Tickets go on sale first week of January

STUMP BEZOS

B2B sales on Amazon (ie Business Pricing) has been steadily increasing. How much GMV has this generated this year on Amazon?

[ Answer at bottom of email ]

💰 A VALUABLE LESSON from a TOP SELLING PRODUCT

In 1990, three roboticists from MIT had a vision that seemed straight out of science fiction: robots in every American home. Not androids or humanoid assistants, just simple, autonomous machines that could handle one of life's most tedious chores.

They called their creation the Roomba, and when iRobot launched it in 2002, it didn't just succeed. It became a cultural phenomenon.

The Golden Years: When Everything Worked

The Roomba was magical in its simplicity. A disc-shaped robot that vacuumed your floors while you did literally anything else. No learning curve. No assembly required. Just press a button and watch it go.

By 2021, iRobot had sold over 40 million household robots. The company's stock hit $133 per share. The Roomba wasn't just a product, it was the robot vacuum. When people said "I need to run the Roomba," they weren't talking about a generic vacuum. They were talking about the Roomba, the same way we "Google" things instead of searching for them.

iRobot had built the perfect first purchase. They'd created a product so novel, so useful, and so well-marketed that millions of households decided they needed one.

And that's exactly where their story should have continued.

Instead, it's where their problems began.

The Cracks Start Showing

By 2022, iRobot's stock had crashed to half its peak value. Amazon swooped in with a $1.7 billion acquisition offer at $61 per share, a premium, but far from the glory days.

The FTC and European regulators killed the deal, citing concerns about competition and consumer welfare. "This merger would lead to higher prices, lower quality, and less innovation for consumers," declared Margrethe Vestager, the EU's competition chief.

They were wrong. Catastrophically wrong.

Without Amazon's resources, iRobot faced brutal competition from Chinese manufacturers, Brand like Roborock, Ecovacs, Dreame, and Xiaomi flooded the market with cheaper alternatives. Double-digit tariffs on imported Roomba parts cost the company $23 million. iRobot laid off more than half its workforce between late 2023 and March 2025.

By Q1 2025, iRobot's global market share had collapsed to less than 10%. Chinese competitors controlled over 50% of the market.

On Sunday, December 15, 2025, iRobot filed for bankruptcy.

The company that sold 50+ million Roombas that revolutionized an entire product category was dead.

The irony? The regulators who blocked Amazon from acquiring an American robotics company on grounds of protecting consumers ended up handing that same company to Chinese manufacturer Shenzhen PICEA Robotics instead.

What Killed Roomba? (Hint: It Wasn't Lack of Demand)

Here's the sentence that should make every Amazon brand operator stop and think:

iRobot sold 50+ million Roombas. Then it went bankrupt.

As BDSN Dream 100 member Liran Hirschkorn recently pointed out in his breakdown of the collapse, iRobot didn't die because people stopped wanting robot vacuums. It died because the company built a world-class first purchase and never built a durable system for what came after.

Think about that business model:

Make money from first-time Roomba buyers

Hope those customers eventually need a replacement in 5-7 years

Repeat

That worked brilliantly ... until it didn't.

Once market penetration peaked, i.e. once most people who wanted a Roomba already owned one, growth stalled. Cheaper competitors drove prices down. Customer acquisition costs climbed. And iRobot had no meaningful way to generate revenue from the millions of existing Roomba owners sitting in their database.

The product kept selling. The business couldn't support itself.

Their Hail Mary was the Amazon acquisition. When regulators blocked it, there was no Plan B.

The Warning Sign You're Ignoring

If you're reading this and thinking "that's unfortunate, but my brand is different," I need you to pause.

Because many Amazon brands are running the exact same playbook right now, even if the P&L looks healthy.

You have a hero ASIN that ranks well. Your ads convert. Revenue is steady month over month. You're hitting your numbers.

But every month still resets to zero. Growth depends entirely on paid acquisition instead of expanding lifetime value from existing customers.

That works in a growing market. It breaks when CPCs rise, competitors scale faster, or pricing compresses—exactly what happened to iRobot.

The iRobot Autopsy: What Liran's Analysis Reveals

Liran identified five critical failures that every brand needs to address heading into 2026:

1. They Never Designed the Second Purchase

When a customer bought their first Roomba, what were they supposed to buy next? A second Roomba for upstairs? Maybe. Eventually. In a few years.

There was no clear, intentional path from purchase one to purchase two, three, and four. LTV was capped by default because the business model never planned beyond the initial transaction.

The lesson: If a customer buys your core product today, what do they buy next, and when? If that path isn't crystal clear and built into your product ecosystem, you're building on borrowed time.

2. No Repeatability in the Ecosystem

Roombas needed replacement filters, brushes, and batteries. But iRobot never built a robust consumables business that turned one-time buyers into recurring revenue streams.

Compare that to a company like Keurig, which gives away brewers at razor-thin margins because they know customers will buy K-Cups every month for years.

The razor-and-blades model works because it creates predictable, recurring revenue that stabilizes margins and reduces reliance on constant new customer acquisition.

The lesson: Build repeatability into your ecosystem. Consumables, refills, accessories, and upgrades are what turn a product company into a sustainable business.

3. Ads Were Only Used for Acquisition

iRobot's advertising strategy was simple: acquire new customers. Once someone bought a Roomba, they disappeared from the ad targeting universe until maybe, possibly, they needed a replacement years later.

They never retargeted existing customers for accessories. They never cross-sold adjacent products. They never reinforced brand memory during natural replenishment windows.

The lesson: Use ads beyond acquisition. Your customer file is an asset. Retarget existing buyers, cross-sell adjacent ASINs, and stay present during the moments when customers are ready to buy again.

4. Amazon Handled Everything (Including the Relationship)

Amazon processed the transaction. Amazon delivered the product. Amazon handled customer service. And iRobot? They just manufactured the product and hoped for the best.

They never owned the post-purchase experience. No education. No engagement. No relationship that would drive reorders or referrals.

The lesson: Amazon handles the transaction. That's table stakes. But brands need to handle education, engagement, and the entire post-purchase journey that drives lifetime value.

5. Adjacent Expansion Never Felt Inevitable

When iRobot launched new products, like the Braava mopping robot or the Roomba with mapping technology, they felt like separate, experimental bets rather than natural next steps for existing customers.

A Roomba owner should have felt like getting a Braava was the obvious next move. "Of course I need that. It's the next piece of my automated cleaning system."

The lesson: New products should feel inevitable to the customer, not experimental to the brand. Each launch should feel like the natural progression of a solution you're already providing.

The Playbook for 2026: Don't Be the Next Roomba

iRobot's collapse isn't a story about market saturation or unfair competition. It's a story about building a business that only works when new customers keep showing up.

That's the warning.

Here's the opportunity:

Design for the second sale from day one. Map out the customer journey beyond the initial purchase. What do they need in 30 days? 90 days? Six months? Make it obvious, accessible, and valuable.

Build a consumables layer. Even if your core product is durable, there should be items customers need to reorder regularly. Filters, refills, upgrades, complementary products—these are what create predictable revenue and margin stability.

Treat your customer list like the asset it is. Stop thinking of buyers as one-time transactions. They're a database of people who've already said yes to your brand. Nurture them, retarget them, and give them reasons to come back.

Own the experience beyond the buy button. Inserts, follow-up emails, educational content, SMS flows, a simple website with product guides—these aren't optional nice-to-haves. They're the difference between a customer who buys once and a customer who buys repeatedly. (Note: Kevin & Norm’s DragonFish can help with your emails!)

Launch products that customers expect, not ones they question. Your existing customers should see new SKUs and think "finally" instead of "why?"

iRobot didn't fail because they stopped innovating. They failed because their business only worked when new customers kept showing up.

For years, that was enough. The market was growing. The product was novel. Acquisition costs were manageable.

Until one day, it wasn't enough anymore.

And by then, it was too late.

Don't let that be your story.

The brands that will thrive in 2026 and beyond aren't the ones with the best first purchase. They're the ones that designed the second, third, and tenth purchase before the first one ever happened.

iRobot sold 50 million Roombas and went bankrupt.

Your hero ASIN could be next, unless you build what comes after.

🌎 INTERESTING STATS

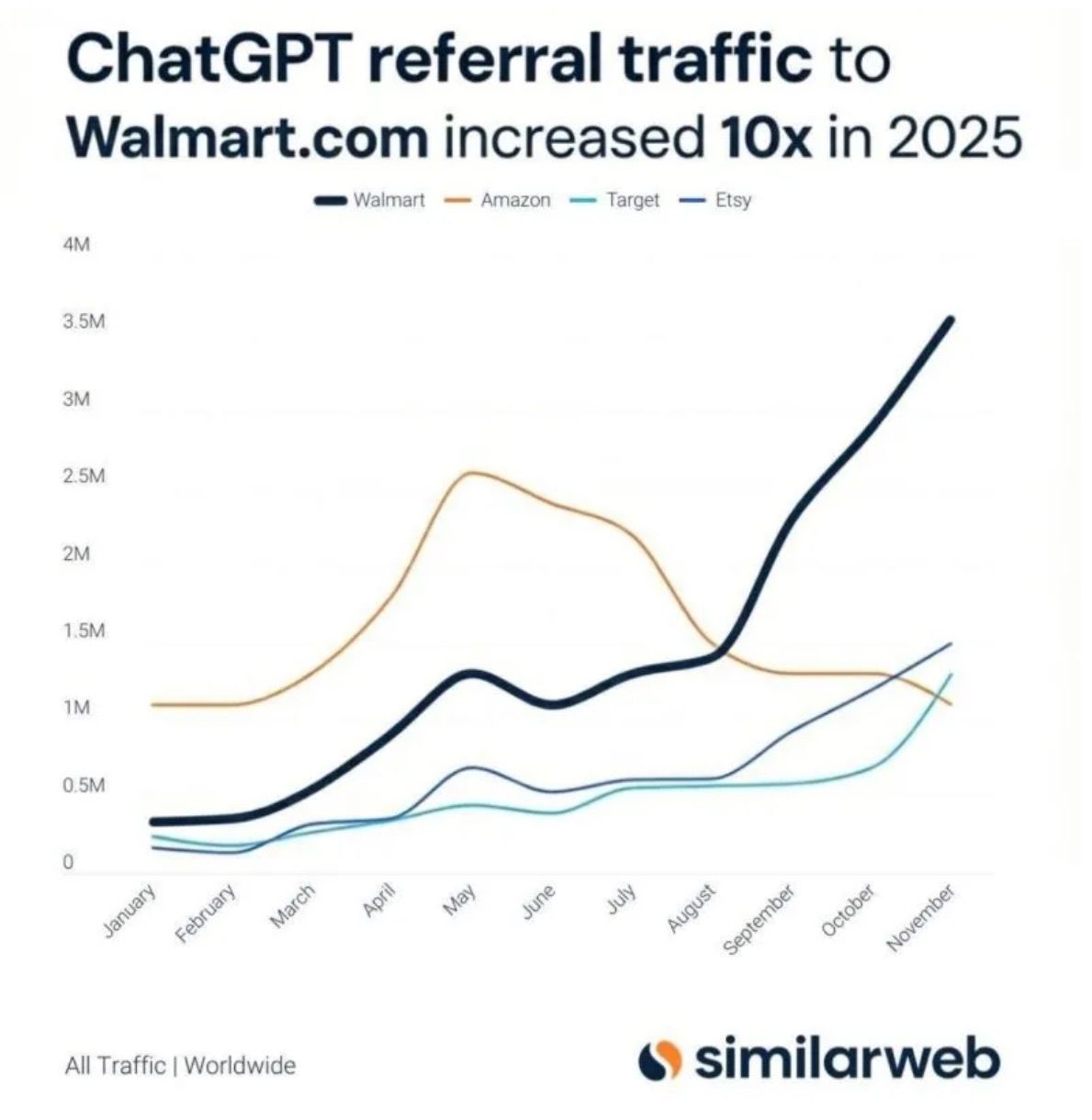

🕹️ AMAZON’S OPENAI DEAL MAY AFFECT PRODUCT DISCOVERY

Amazon is in advanced talks to invest up to $10 billion in OpenAI, a deal that could fundamentally reshape how customers discover and buy products on the marketplace.

The potential investment would value OpenAI at $500 billion and includes two critical components for sellers:

Enterprise ChatGPT Integration: OpenAI would provide Amazon with an enterprise version of ChatGPT, specifically designed to power new shopping features across Amazon's mobile apps and voice interfaces

Infrastructure Play: OpenAI would use Amazon's Trainium chips for AI computing, deepening the technical integration between the companies

Impact on Product Discovery & Conversion

This partnership could accelerate Amazon's shift toward conversational commerce, fundamentally changing how customers find and purchase products:

Search Evolution: Traditional keyword-based search may give way to natural language queries where customers describe what they need rather than typing product names.

ChatGPT's advanced language understanding could interpret complex, multi-part requests ("I need a coffee maker that's quiet, fits under low cabinets, and makes strong espresso").

Personalized Recommendations: AI-powered discovery could analyze purchase history, browsing patterns, and conversational context to surface hyper-targeted product suggestions in real-time conversations.

Alexa Transformation: Amazon's stated goal to make Alexa a "super-agent for shopping" could finally materialize, enabling voice-driven product discovery with dynamic bundling, deal-finding, and purchase completion.

What Sellers Need to Watch:

Listing Optimization Shift: Product detail pages may need optimization for AI interpretation, not just human readers and keyword algorithms

Answer Engine Optimization (AEO): Content that answers customer questions naturally will likely gain prominence over traditional SEO tactics

Ad Strategy Changes: Sponsored placements may evolve to integrate with AI-recommended product sets rather than keyword-targeted slots

If completed, this would be one of the largest AI investments in history and signals Amazon's commitment to AI-first commerce. Combined with existing tools like Rufus, this partnership could position Amazon to dominate the emerging conversational shopping landscape, forcing sellers to adapt quickly or risk losing visibility in AI-powered discovery.

The timeline remains uncertain, but sellers should begin preparing for a marketplace where AI agents, not search bars, drive the majority of product discovery.

🛠️ BDSN SOFTWARE TOOL of the DAY 🛠️

Pattern's complementary Digital Shelf tool provides insights into your competition across thousands of searches.

Everyday, they collect data on more than 3 million searches and 26 million unique products across mutitlple Amazon marketplaces.

Then their machine learning algorithm crunches this data providing a customized competitive landscape of products that appear most frequently alongside yours in shoppers' searches.

🚀 AI SEARCH is CHANGING HOW SELLERS OPTIMIZE LISTINGS

Modern Retail says Amazon sellers are quietly rethinking their SEO strategies as Rufus reshapes product discovery, even without official guidance from the platform.

What's Different About Rufus

Unlike traditional keyword-based search, Rufus understands context and intent. A shopper searching "gentle shampoo for sensitive scalp" might see sulfate-free products even if "sensitive scalp" isn't in the title. This means the old "keyword stuffing" playbook needs updating.

How Sellers Are Adapting

Instead of cramming keywords, sellers are making listings more conversational and detailed:

Better titles: "Valentine's Day milk & dark chocolate, 12-piece heart box" vs. "gift chocolate valentines day dark milk assorted heart box candy 12 pack best gift"

More context: Adding conversational phrases shoppers actually use, like "best candy for Valentine's Day"

Complete product data: Dimensions, compatibility, use cases, brand story—everything Rufus needs to understand and recommend your product

Strategic pricing: IQBar is keeping prices at key thresholds ($19.99 vs. $20) because Rufus users often search "What can I buy for under $20?"

Image optimization: Since Rufus reads text in images, brands like IQBar are updating packaging to prominently display key features

The Results

Sellers optimizing for AI search are seeing real impact:

One confectionery brand: 58% YoY sales increase

Mars Wrigley brands: 8% average increase in search visibility

Some clients: 35% traffic increases, with slow-moving products doubling sales

The Bottom Line

With 250 million customers using Rufus this year (up 140% YoY) and users 60% more likely to complete purchases, AI search optimization isn't optional anymore.

Amazon projects Rufus will drive over $10 billion in incremental annual sales. The fundamentals still matter—reviews, accurate info—but conversational, context-rich listings are the new competitive edge.

Reach page 1 on Amazon simply by sending free products to Micro-Influencers

Use the platform Stack Influence to automate Micro-Influencer product seeding collaborations at scale (get thousands of collabs per month) and increase your Amazon ranking, generate UGC, and boost up your recurring revenue like never before.

Top Amazon brands like Magic Spoon, Unilever, and MaryRuth Organics have been able to get to #1 page positioning on Amazon and increase their monthly revenue as high as 13X in as little as 2 months.

Pay influencers only with products (stop negotiating fees)

Increase external traffic Amazon sales (get to top page rankings)

Get full rights image/video UGC (build your brand with authentic content)

100% automated management (don’t lift a finger to get influencer collabs at scale)

Don't believe it? Check out the results from the Blueland Micro Influencer campaign which generated a 13X ROI scaling up influencers on Amazon.

After successfully raising investment on Shark Tank, Blueland turned to Stack Influence to boost their Amazon sales and become a top selling listing using Micro Influencer marketing.

Increase your Amazon listings ranking for targeted keywords and multiply your organic recurring revenue in 2025!

Get 10% OFF by signing up this month

💵 AMAZON and AI LENDER SLOPE TEAM UP for SELLER FUNDING

Starting tomorrow, Amazon sellers can access financing directly through Seller Central thanks to a new partnership with Slope, an AI-powered lending startup backed by Sam Altman and JPMorgan Chase.

Key Details:

Lines of credit starting at 8.99% APR

Real-time approval using AI and Amazon's proprietary performance data

Flexible repayment terms (3-12 months) to match inventory cycles

Minimum requirements: 1+ year in business, $100K+ annual revenue

Unlike previous third-party lending options focused on smaller sellers, Slope targets mature businesses, including those doing hundreds of millions in revenue, with bank-grade financing. The AI underwriting analyzes granular Amazon data (like sales by product) to make faster, more informed decisions than traditional banks.

Early results show significant demand, with applications growing 300% week-over-week during the trial period.

This replaces Amazon's own lending program (discontinued ~4 years ago) and could dramatically expand available capital for the seller ecosystem, which drives over 60% of Amazon's total sales.

If you need working capital for inventory or growth, you can now apply and get approved in minutes without leaving Seller Central.

Like BDSN? Forward this email to a friend!

If you’re that smart friend, subscribe now:

🔥 MORE HOT PICKS 🔥

🥃 PARTING SHOT

“Credibility = Expertise + Trustworthiness”

✌🏼 See you again Thursday …

The answer to today’s STUMP BEZOS is

Amazon Business has generated $35 billion iN GMV