NEXT MARKET MASTERS is NOV 13-17 in AUSTIN, TX

Secure your hot seat spot by Sept 30 and save $5,000.00

Secure your audience member spot by Sept 30 and save $1,000.00

STUMP BEZOS

Temu's hit $54B in 2024. Its secret sauce is simple: ship direct from China, bulldoze prices, blitz with ads. Name 2 countries they are #1 in e-commerce sales.

[ Answer at bottom of email ]

💰 AMAZON BUSINESS JUST GOT MORE PROFITABLE

Amazon just made B2B selling significantly more profitable with new FBA fee discounts for business pricing, while certification programs can help you capture mandated diversity spend.

New FBA Fee Discount (Started Sept 24)

Amazon is rewarding sellers who offer 3%+ business pricing or volume discounts with reduced fulfillment fees on multi-unit orders. This aligns perfectly with Amazon's major push for Amazon Business at Accelerate a few weeks ago.

Key Details:

Requirement: 3%+ discount through business pricing or quantity discounts

Benefit: Per-unit FBA fee reductions on bulk orders from Amazon Business customers

Applies to: Small-standard and large-standard size tiers only

Target market: 8M+ business customers who order 74% more units and return 42% fewer items

Example Impact: A supplement brand with 5% quantity discounts saves $51.50 in fulfillment fees on a single 50-unit order. Monthly reorders from just one account = $618 annual savings. Scale to 10 accounts = $6,000+ in margin to reinvest.

Action Item #1: Set Business Pricing Today

If you haven't enabled business pricing on your listings, do it now. This feature can increase sales even without the new fee discount, and now it's become significantly more profitable.

Action Item #2: Get Certified for Competitive Advantage

Many business buyers have mandates requiring a percentage of spend with minority, veteran, or women-owned businesses. When they filter by these certifications on Amazon Business, you eliminate most of your competition.

Available Certifications:

Minority-owned business

Veteran-owned business

Women-owned business

SBA certified small business

State-specific designations

Up to 11 total certifications possible

Why This Matters: With 8 million registered business buyers on Amazon, differentiation is critical. Business certifications create a filter advantage that most sellers ignore.

Get Started:

Business pricing: Set up in Seller Central today

Certifications: Visit https://services.amazon.com/amazon-business/certifications.html

Additional certification info: https://www.uschamber.com/co/start/strategy/small-business-certifications-guide

Amazon Business represents a massive, underutilized opportunity. With higher order values, lower return rates, and now better margins through fee discounts, every seller should be capturing B2B demand through proper pricing and certification strategies.

🌎 INTERESTING STATS

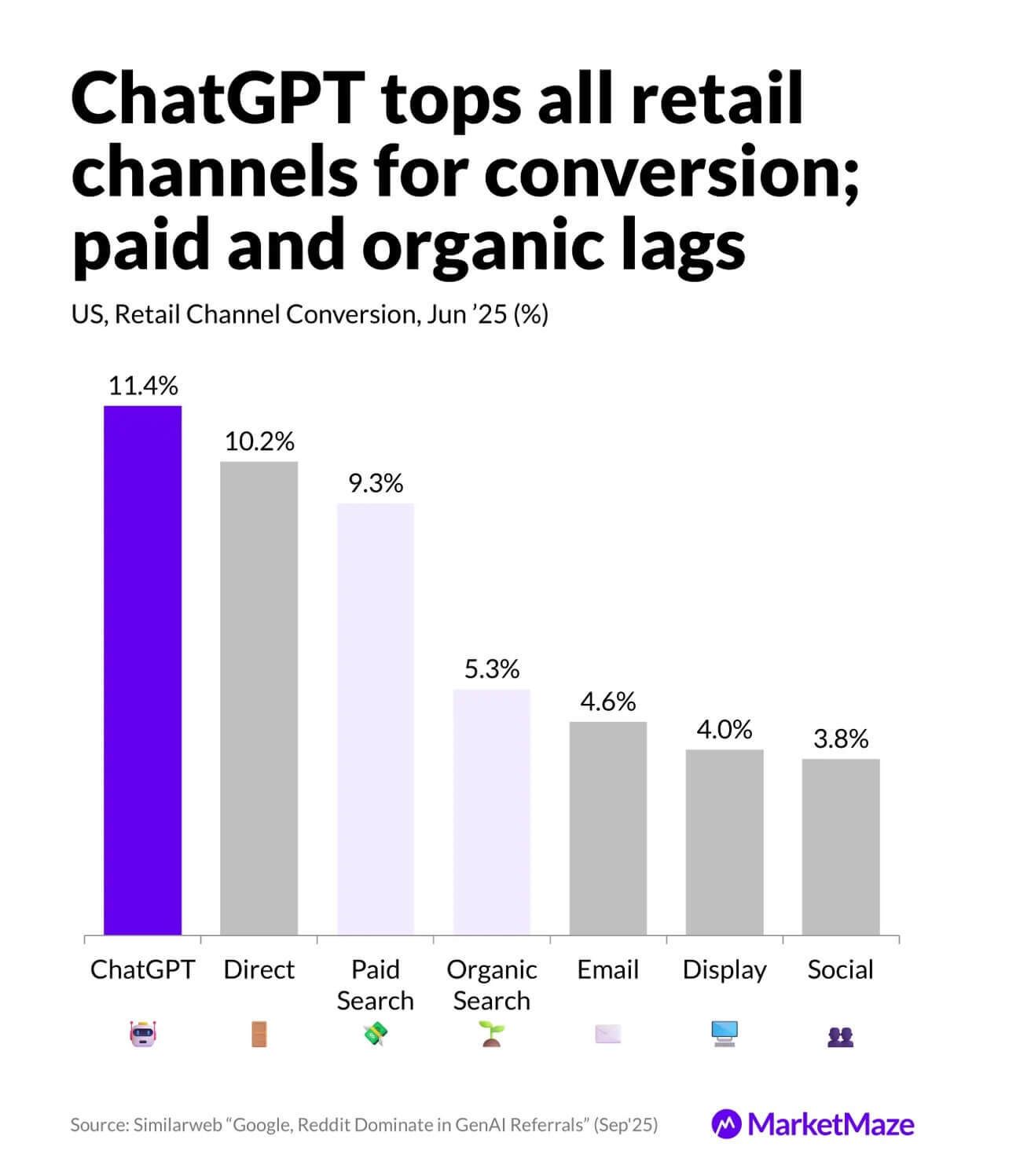

🕹️ 20% of WALMART’S REFERRAL TRAFFIC is from CHATGPT

ChatGPT has rapidly become a major source of referral traffic for major retailers, fundamentally changing how consumers discover and shop for products online.

Key Traffic Numbers:

Walmart: 20% of referral traffic from ChatGPT (up 15% from July)

Etsy: Over 20% of referral traffic

Target: Nearly 15% of referral traffic

eBay: 10% of referral traffic

Shopping volume: ~50 million ChatGPT shopping queries daily (2% of total queries)

Source: SimilarWeb

Amazon's Strategic Absence

While competitors embrace AI traffic, Amazon has deliberately blocked AI crawlers from accessing its site, causing its ChatGPT referral traffic to drop 18% in August to under 3%.

This defensive move protects Amazon's $60+ billion advertising business. When shoppers arrive via ChatGPT with high purchase intent, they're less likely to click on sponsored ads within Amazon's ecosystem.

Instead, Amazon is betting on its own AI chatbot Rufus, which has already handled over 500 million customer questions and now features integrated advertising.

What This Means for Sellers:

Free traffic opportunity: Retailers are currently receiving valuable, high-intent traffic at no cost from AI platforms

Traffic won't stay free: OpenAI is reportedly developing payment and checkout systems that will likely introduce affiliate fees or transaction costs

Competitive advantage: With Amazon's 600 million product listings effectively removed from AI search results, sellers on other platforms have less competition in AI-generated recommendations

While AI referral traffic is still small compared to total site visits, its rapid growth and high purchase intent make it a channel e-commerce sellers can't afford to ignore, especially while it's still free.

DragonFish (from Kevin King and Norm Farrar) can help your brand be the One recommended by AI language models.

🔗 BDSN MYSTERY LINK of the DAY 🔗

🖥️ YOU GOTTA SEE THIS MASTERCLASS

Jay Hunter, CRO at MaryRuth Organics, breaks down how they’ve scaled to over $500M/year in supplements.

He tells the Marketing Misfits how their TikTok Shop strategy feeds Amazon sales through halo effects, and why most brands get everything wrong about influencer marketing and channel diversification.

This is a masterclass in real-time execution.

The $35M Amazon boost from TikTok Shop

Why they target complementary, not competitive products

How J’s team reaches out to 3,000 creators daily using AI

How MaryRuth became the top supplement brand on Amazon

What not to do with retail expansion

Unconventional ad platforms like AppLovin & AI UGC tools

Reach page 1 on Amazon simply by sending free products to Micro-Influencers

Use the platform Stack Influence to automate Micro-Influencer product seeding collaborations at scale (get thousands of collabs per month) and increase your Amazon ranking, generate UGC, and boost up your recurring revenue like never before.

Top Amazon brands like Magic Spoon, Unilever, and MaryRuth Organics have been able to get to #1 page positioning on Amazon and increase their monthly revenue as high as 13X in as little as 2 months.

Pay influencers only with products (stop negotiating fees)

Increase external traffic Amazon sales (get to top page rankings)

Get full rights image/video UGC (build your brand with authentic content)

100% automated management (don’t lift a finger to get influencer collabs at scale)

Don't believe it? Check out the results from the Blueland Micro Influencer campaign which generated a 13X ROI scaling up influencers on Amazon.

After successfully raising investment on Shark Tank, Blueland turned to Stack Influence to boost their Amazon sales and become a top selling listing using Micro Influencer marketing.

Increase your Amazon listings ranking for targeted keywords and multiply your organic recurring revenue in 2025!

Get 10% OFF by signing up this month

🤑 AMAZON SETTLES $2.5B PRIME SUBSCRIPTION CASE

Amazon has agreed to pay a record-breaking $2.5 billion settlement with the Federal Trade Commission over allegations that it deliberately tricked millions of customers into Prime subscriptions and made cancellations nearly impossible.

Settlement Financial Breakdown:

$1.5 billion goes directly to customers as refunds

$1 billion in civil penalties to the government

Largest FTC settlement in history

Who Gets Refunds:

Anyone who signed up for Prime between June 23, 2019 and June 23, 2025

Customers who unsuccessfully tried to cancel during this period

Approximately 35 million affected customers eligible

Refund Process:

Automatic refunds up to $51 for qualifying customers (issued within 90 days)

Additional claims process for others who must submit documentation

Refund website will be announced on Amazon’s site and Prime pages

Customers have 180 days to submit claims once notified

How This All Started

The controversy stems from Amazon's use of "dark patterns" - deliberately confusing interface designs that manipulated customers into subscribing. Internal documents revealed Amazon executives were well aware of these deceptive practices for years.

Key Internal Revelations:

Amazon employees described practices as "a bit of a shady world" and an "unspoken cancer"

One former employee testified the interface was "deliberately confusing"

Internal reports from 2017-2020 repeatedly flagged customer confusion but changes were shelved because they reduced subscription growth

The cancellation process was nicknamed "Iliad" internally - referencing Homer's epic about a long, difficult war

The Tactics:

Checkout buttons saying "Get FREE Two-Day Delivery" enrolled customers in Prime without clear disclosure

Declining Prime required finding small, hidden links while sign-up used prominent buttons

Cancellation required navigating a "labyrinthine" 4-page, 6-click, 15-option process

Price and auto-renewal terms were buried in fine print

This settlement could reshape subscription practices across industries. The case was part of the push for "click-to-cancel" rules that would require businesses to make canceling subscriptions as easy as signing up. While those federal rules were blocked by courts, this Amazon case sends a strong signal to other subscription-based businesses about deceptive practices.

The settlement allows Amazon to avoid admitting wrongdoing while moving forward with cleaner practices - but it serves as a costly reminder that customer manipulation tactics will face serious consequences.

Like BDSN? Forward this email to a friend!

If you’re that smart friend, subscribe now:

📛 TIKTOK’s $14 BILLION DEAL

The long-awaited TikTok US deal has finally materialized, but the price tag is sparking intense debate across tech and investment circles.

President Trump signed an executive order last week to advance an agreement requiring ByteDance to divest TikTok's US operations, valuing the platform at just $14 billion, significantly below analyst expectations.

The agreement creates a new US-based joint venture with American investors holding majority control.

Ownership Distribution:

45% - American investors (Oracle, Silver Lake, and Abu Dhabi's MGX, roughly 15% each)

35% - New investors and existing ByteDance backers (General Atlantic, Susquehanna, Sequoia)

19.9% - ByteDance (capped for national security compliance)

Is $14 Billion a Steal?

Industry analysts are calling this valuation controversial, with some labeling it "the most undervalued tech acquisition of the decade." Consider the numbers:

TikTok US by the Numbers:

180+ million active US users

$15-20 billion estimated annual US revenue

1x revenue multiple (compared to competitors trading at 2.5x-25.3x)

Competitor Valuations for Context:

Snap: 2.5x revenue multiple

Pinterest: 5.9x revenue multiple

Reddit: 25.3x revenue multiple

The Hidden Revenue Stream

Recent reports reveal ByteDance may retain significant financial benefits despite the divestiture. The Chinese parent company is expected to receive:

Licensing fees on all US revenue generated using TikTok's algorithm

~50% of overall US profits through this licensing arrangement

Continued profit sharing proportional to its 19.9% equity stake

This profit-sharing structure may explain the seemingly low $14 billion valuation—ByteDance maintains substantial economic interest without operational control.

For e-commerce brands and digital marketers, this deal brings stability to one of the most powerful advertising platforms. With over 180 million engaged US users, TikTok's continued operation under American ownership removes regulatory uncertainty while maintaining the platform's addictive algorithm that drives consumer behavior.

🔥 MORE HOT PICKS 🔥

🥃 PARTING SHOT

“The most underrated skill in life is to keep showing up, even when you don’t feel like it.”

✌🏼 See you again Thursday …

The answer to today’s STUMP BEZOS is

Temu tops e-commerce sales in Finland and Slovenia.