Just in time for BFCM, three experts will help you prepare to protect your brand and listings this holiday season.

TODAY: MONDAY, NOVEMBER 24 at 2pm EST only inside BDSC

Hosted by Kevin King, with Paul Rafelson, Chris Keef and Rich Goldstein.

They have crazy stories to share, and specific tactics you can do if you get attacked, copied, or messed with my other sellers, as well as things to do in advance to prevent malicious activity by competitors.

You'll be able to ask them questions too if you are currently, or have dealt with issues against you by other sellers in the past.

Don't miss this!

STUMP BEZOS

For a product to have the best chance to succeed on TikTok, it must be 1) demonstrable, 2) serve a passionate audience and 3) what else?

[ Answer at bottom of email ]

💰 AMAZON RUFUS REVOLUTION that’s REWRITING the RULES

While most Amazon sellers are frantically optimizing bullet points and backend keywords, Amazon's AI shopping assistant Rufus just changed the entire game. And if you're not paying attention, you're already falling behind.

The Off-Site Authority Play Everyone's Missing

Dream 100 member Leo Sgovio says Rufus isn't just reading your product listings anymore. When shoppers search for products, they're now seeing a "Researched by AI" section at the top of search results before the actual products appear. And Rufus is citing external authoritative sources like GamesRadar+, Your Teen Magazine, and industry publications to inform buying decisions.

Amazon is literally telling shoppers: "We trust external publishers more than seller product pages."

This fundamentally changes the optimization playbook. On-page SEO alone has become commoditized. The new competitive moat? Topical authority across the web.

Your brand's presence in magazines, niche industry publications, and authoritative blogs now directly impacts your Amazon visibility. It's exactly how Google's algorithm works, and Amazon is following the same path with topical clusters and external validation.

Influencer Opinion Is Now Baked Into Search Results

But wait, there's more says Andrew Bell. Rufus is now surfacing influencer and trend-based content directly in shopping results. Shoppers now see:

Influencer Storefronts featuring curated product recommendations

Trend-driven TikTok favorites showcasing viral products

Here's the strategic opportunity: Products that appear in influencer storefronts or earn TikTok virality have an extra pathway to being surfaced in Rufus's exploration layout. This means your influencer partnership strategy just became a critical ranking factor.

Action items:

Make sure influencers are adding your products to their active Amazon Storefronts

Encourage authentic TikTok engagement so your product can appear in panels like "Viral TikTok favorites"

Optimizing for Rufus now means putting your product at the forefront of your influencer partnerships, not just getting a mention, but securing placement in their curated Amazon presence.

The Future of Advertising: Sponsored Prompts

Amazon just launched what may become the dominant advertising model in the age of AI: Sponsored Prompts in Rufus. This is groundbreaking says Max Sinclair, and you can bet OpenAI, Google, and Perplexity will follow suit.

The era of 10 blue sponsored links is dead. In AI-powered shopping, consumers ask questions and expect personalized recommendations. Amazon's solution? Allow brands to sponsor prompts within Rufus conversations—answering in their own tone of voice.

How Sponsored Prompts Work

There are two types, both currently free extensions to traditional Sponsored Products and Sponsored Brands campaigns:

Product-Level Prompts: When a shopper is browsing TVs, for example, they might see a sponsored question like "What are the key features of Samsung TVs?" These prompts focus on reviews, sizing, and specific product details.

Brand-Level Prompts: These address broader category discovery questions and research queries that help shoppers explore options before narrowing their choice.

Unless you opt out, Amazon will automatically show related prompts to consumers chatting with Rufus. And here's what makes this significant: 250 million customers have already chatted with Rufus, and Amazon reports that consumers show 60% higher purchase intent when searching through the AI assistant.

Even though the format is nascent, you should be testing sponsored prompts immediately. Why? Because running them now helps train the AI models to prefer your brand in future recommendations. Think of it as building authority within Amazon's AI infrastructure.

What You Need for Effective Sponsored Prompts:

Success comes down to data strategy. Amazon's large language models need structured, machine-readable data:

Clear product titles and descriptions

Accurate sizing, color, and attribute information

Strong review profiles

Content beyond your product page: Rufus pulls from Reddit, social forums, and the broader web

Amazon will provide reporting through a dedicated "prompts tab" showing impressions, clicks, orders, and—critically—which prompts led to conversions. For the first time, brands can see exactly how consumers chat with AI and what influences buying decisions.

The Holiday Power-Up: Personalization and Agentic Features

Amazon rolled out 50+ technical upgrades to Rufus just before the holiday shopping rush, making it faster and more useful. Key features include:

Personalized Results: Rufus now uses your account preferences and shopping history to tailor recommendations, from reordering past purchases to suggesting age-appropriate products for your kids.

Visual Search: iOS users can photograph shopping lists, and Rufus will identify products—including non-Amazon items through the "Buy for Me" feature.

Agentic Capabilities: Beyond shopping, Rufus handles customer service and can escalate complex issues. It's also being positioned as a tool for recommending personalized Prime Day, Black Friday, and Cyber Monday deals.

This fits into Amazon's broader AI ecosystem alongside the upgraded Alexa+ (with expanded agentic features) and Amelia (the AI assistant for marketplace sellers).

How to Beat Your Competition with Rufus

Now here's where it gets really actionable. BDSS Dream 100 member Amy Wees just won first place in Nick Penev's Hack Contest with a Rufus optimization strategy that's devastatingly effective. The premise? Rufus knows exactly why people aren't buying your products—you just need to ask the right questions.

The Amy Wees Rufus Optimization Method

Most presentations about optimizing for Amazon's AI focus on generic best practices. Amy's approach is different: it shows you how to conduct a true competitive analysis to identify exactly what's preventing conversions and what you can change.

Here's what happened with one of her clients selling foot rollers: He came from an athletic background and positioned everything around sports and athletic endorsements.

After running through this Rufus process, they discovered his actual core customer was nurses and people with jobs requiring long hours on their feet, not athletes. The insights completely transformed his messaging and imagery.

The Step-by-Step SOP

STEP 1: Ask Rufus These Initial Questions

Navigate to your product listing, click the Rufus icon, and ask these five questions:

"Hello, what is this product for?"

"What do people like about this product?"

"What don't people like about this product?"

"What are people buying instead of this product?"

"Why do you think people choose this product over these other alternatives?"

Copy all the responses. These answers contain data that goes far beyond your reviews—Rufus has backend information from DSP, search data, and broader marketplace insights.

STEP 2: Use This ChatGPT Prompt

Paste this prompt into ChatGPT, then attach your current listing text, product images, and A+ content (you can right-click and "copy image" directly into ChatGPT):

I am working with my client to optimize his Amazon listing. Although it has all the right SEO keywords, we want to make sure it is optimized for AI. I am going to give you the listing as well as images and feedback from questions and answers from Amazon's Rufus tool. I want you to take these insights and help us:

1. Identify if there are any other questions we need to ask Rufus for optimization

2. Identify opportunities based on Rufus feedback that will allow us to optimize the listing and images further (for example comparison charts, athlete endorsements, etc.)

3. Give us a fully optimized listing plan

Do you understand the task?Then paste in your Rufus Q&A responses.

STEP 3: Ask Rufus the Follow-Up Questions

ChatGPT will generate additional strategic questions to ask Rufus. These might include:

"When customers are shopping for [your product category], which product features do they ask about most often?"

"What phrases or problems do customers most often describe that lead them to buy a [your product]?"

"How does [your material] compare to [alternative materials] in terms of hygiene, durability, and comfort?"

"Do customers respond more positively to athletic endorsements or medical/therapist recommendations for [product type]?"

"What visual information do customers expect to see before purchasing a [your product]?"

"What is the average price range that customers consider reasonable for a [your product type]?"

"What other products are commonly bought with or immediately after buying a [your product]?"

"Which customer groups are most likely to buy this product beyond [obvious group]—for example, nurses, teachers, elderly?"

Amy's recent client selling backpacks got SEO insights, exact long-tail keywords, high buyer-intent queries, and was even told they were in the wrong category entirely.

Rufus gave them everything they needed for both discoverability and conversion optimization.

STEP 4: Feed Everything Back to ChatGPT

Copy the new Rufus responses and paste them back into your ChatGPT conversation.

Now ChatGPT has:

Your current listing and images

Initial Rufus feedback

Detailed follow-up Rufus insights

Ask ChatGPT to provide your complete optimization plan, including:

Revised listing copy

Image recommendations and comparison charts

A+ content suggestions

Category and keyword strategy

Agencies aren't doing this level of analysis. They're guessing based on competitor research and keyword tools. You're getting data directly from Amazon's AI about:

What customers actually want to know

Why they're choosing competitors

What's missing from your listing

How to position your product for your real customer (not who you think they are)

The listings that come out of this process are optimized for both traditional SEO and AI-driven queries. They convert better because they answer the exact questions customers are asking and address the specific objections preventing purchases.

Now get to work. Your competitors certainly are.

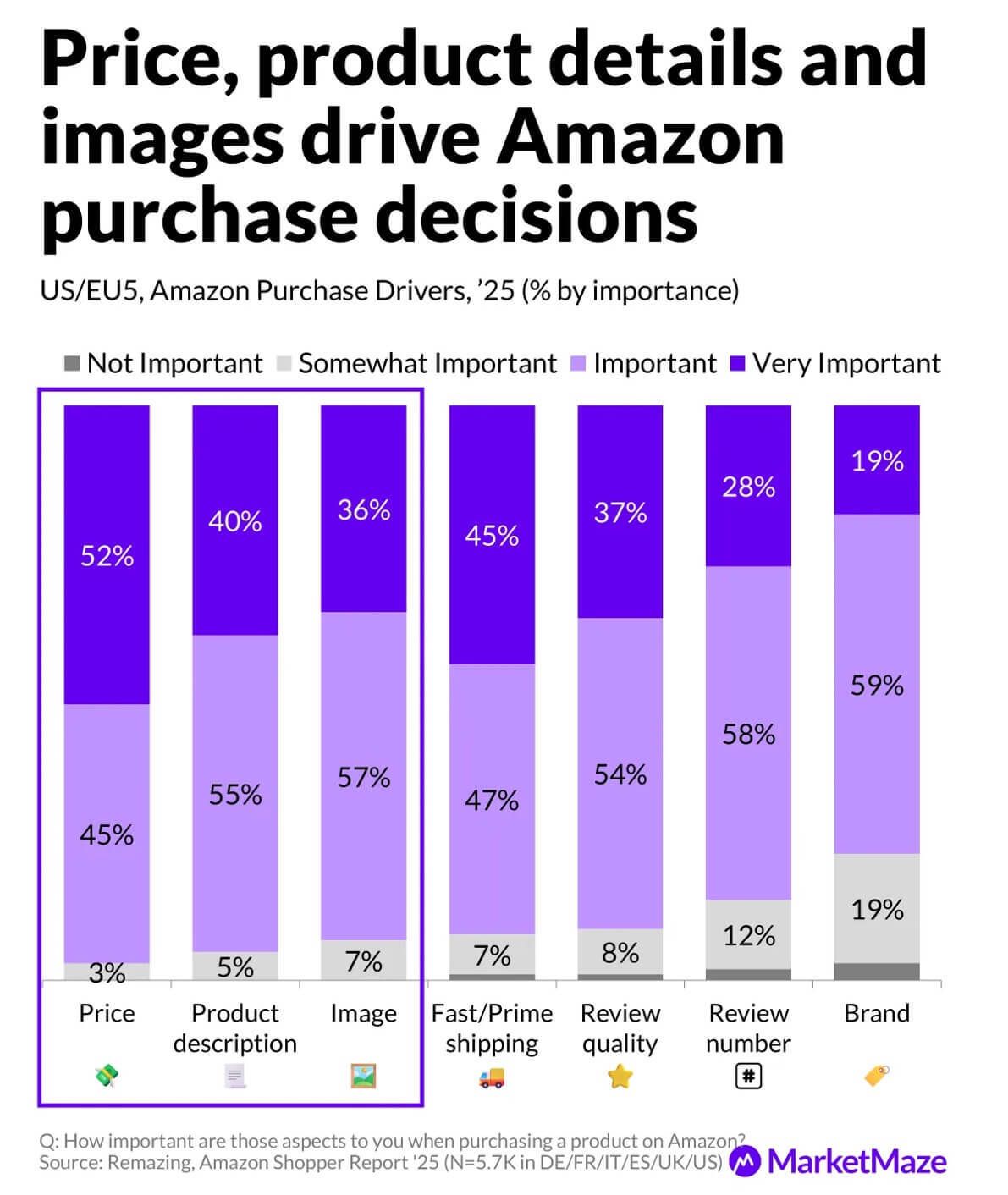

🌎 INTERESTING STATS

🕹️ AMAZON ESCALATES AI DEFENSE: BLOCKS MORE CRAWLERS

Amazon has quietly expanded its restrictions against OpenAI, blocking additional ChatGPT web crawlers from accessing its site updates to its robots.txt file.

Amazon now blocks two critical OpenAI crawlers beyond the previously restricted GPT-bot:

ChatGPT-User - the agent that fetches live web information when users ask ChatGPT questions

OAI-SearchBot - powers OpenAI's SearchGPT search engine

These crawlers help process around 50 million shopping queries daily, from product recommendations to price checks.

Some of the disallows in Amazon’s robots.txt file

Why It Matters for Sellers: While competitors like Walmart, Target, and Etsy are partnering with ChatGPT and seeing referral traffic surge (Walmart now gets 36% of referrals from ChatGPT), Amazon is doubling down on keeping shoppers within its own ecosystem.

The company generates $56 billion annually from advertising. That revenue depends on customers browsing Amazon rather than shopping through external AI tools.

Amazon's Counter-Strategy: Instead of opening to outside agents, Amazon is investing in proprietary AI tools like Rufus, Auto Buy, and its "Buy For Me" agent. The company projects these tools will generate over $10 billion in yearly sales.

Amazon controls nearly 40% of U.S. e-commerce and 90% of its shoppers start searches directly on Amazon. For now, sellers should expect Amazon to continue prioritizing its own AI shopping experience over third-party integrations.

🛠️ BDSN SOFTWARE TOOL of the DAY 🛠️

Cajari focuses on automating the collection and structuring of Amazon Seller Central data so agencies can monitor performance, operations, and risk across many client accounts without manual exports.

Key capabilities

Automatically pulls data from multiple Seller Central accounts on a recurring basis, reducing manual spreadsheet work for agencies.

Extracts account health metrics, shipping and delivery performance, and policy-related signals so teams can track risk and compliance.

Collects pricing and buy box–related intelligence to help agencies monitor competitiveness and react to marketplace changes.

Primary users and benefits

Designed for Amazon-focused agencies and large sellers managing multiple accounts and marketplaces.

Helps teams centralize operational and performance data, speed up reporting, and catch account issues earlier, improving client service and decision-making.

📸 TOP 10 AMAZON ADS UPDATES from UNBOXED

🇺🇸 AMAZON CONFIRMS it’s AMERICA’S LOW PRICE LEADER

New research from Profitero shows Amazon's prices are 14% lower on average than 23 major U.S. online retailers, marking the ninth consecutive year Amazon has held this position.

Key Findings:

Study analyzed 10,000+ items across 16 categories

Amazon leads in every single category tested

Holiday gift categories: Amazon is up to 5% cheaper than nearest competitor

Everyday essentials: 5% lower than next closest retailer

Fashion: 16% lower on average, 5% cheaper than second-lowest

What Sellers Should Know:

Amazon's aggressive pricing strategy affects how your products compete. The platform actively works to match or beat competitors' prices, both for retail items and by featuring competitively-priced third-party offers in search results.

Amazon prioritizes surfacing offers that match or beat major retailers, whether from Amazon Retail or independent sellers. To stay competitive and win the Buy Box, your pricing needs to be sharp, especially heading into Black Friday and Cyber Monday.

With Amazon positioning itself as the price leader across all categories, sellers who can maintain competitive pricing while protecting margins will have the strongest advantage during the critical holiday shopping season.

Reach page 1 on Amazon simply by sending free products to Micro-Influencers

Use the platform Stack Influence to automate Micro-Influencer product seeding collaborations at scale (get thousands of collabs per month) and increase your Amazon ranking, generate UGC, and boost up your recurring revenue like never before.

Top Amazon brands like Magic Spoon, Unilever, and MaryRuth Organics have been able to get to #1 page positioning on Amazon and increase their monthly revenue as high as 13X in as little as 2 months.

Pay influencers only with products (stop negotiating fees)

Increase external traffic Amazon sales (get to top page rankings)

Get full rights image/video UGC (build your brand with authentic content)

100% automated management (don’t lift a finger to get influencer collabs at scale)

Don't believe it? Check out the results from the Blueland Micro Influencer campaign which generated a 13X ROI scaling up influencers on Amazon.

After successfully raising investment on Shark Tank, Blueland turned to Stack Influence to boost their Amazon sales and become a top selling listing using Micro Influencer marketing.

Increase your Amazon listings ranking for targeted keywords and multiply your organic recurring revenue in 2025!

Get 10% OFF by signing up this month

📖 AMAZON and TEMU are SWAPPING PLAYBOOKS

According to Marketplace Pulse, the e-commerce landscape is experiencing a dramatic shift as major platforms blur the lines between their once-distinct strategies.

Temu's Speed Revolution

Temu has rapidly built local fulfillment capabilities, with 20%+ of U.S. sales now coming from domestic warehouses. The company is targeting 50% local fulfillment in the UK and 80% across Europe.

Some orders now arrive in two days instead of weeks, achieved through partnerships with fulfillment providers like WINIT and Easy Export rather than building their own warehouse network.

U.S. sellers are taking notice. PopMarket reports Temu became their fastest-growing channel after joining in late 2024, demonstrating genuine marketplace traction beyond just bargain-hunting consumers.

Amazon's Discount Push Goes Global

Amazon isn't sitting still. Two weeks ago, it launched Amazon Bazaar, a standalone app expanding its Haul direct-from-China model to 14 new countries including Hong Kong, the Philippines, and Nigeria.

Combined with existing Haul markets, Amazon's low-price, slow-shipping option now operates in over 25 countries. Before Amazon hid Haul data in May, these items represented 5-15% of top 100 bestseller lists.

What's Driving This?

Regulatory changes are forcing the shift. The U.S. ended its $800 de minimis exemption for Chinese imports in May 2025. Europe is following suit, eliminating its €150 exemption with interim changes in 2026 and full implementation by 2028. Without duty-free shipping, direct-from-China platforms need new value propositions beyond just low prices.

The Two-Tier Future

Both platforms are embracing hybrid models: maintaining their core strengths while adding the other's capabilities. Temu keeps direct-from-China for ultra-low prices while building local speed. Amazon protects Prime's dominance while testing budget alternatives through Haul and Bazaar.

🔥 MORE HOT PICKS 🔥

🥃 PARTING SHOT

“Happiness is not in money, but in shopping.”

✌🏼 See you again Thursday …

The answer to today’s STUMP BEZOS is

It must also show a clear transformation