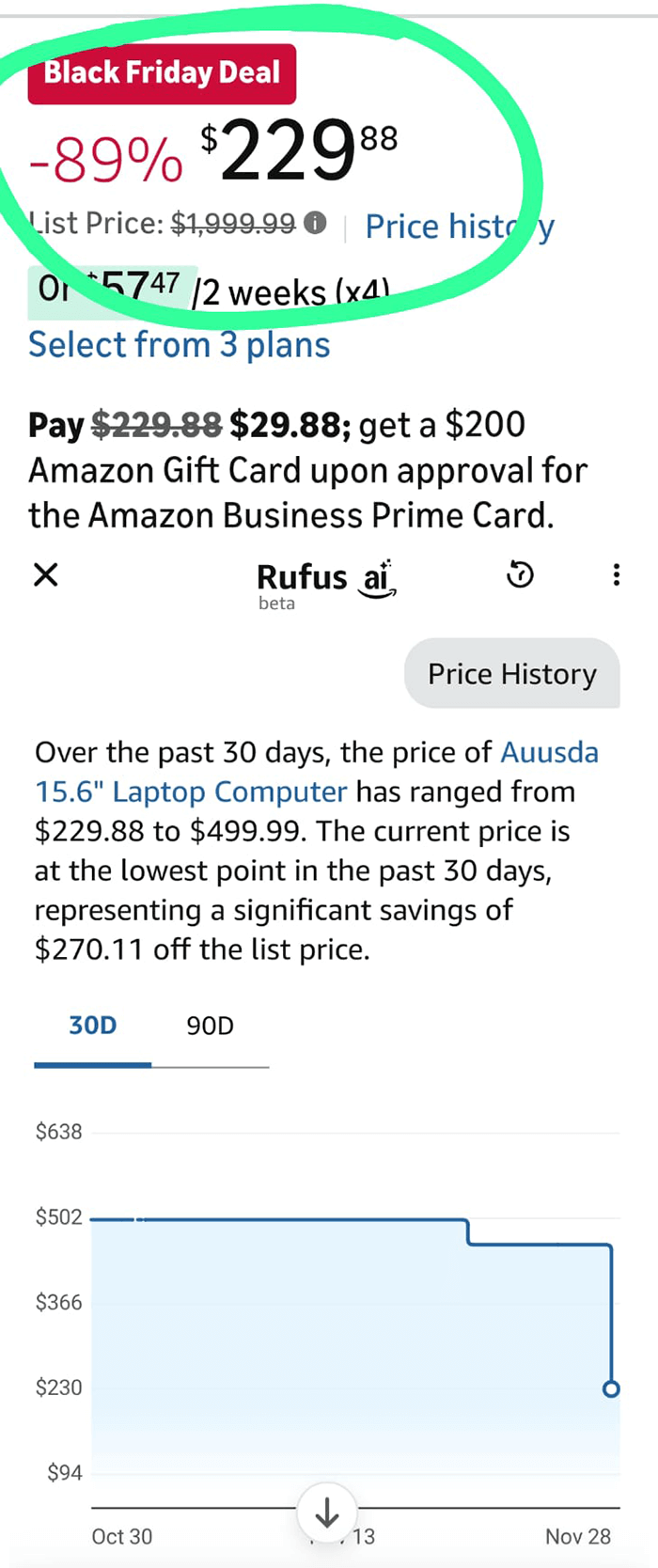

🗜️ RUFUS’ PRICE HISTORY POPULAR this WEEKEND

Lots of seller try to game the system during Q4 by raising list prices or selling prices, then putting huge discounts on them (like in the example below) to try to attract attention.

Amazon's Rufus AI assistant now displays product price history directly on product pages with no plugins needed. Shoppers can tap the Rufus icon to see price fluctuations, discount frequency, deal quality, and pricing patterns over time.

This transparency could be challenging for sellers, as buyers can now instantly compare price stability across competitors and spot frequent price changes. Rufus has evolved from just recommending products to actively educating shoppers with data-driven insights.

BFCM Impact: Usage of this feature has increased dramatically over Black Friday/Cyber Monday, as shoppers leverage the price history tool to determine if holiday "deals" are genuinely discounted or artificially inflated.

🔥 MORE HOT PICKS 🔥

🥃 PARTING SHOT

"Stopping advertising to save money is like stopping your watch to save time."

✌🏼 See you again Thursday …

The answer to today’s STUMP BEZOS is

84% of US adults use Youtube, 50% of them daily