Reach 32,000+ engaged sellers

Advertise in BDSN

STUMP BEZOS

In 2020 there were 200,000 digital creator jobs in the USA. How many were there in 2024?

[ Answer at bottom of email ]

💰 MC, VISA & PAYPAL PLAN to POWER AGENTIC COMMERCE

Visa, Mastercard, and PayPal just tipped the next big domino in e-commerce: they’re opening their payment networks to AI “shopping agents” that can find, choose, and purchase products autonomously using new tokenized credentials and strict consumer-controlled spend rules.

For Amazon sellers, that means agent-friendly product data and flexible checkout options will soon decide whether your listing is surfaced—or skipped—by the bots shoppers trust most.

“Agentic search” is the next channel. Shopping bots will crawl catalog data directly and check out inside a chat window. Listings with rich, structured metadata, transparent inventory feeds and token-ready checkout links will be favored.

Tokenization becomes table stakes. All three networks hinge on tokenized credentials and granular spend rules. Make sure any off-Amazon checkout (Buy with Prime, Shopify headless, brand site) supports network token standards.

Control & compliance shift to the network. Visa/Mastercard handle disputes, authentication and fraud for AI purchases—reducing seller risk but also visibility. Monitor your chargeback and agent-flag data closely.

Prepare for cross-platform attribution chaos. If an agent shops your product on Amazon but pays via a network token outside traditional referral paths, tracking may fragment. Tighten first-party analytics and AMC integration.

Early movers win shelf space. Optimize your PDPs and feeds now so AI-shopping companions surface your SKUs first—especially for generic, attribute-driven queries (“find me a non-toxin multivitamin under $30 delivered tomorrow”).

Payments giants are turning conversational AI into a one-click storefront. Amazon sellers who embrace tokenized payments, clean product data and agent-friendly policies can ride the wave—those who ignore it risk vanishing from the next generation of product search.

FROM $1.5 MILLION to $5 MILLION in 5 MONTHS

LISTEN or WATCH HOW PALAK DID IT!

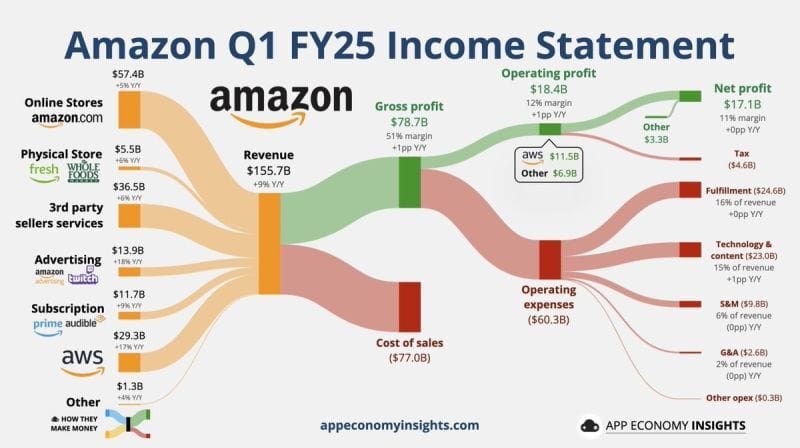

🌎 AMAZON PROFITS SOAR

🕹️ TARIFFS STACK the DECK - FOR AMAZON, NOT YOU

Amazon CEO Andy Jassy’s blunt take late last week: Because many U.S. brands source through intermediaries who already marked up China-made goods, the tariffs hit them harder than China-based sellers shipping direct. Net result: Chinese competitors can undercut on price—even after duties—while U.S. sellers eat bigger landed costs.

Marketplace math: With 2 million sellers, Amazon simply swaps in lower-cost merchants if others raise prices or drop out. That diversity lets Amazon keep storefront prices steady and shopper loyalty high, even as individual sellers bleed margin.

Inventory sprint, not marathon: Amazon urged third-party sellers to rush extra stock into U.S. warehouses before tariffs bite. Analysts say most have < six months of cushion; once it’s gone, either prices rise or margins crater—right as Prime Day and Q4 peak demand arrive.

De minimis cliff (began May 2): The end of no duty small-parcel imports will further squeeze direct-from-China shipping models many sellers rely on, but it won’t dent Amazon’s cut of seller fees.

Why Amazon “wins” either way: Seller fees topped $150B in 2024, and grocery/CPG lines—mostly sourced outside China—sit largely untouched by tariffs. Investors worry about margins; Amazon signals it will be “just fine.” For U.S. third-party sellers, the outlook is far less rosy, as you know.

If you are a mid 7-figure or above seller, you are invited to join us at an exclusive dinner on May 20, the night before the Pattern Accelerate 2025 conference.

You can register for the dinner here (no charge):

The power of networking at this dinner will be off the charts.

Plus, if you would like to attend the conference, you can use code KEVIN15 to save 15% off the ticket price.

🛠️ TRADESHOW SOURCING RESOURCES

Looking to source outside of China or find suppliers often not listed on websites like Alibaba? You might consider either attending tradeshows for your niche, or at the very least looking at the directory of exhibitors usually on the show site and reaching out.

Here are two good sources to find show worldwide:

🚀 BDSS Dream 100 member Ritu Java is doing another AI masterclass — and trust me,

it’s worth grabbing a seat.

The one she did in February sold out and got raving reviews.

If you’ve been meaning to get your hands dirty with Make (or finally do something with all those AI automation ideas floating in your head), this is the one to join.

Ritu’s workshops always sell out, and there’s a reason — she cuts through the fluff, shows you real workflows, and gets you building something that actually works.

📆 Live on Wednesday, June 5 at 1 PM PST

💸 Early bird price: $99 (goes up to $129 tomorrow)

➡️ Secure your spot on the waitlist here.

😱 ZUCK’S AD CREATIVE BOMBSHELL - AMAZON NEXT?

Zuck’s “Infinite Creative” Bombshell—Why Amazon Sellers Should Pay Attention

Meta CEO Mark Zuckerberg just told Stratechery that his goal is to let advertisers “tell us your objective, connect your account, and you don’t need any creative, targeting, or measurement—just read the results we spit out.”

In other words, Meta’s AI will generate the images, video, copy, audience, optimization, and even checkout flow for you. Meta pulled $41.4 billion in ad revenue last quarter and internally pegs generative-AI ads at $1.4 trillion by 2035—so this isn’t a side project.

Why it matters for Amazon’s ad landscape

Creative as a commodity. Amazon already lets brands auto-generate product images and videos; a fully managed “one-click” campaign tier is the logical next step.

Black-box performance data. If Meta keeps the full loop in-house, expect Amazon to tighten its own attribution stack, reducing third-party visibility and putting pressure on agencies.

Lower barrier, higher competition. When sellers can launch pro-quality ads instantly, auction prices for Sponsored Products and Brands rise—so early AI adopters will grab cheaper impressions.

Agencies must evolve. Creative studios, PPC shops, and analytics vendors need to pivot toward brand strategy, prompt engineering, and auditing platform-reported results.

Fast moves for sellers & service partners

Test Amazon’s AI creative tools now to benchmark uplift before the rush.

Document your brand voice so AI outputs stay on-brand across every channel.

Build first-party lists (newsletters, inserts) to offset future targeting opacity.

Re-scope agency contracts toward strategic oversight and independent validation.

Stay liquid on ad budgets—shift some spend quickly if Meta’s AI ads start outperforming Amazon DSP.

Zuckerberg’s vision is a direct shot at the entire ad stack; Amazon won’t be far behind.

Like BDSN? Forward this email to a friend!

If you’re that smart friend, subscribe now:

📛 SNEAKING PAST AMAZON’S KEYWORD CENSORS

\Swap literal (and often restricted) ingredient terms for benefit-first, emotion-driven language that shoppers instantly understand—no policy flags, no disapprovals.

How to apply on Amazon

Audit listings & ad copy – Highlight every ingredient or process word Amazon might flag (CBD, hemp, steroid, “slimming,” etc.).

Translate each trigger term into a shopper-centered benefit – energy boost, hangover-free fun, calm focus, sugar swap—whatever solves their pain point.

Lead with the problem they already have – “Sip without the slump,” “Snack without the spikes,” “Melts Like Butter,” “Recover without the crash.” Shoppers don’t care how; they want the result.

Test on external channels first (TikTok, Reels) – Viral engagement tells you which euphemisms resonate before you import them to Amazon’s stricter environment.

Stay consistent across the ecosystem – PDP bullets, A+ images, Storefront banners, Sponsored Brand headlines, social clips—all echo the same benefit language so customers “get it” without seeing the banned words.

Why it works

Complies with policy: Avoids restricted keywords that collapse ads or suppress listings.

Broadens reach: Many new-to-category shoppers aren’t searching “THC”—they’re hunting for “hangover-free drinks.”

Boosts CTR & conversion: Emotion-first hooks (“drink without regret”) beats ingredient jargon every time.

When Amazon’s word police close one door, open another with language that sells the feeling, not the formula.

💡 BRAND METRICS NUMBER YOU BETTER KNOW to RANK

BDSS Dream 100 Member and Cofounder of BTR Media you better know how your conversion rate and traffic compares to your category. Otherwise you could be fighting an uphill battle to rank without making changes or getting a brand lift with outside traffic.

Click the image below to download a short pdf guide on how to find your numbers.

🔥 MORE HOT PICKS 🔥

🥃 PARTING SHOT

“Choose a market with weak competition and you can succeed. In the land of the blind the one eyed man is king.”

✌🏼 See you again Thursday …

The answer to today’s STUMP BEZOS is

There were 1.5m creator jobs in the USA in 2024