Last Thursday’s webinar hosted by Kevin King and Norm Farrar has attendees saying “mind blowing,” “wow wow wow” “invaluable stuff” and “this content is amazing.”

You can now watch the replay (or rewatch it a second time).

AI shopping is exploding. 60+ million daily queries on ChatGPT alone, and Amazon's Rufus contributed $10 BILLION in incremental sales last year.

If you're not optimizing for Answer Engine Optimization (AEO), you're invisible to the future of commerce.

Topics Covered:

Why AI citations are the new currency (backlinks are dying)

How Rufus, ChatGPT, and Google Gemini discover products

The citation gap—why top Google rankings don't guarantee AI mentions

Reddit & Quora strategies for instant AI visibility

Product cards and schema markup essentials

Actionable Tactics Shared:

Complete product attribute optimization for Amazon's Cosmo algorithm

The exact Reddit SOP our team uses (step-by-step playbook)

Press release strategies that get you cited in 2-3 hours

How to reverse-engineer competitors using Rufus

LLMs.txt file setup for instant AI indexing

Content types AI loves (FAQs, glossaries, comparison charts)

Bonus from Dan Kurtz:

Google's internal search quality guidelines (8,000+ lines)

Custom schema generator & LLM sitemap frameworks

How to track AI-powered keyword rankings

Digg.com opportunity (Reddit co-founder's new platform)

This is NOT theory. This is the exact playbook working for brands seeing 150-468% growth in 90-100 days.

⚠️ First-mover advantage is NOW. The brands dominating AI search in 2030 are the ones taking action today.

Watch the replay

STUMP BEZOS

How much is it projected ChatGPT could generate capturing high-intent commercial queries with ads by 2030?

[ Answer at bottom of email ]

💰 MATH BEHIND WINNING AMAZON SEARCH RANKINGS

New data from Smart Scouts just confirmed what we've all suspected: The top spot doesn't just get more clicks: it captures 18.7% of ALL sales for that search term.

Scott Needham of Smart Scout analyzed 2 million search terms in January 2026.

Here's what the data shows:

Position 1:

Gets 25.4% of clicks

Captures 18.7% of sales

Position 2:

Gets 11.9% of clicks

Captures 8.2% of sales

Position 3:

Gets 7.9% of clicks

Captures 5.3% of sales

The takeaway? You don't necessarily need to rank #1. You need to get clicked more than anyone else.

4 Ways to Win the Click

Put searchable benefits directly on your main image. Make it obvious why someone should click.

Add a visible discount. Even a $1-2 coupon or Subscribe & Save badge works. I've been bullish on coupons since 2019, and the data keeps proving it works.

Maximize your product size in the frame. Fill the white space so your packaging is readable and your product looks substantial.

Test constantly. Pattern interrupt stops the scroll. What worked last month might not work today.

Calculating the Revenue Potential of Ranking Higher

Last week, BDSS Dream 100 member Jon Derkits shared a method in his newsletter for using Amazon's first-party data to determine if a ranking push is worth the investment.

The scenario: You're at the bottom of page 1 for a relevant keyword. You're confident you can reach the top. But will the PPC or influencer investment actually pay off?

Example for the steps below

Here's how to estimate your revenue potential:

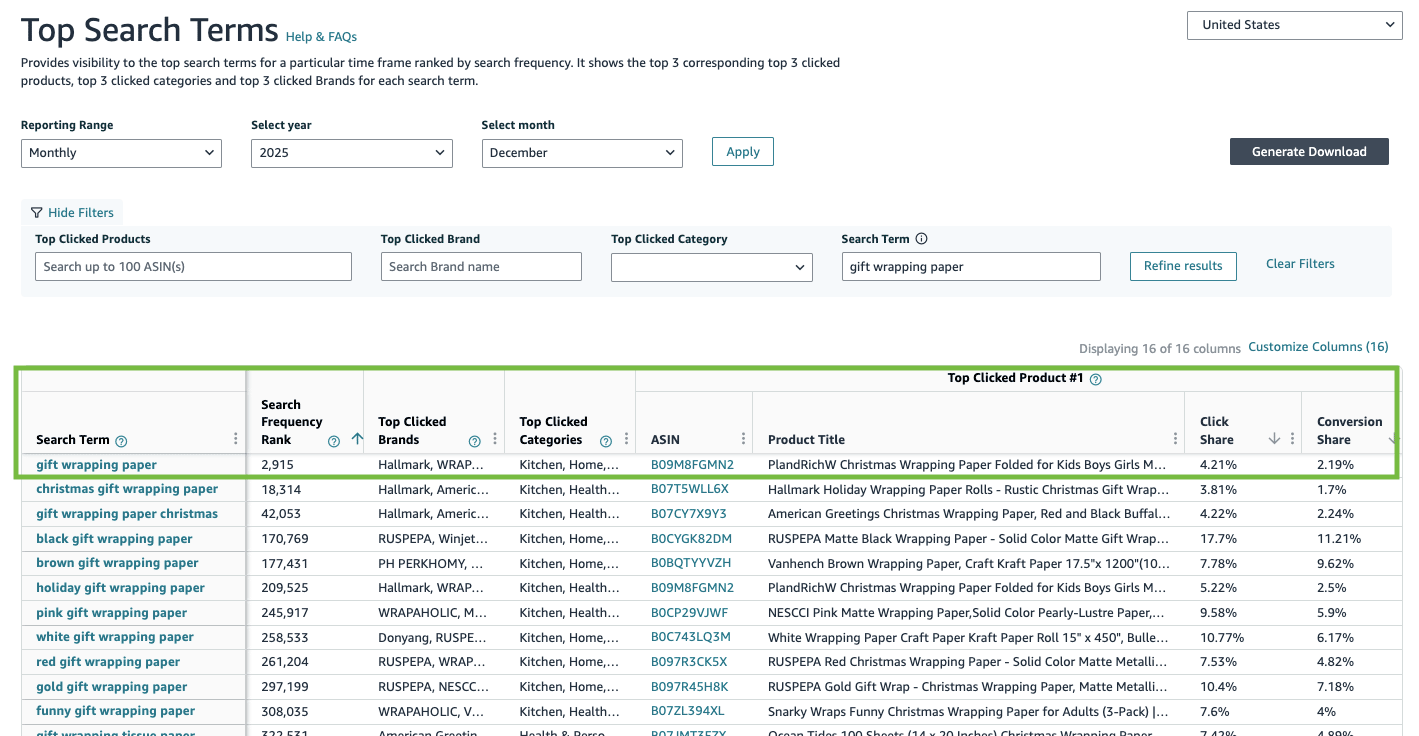

STEP 1: Open the Search Terms Report in Brand Analytics.

STEP 2: Filter for your target keyword. (Example: "gift wrapping paper")

STEP 3: Note the Click Share and Conversion Share for the #1 ASIN. For "gift wrapping paper": 4.21% click share, 2.19% conversion share

STEP 4: Go to Search Query Performance and find the Search Query Volume. "Gift wrapping paper" in this example for December 2025: 358,155 searches

STEP 5: Check Product Opportunity Explorer for the Search Conversion Rate of your niche. Use recent data or average it out if it's volatile

STEP 6: Calculate your potential:

Search Volume × Search Conversion Rate × Conversion Share × Your ASP = Monthly Sales Potential

Using the above example:

358,155 × 5.42% × 2.19% × $20 = $8,502/month

That's the revenue ceiling if you win and hold the #1 organic spot for "gift wrapping paper."

Now you know the juice. The question is: Is it worth the squeeze?

🌎 INTERESTING STATS

🕹️ HOW AMAZON SELLERS can WIN in the AGE of AI

The Wall Street Journal published an article over the weekend on how businesses are manipulating ChatGPT results, highlighting the need for sellers to adapt.

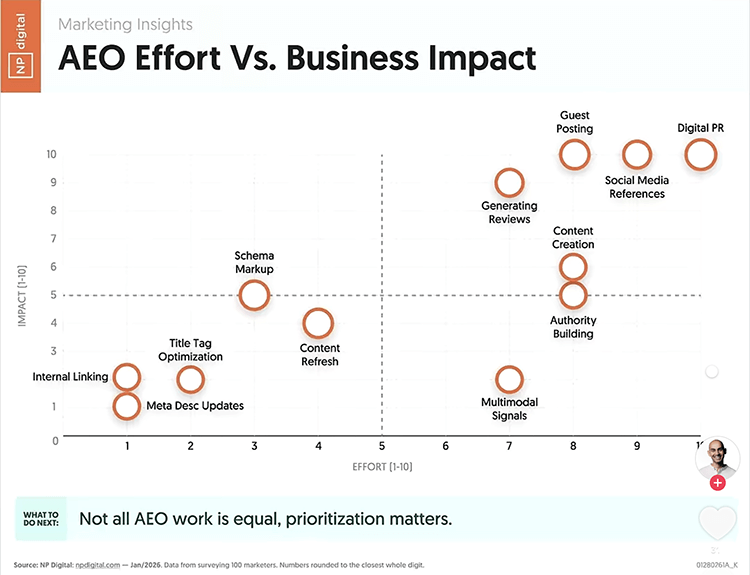

What You Need to Know About Answer Engine Optimization (AEO)

If you've mastered Amazon SEO, it's time to learn AEO (Answer Engine Optimization). As ChatGPT and other AI assistants increasingly recommend products, a new industry has emerged to help businesses rank in AI-generated answers.

The Shift Is Real

The numbers tell the story: Just 18 months ago, 90% of referral traffic came from Google. Today, AI chatbots account for 44% of referrals on average, according to leading SEO firms. And those AI referrals are valuable as users who click through from ChatGPT spend more time on sites, view more pages, and convert at higher rates than Google referrals.

Why This Matters for Amazon Sellers

When shoppers ask ChatGPT "what's the best [product] for [use case]," they're bypassing Amazon's search entirely. The AI decides which products to recommend before the customer ever reaches your listing.

This represents both a threat and an opportunity. Sellers who optimize for AI discovery can capture customers earlier in the journey. Those who ignore it risk becoming invisible to an entire channel of high-intent shoppers.

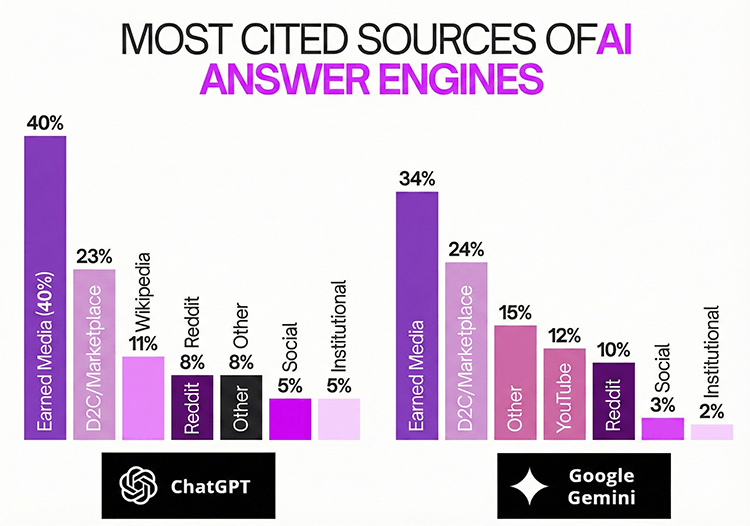

How AI Recommendations Actually Work

Unlike Amazon's algorithm, AI chatbots synthesize information from across the web.

They're looking for:

Brand authority statements - Phrases like "highest-rated for [use case]" or "top performer in [category]"

Multiple mentions - Your brand appearing on 10+ credible websites

Superlatives - "Most cited," "leading," "trusted by professionals"

Source credibility - Major media mentions carry more weight than Reddit comments

Think of it this way: AI is easier to influence when it has less built-in knowledge about a topic. For specialized products, exactly what many private label sellers offer, this creates opportunity.

Practical Strategies for Amazon Sellers

Build Off-Amazon Authority

Maintain an informational blog on your brand website

Guest post on industry blogs and review sites

Pursue media coverage (press releases) for product launches

Develop educational content that positions your brand as an expert

Optimize Your Brand Presence

Ensure your product appears on comparison sites and review platforms

Create consistent "best for [use case]" messaging across channels

Build backlinks from credible sources in your niche

Monitor how AI chatbots currently describe your products

Don't Neglect Traditional SEO ChatGPT and other AIs still crawl Google results. Your Google ranking influences AI recommendations, so traditional SEO remains foundational.

The Reality Check

AI recommendations aren't verified like human reviews. They're synthesized from available information, which means they can be influenced. Smart sellers will learn to shape that narrative using companies like DragonFish.

But here's the caveat: If major media has already defined your brand story (like country of origin controversies), even the best AEO won't override established facts.

What's Next

As ChatGPT adds more shopping features and Rufus becomes more sophisticated, AI-driven discovery will only grow. The sellers who invest in building credible, off-Amazon brand authority now will be positioned to capture this emerging traffic.

The question isn't whether AI will change how customers discover products, it already has. The question is whether you'll adapt before your competitors do.

Bottom line: Start thinking beyond Amazon's A9 algorithm. The next frontier of product discovery is AI-powered, and it rewards sellers who build genuine authority across the web.

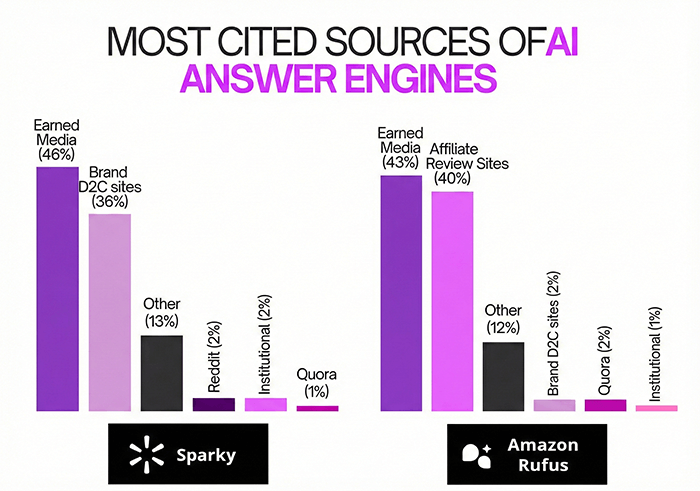

👫 CHAT GPT NEEDS AMAZON more than AMZ NEEDS CHATGPT

A ChatGPT-Amazon partnership looks increasingly likely, and it could reshape how your products get discovered and sold.

Google just locked down major retailers (Walmart, Target, Shopify, Best Buy, etc.) for their AI shopping platform, leaving ChatGPT scrambling. Meanwhile, Amazon's holding all the cards and knows it.

Key stats that matter:

Amazon products already dominate AI recommendations across platforms (even without partnerships)

ChatGPT's market share is dropping: from 87% to 65% while Google's Gemini jumps from 6% to 22%

Rufus drove 3.5x higher conversion during Black Friday and captured 66% of purchases

Why Amazon Products Win in AI Shopping

When AI models recommend products, they prioritize three things: price, trustworthiness, and delivery speed, exactly what Amazon's infrastructure provides through Prime, reviews, and competitive pricing.

Research testing 500 e-commerce queries found Amazon dominated recommendations across AI platforms, even without paying for placement. Your investment in Amazon's ecosystem is positioning you perfectly for AI-driven discovery.

Amazon's $68 Billion Problem

Here's the catch: Amazon generated $68B in advertising revenue last year, built on consumers clicking through 14+ times on average before purchasing. AI shopping compresses that funnel dramatically as users get 3-5 curated options, copy the product name, paste into Amazon, and buy. Fewer clicks = fewer ad impressions.

Any ChatGPT partnership would need to replace that lost ad revenue.

The Likely Deal Structure

If they partner, expect:

Amazon DSP as ChatGPT's exclusive advertising partner

Off-site Sponsored Products ads appearing in ChatGPT results

Amazon getting access to ChatGPT query data for targeting

ChatGPT taking 3.5-4% transaction fees

What This Means for You

AI optimization is now table stakes—your products need strong signals (reviews, competitive pricing, Prime eligibility)

Off-site advertising opportunities will expand beyond Pinterest into AI platforms

The discovery funnel is changing—fewer browsing sessions, more direct conversions from AI recommendations

The shift toward AI-powered shopping isn't coming, it's already here. Amazon's infrastructure advantage means sellers optimized for Amazon's ecosystem are automatically positioned for the AI shopping era.

Reach page 1 on Amazon simply by sending free products to Micro-Influencers

Use the platform Stack Influence to automate Micro-Influencer product seeding collaborations at scale (get thousands of collabs per month) and increase your Amazon ranking, generate UGC, and boost up your recurring revenue like never before.

Top Amazon brands like Magic Spoon, Unilever, and MaryRuth Organics have been able to get to #1 page positioning on Amazon and increase their monthly revenue as high as 13X in as little as 2 months.

Pay influencers only with products (stop negotiating fees)

Increase external traffic Amazon sales (get to top page rankings)

Get full rights image/video UGC (build your brand with authentic content)

100% automated management (don’t lift a finger to get influencer collabs at scale)

Don't believe it? Check out the results from the Blueland Micro Influencer campaign which generated a 13X ROI scaling up influencers on Amazon.

After successfully raising investment on Shark Tank, Blueland turned to Stack Influence to boost their Amazon sales and become a top selling listing using Micro Influencer marketing.

Increase your Amazon listings ranking for targeted keywords and multiply your organic recurring revenue in 2026!

Get 10% OFF by signing up this month

🔍 AMAZON’S AI is CHANGING HOW your PRODUCTS are FOUND

Amazon's Rufus AI assistant is fundamentally changing product discovery, and most sellers haven't noticed yet.

Here's what's happening:

When shoppers search for specific products like "men's lotion," they see the standard product grid. But type in something broader like "men's skin care," and Rufus takes over curating products and marking them as "Researched by AI." Amazon is distinguishing between shoppers ready to buy and those still figuring out what they need.

Traditional keyword ranking isn't dead, but it's no longer enough. For broad, high-intent searches, being selected by Rufus matters as much as ranking well organically.

Four changes you need to make now:

Clarify your product's role. If your listing doesn't explicitly show where it fits in a skincare routine (or any routine), Rufus will guess, and it might guess wrong.

Optimize for routines, not just products. Think beyond the single ASIN. Show how your product works as part of a complete system or daily workflow.

Make your images instructional. Use lifestyle images and infographics that demonstrate when and how to use your product. Show the sequence.

Write copy that explains context. Don't just list features. Explain usage order, timing, and how your product complements others.

Amazon isn't just displaying search results anymore. It's actively guiding purchase decisions. As AI-curated discovery expands, sellers who clearly position their products within customer routines will dominate broad, research-oriented searches.

The shift is already happening. The question is whether you'll adapt before your competitors do.

Like BDSN? Forward this email to a friend!

If you’re that smart friend, subscribe now:

🔥 MORE HOT PICKS 🔥

🥃 PARTING SHOT

"The ultimate form of preparation is not planning for a specific scenario, but a mindset that can handle uncertainty."

✌🏼 See you again Thursday …

The answer to today’s STUMP BEZOS is

ChatGPT ads is expected to top $25B by 2030