STUMP BEZOS

Traffic on X (formerly Twitter) is especially bad for bot traffic. What percentage of its traffic is bot driven?

[ Answer at bottom of email ]

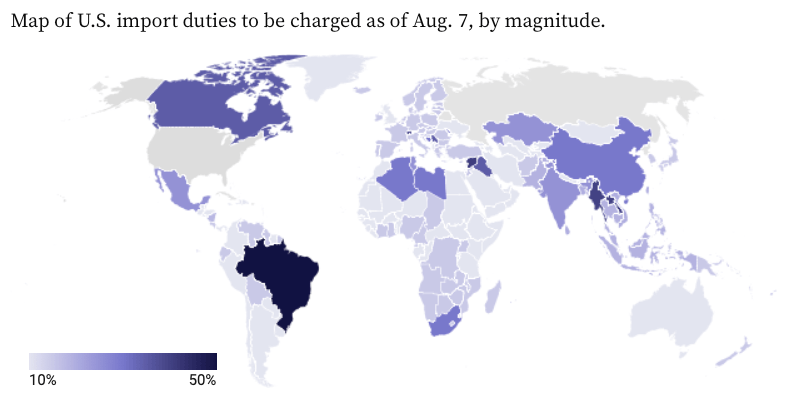

👀 NEW TRUMP TARIFFS TAKE EFFECT TODAY

August 7, 2025 marks a pivotal day for Amazon sellers as President Trump's sweeping new tariff regime officially launches, fundamentally reshaping the cost structure for importing goods to the United States.

The new tariffs, ranging from 10% to 41%, are now in effect for over 60 countries based on a tiered system that considers trade balance relationships:

10% for countries where the US has a trade surplus

15% for countries with small US trade deficits

Higher rates (up to 41%) for countries with large deficits or those that failed to negotiate trade dealsCountries and Rates Affecting Amazon Sellers

Major Trading Partners: All of the US's top 10 trading partners now face tariffs of at least 15%, though some product-specific exceptions apply.

Notable Exceptions: Countries with negotiated deals, including Japan, Britain, the EU, Indonesia, and South Korea, have rates reflecting their specific agreements, though details are still being finalized.

Immediate Effects (This Week):

Price increases on affected products

Supply chain disruptions as sellers reassess sourcing

Potential inventory shortages as importers delay shipments

Goods in Transit: Products loaded onto vessels by August 7 won't face the new tariffs if entered for consumption by October 5, providing a brief buffer for current inventory.

The 40% "Transshipment" Penalty: A Game Changer

Perhaps the most significant development for Amazon sellers is the additional 40% tariff on any goods deemed "transshipped,” Those are products made in one country using components from another to avoid tariffs.

Malaysia: A Case Study in Disruption

Malaysia's solar industry provides a stark example of what sellers can expect. Over the past decade, Chinese companies invested $15 billion in Malaysian solar panel factories, creating tens of thousands of jobs.

However, when the US imposed tariffs of up to 250% on Malaysian solar equipment (suspecting Chinese component usage), the industry collapsed. Only two manufacturers remain from the original ten.

Products that appear to circumvent tariffs through third-country assembly will face severe penalties. The Trump administration is specifically targeting this practice, which has been common in Southeast Asia where Chinese components are assembled into finished goods for US export.

In addition to the country-specific tariffs, Amazon sellers face another major change on August 29 when the de minimis exemption, which allows packages under $800 to enter duty-free, will be eliminated for all countries.

What This Means:

All imported goods will require customs declarations and duty payments, regardless of value

Individual customers may balk at increased complexity and costs

International logistics providers and cargo airlines expected to lose significant business

E-commerce retailers, especially those sourcing from overseas, will face substantial operational changes

Alternative Options: The new rules include flat rate options ($80-$200 per item) linked to each country's emergency tariff rate, available for six months.

🔭 THE TRUTH ABOUT SUPPLEMENTS ON AMAZON

The Shocking Truth About What's Really in Your Amazon Supplements

Are you unknowingly poisoning yourself with fake supplements? A veteran Amazon seller just exposed the dirty secrets of the supplement industry that could save your health, and your wallet.

When Kevin King and Norm Farrar sat down on the Marketing Misfits podcast with supplement industry insider Adam Ackerman, they uncovered a disturbing reality that every Amazon shopper needs to know about.

The Wild West of Supplement Sales

"Amazon, for years, has been the Wild West," reveals Ackerman, who has generated hundreds of millions in supplement sales. The shocking truth? Many supplements sold on the platform contain absolutely nothing of what's promised on the label.

In one jaw-dropping example, Ackerman describes testing products for companies sourcing from overseas: "We tested the product, and it turned out the product wasn't real. It wasn't what they were selling." The kicker? What customers were paying for these fake supplements was actually more than what real ingredients would cost.

Even with brand registration and ownership protections, counterfeit supplements continue to flood the marketplace through commingled inventory systems.

The Marketing Tricks That Fool You

The show reveals how supplement companies use clever marketing psychology to sell identical products at wildly different prices. From "keto sleepoids" that are just rebranded melatonin to fancy packaging that adds $20 to the price tag, the manipulation runs deep.

Want to know the full story? Watch the complete interview where Adam Ackerman pulls back the curtain on supplement manufacturing, reveals which ingredients are worth paying extra for, and shares the insider secrets that could save you from becoming another victim of supplement fraud.

🌎 INTERESTING STATS

🔒 TIKTOK CASE STUDIES VAULT

If you want to see how brands are doing well on TikTok, Stephanie Tramicheck just updated all her TikTok Shop Case Studies with brand-new data and insights on how the top-performing brands are scaling. Goli. Canvas Beauty. Neuro, and more.

Her team reverse-engineered some of the most successful TikTok Shop plays of the last 12 months.

Goli: $22M+ in affiliate-led sales

Canvas Beauty: $37M with aggressive live strategie

Neuro: $87M+ in cumulative TikTok Shop revenue

Inside each case, you'll learn:

Launch sequencing

Affiliate and creator activation

Pricing and bundling tactics

What actually scaled

❓ WHY DID AMAZON REALLY PULL its GOOGLE ADS?

In late July, Amazon made a move that sent shockwaves through the digital advertising world. The e-commerce giant abruptly pulled out of Google Shopping ads entirely, marking its most significant retreat from Google's advertising ecosystem in years.

The numbers tell the story: Amazon's shopping ad impression shares plummeted to zero across the U.S., U.K., and Germany between July 21-23, 2025. This was a dramatic fall from their previous dominance just days earlier, Amazon commanded a 60% share of impressions in the U.S. and 55% in the U.K.

"Amazon is officially gone from shopping auctions," confirmed Andy Taylor, vice president of research at Tinuiti, analyzing data from the agency's clients.

Amazon's sudden exit created an immediate opportunity for other sellers and brands. When the whale leaves the pool, as Tinuiti analysts put it, "cost per clicks will fall." The data backs this up:

CPC Decreases: Some agencies reported cost-per-click drops of up to 40% in categories where Amazon was heavily active

Impression Share Gains: Competitors like Walmart, Target, and Home Depot increased their impression shares by as much as 20% since July 23

Click Growth Surge: Q2 2025 saw the strongest Google shopping ad-click growth since the first half of 2022

For Amazon sellers who also advertise on Google Shopping, this presents a double-edged opportunity. Lower CPCs mean more affordable advertising, but they're also competing for the same customers that Amazon is no longer directly funneling through Google's platform.

The Real Strategic Picture: It's About Agentic AI

While industry observers initially speculated about cost-cutting or incrementality testing, the real reason behind Amazon's withdrawal becomes clear when viewed through the lens of agentic AI and the future of commerce.

Understanding Agentic Shopping

Agentic AI represents a fundamental shift in how consumers will shop. These are autonomous software agents that can make purchasing decisions without human intervention. Unlike traditional chatbots that simply answer questions, agentic browsers can:

Browse websites automatically

Compare products across multiple retailers

Complete entire purchase transactions

Access real-time pricing and availability data

Make decisions based on user preferences and past behavior

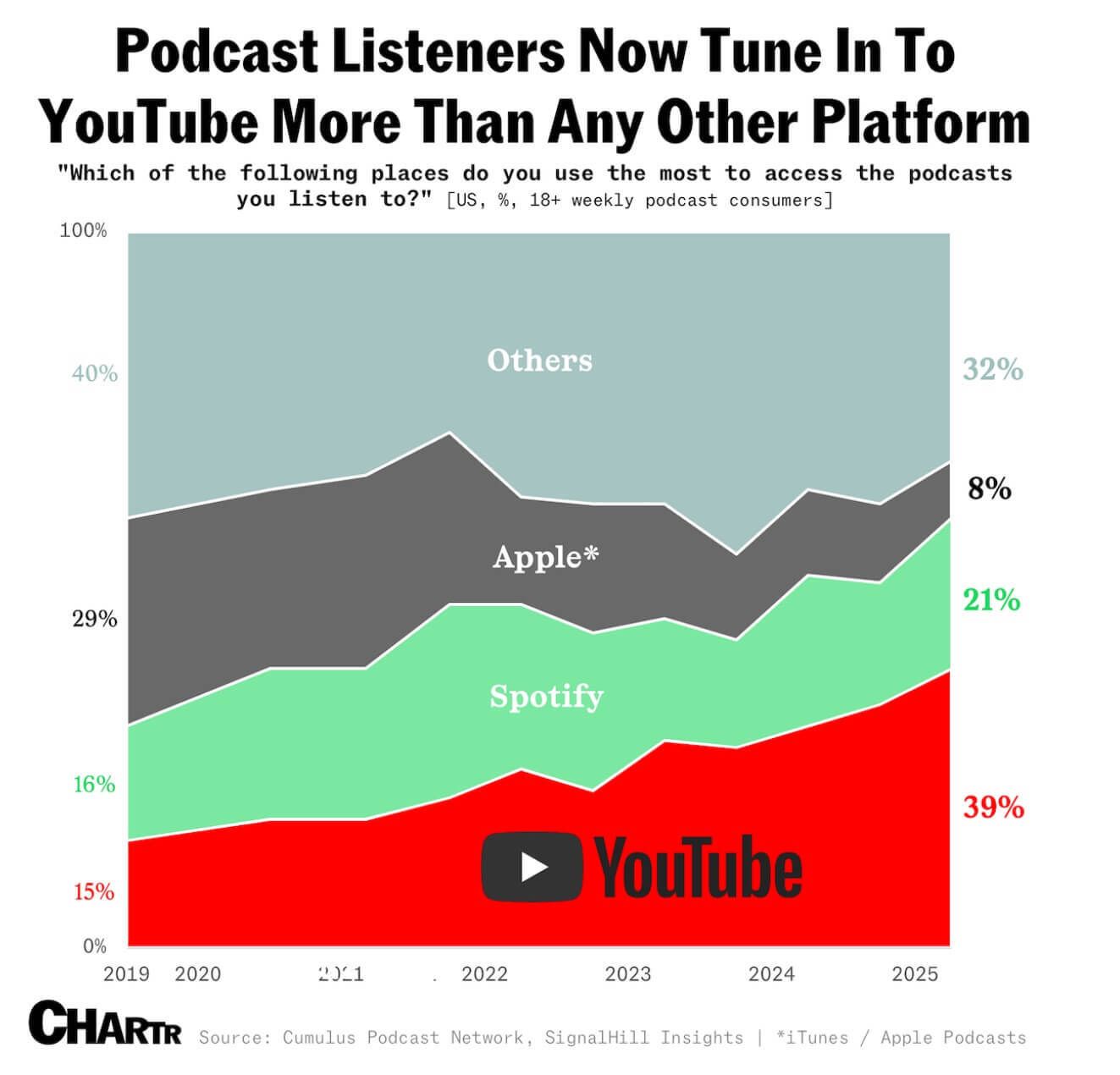

Bots and agents now account for a staggering 80% of all web traffic, with OpenAI's GPT bots alone generating 13% of total web traffic, more than Google's own crawlers at 8%.

Amazon's Agentic AI Strategy

Amazon's Q2 2025 earnings call revealed the company's true strategic direction. CEO Andy Jassy confirmed that Amazon now designs products for "non-human" customers. Software agents that "will hit 'buy' without a person in the loop."

Amazon isn't just preparing for this future; they're actively building the infrastructure to dominate it:

Strands Toolkit: Open-sourced in May 2025 for creating agents

AgentCore: A serverless runtime that Jassy called "the industry's first secure, scalable way to give agents memory, identity and observability"

AWS Agent Infrastructure: Positioning Amazon Web Services as the place where enterprise agents live and operate

The Defensive Play

While building agentic infrastructure, Amazon is simultaneously protecting its retail ecosystem from competitors' AI tools. The company has updated its website code to block AI agents from Google, Perplexity, Anthropic, and OpenAI.

When users search for products using these external AI tools, Amazon products often don't appear in results and they're directed to other retailers instead.

This creates a two-pronged strategy: build the future of agentic commerce while preventing competitors from using AI to siphon away Amazon customers.

Why Google Shopping Ads Had to Go

Amazon's withdrawal from Google Shopping ads makes perfect strategic sense within this context:

Funding the Competition: Every dollar Amazon spent on Google ads was essentially funding a rival in the AI search wars

Channel Conflict: Why pay Google to drive traffic when Amazon is building its own agentic shopping ecosystem?

Data Control: Amazon wants complete control over the customer journey, from discovery to purchase

Future-Proofing: As AI agents become the primary shopping interface, traditional search ads become less relevant

No one wants to be where the AI agents are shopping at—everyone wants to build AI agents that do the shopping.

Opportunities

Reduced Google Shopping Competition: With Amazon out of the auction, your Google Shopping campaigns may become more cost-effective

Agentic Commerce Early Adoption: Sellers who optimize for AI agents early may gain significant advantages

AWS Infrastructure: Amazon's agentic tools could provide new ways to automate and scale your business operations

Challenges

Changing Discovery: As traditional search gives way to AI-powered recommendations, product discoverability will fundamentally change

Platform Dependence: Amazon's increasing control over the shopping ecosystem makes platform diversification more critical

Technical Adaptation: Sellers will need to understand and optimize for AI agent behavior, not just human customers

We're witnessing the early stages of what may be the most significant transformation in e-commerce since the advent of online shopping itself.

The traditional model of creating content to attract human eyeballs and selling those eyeballs to advertisers is breaking down.

Since Google launched AI Overviews in May 2024, zero-click searches have increased from 56% to 69%. Publishers and retailers are watching their traffic "evaporate into the ether of AI-generated summaries."

Amazon's withdrawal from Google Shopping ads isn't just a tactical business decision, it's a strategic repositioning for a world where AI agents, not humans, do most of the shopping.

By controlling both the infrastructure that powers these agents (through AWS) and the retail ecosystem they shop in (Amazon), the company is positioning itself to dominate commerce in the age of artificial intelligence.

For Amazon sellers, understanding this shift isn't optional. It's essential for long-term success in an increasingly AI-driven marketplace.

🔗 BDSN MYSTERY LINK of the DAY 🔗

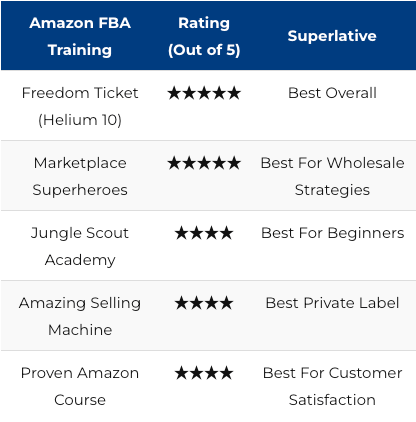

📖 THE 8 BEST COURSES FOR FBA SELLERS

Are you ready to launch your Amazon FBA business but feeling overwhelmed by all the training options out there? You're not alone. With countless Amazon FBA courses flooding the market, it's tough to know which ones actually deliver results and which ones will just drain your wallet.

Spencer Paddy is someone who's been in the trenches of Amazon selling and has tested multiple training programs, so he made it his mission to help new sellers cut through the noise and find the resources that truly work.

He shared his top 8 courses for selling on Amazon with comprehensive reviews. But he considesr the absolute best Amazon FBA course available to be Freedom Ticket by Helium 10.

Why Freedom Ticket Takes the Crown

After evaluating dozens of Amazon FBA training programs based on content quality, instructor expertise, student success rates, and overall value, Spencer says Freedom Ticket consistently comes out on top.

This isn't just another generic course thrown together by someone who read a few blog posts. Kevin King is a seasoned Amazon seller with years of real-world experience and proven results. His insights come from actually building successful Amazon businesses, not just theorizing about them.

Freedom Ticket doesn't just scratch the surface. This course takes you from complete beginner to advanced seller, covering every aspect of the Amazon FBA journey you'll encounter.

Core Features That Set Freedom Ticket Apart:

Complete Module System: Step-by-step training covering product research, sourcing, listing optimization, PPC advertising, and scaling strategies

Helium 10 Tools Integration: Immediate access to the industry's most powerful Amazon seller toolkit

Premium Video Content: High-quality tutorials that are easy to follow and implement

Real Case Studies: Learn from actual success stories and mistakes, not hypothetical scenarios

Pricing That Makes Sense

Here's where Freedom Ticket gets really smart. Instead of charging thousands for a standalone course, it's included with your Helium 10 membership

You'll need these tools anyway to research products, track keywords, and optimize your listings. It's like getting the course as a bonus with the tools you absolutely need to succeed.

Freedom Ticket isn't just teaching theory. It's giving you a complete system for Amazon success. You get world-class training from Kevin King combined with the tools to immediately implement what you learn.

Key Advantages:

✓ Learn from a proven Amazon seller with real results

✓ Comprehensive training that covers everything you need

✓ Practical strategies you can implement immediately

✓ Access to essential Amazon seller tools

✓ Ongoing support through live sessions

✓ Flexible learning that fits your schedule

Remember: Success on Amazon isn't about finding shortcuts, it's about learning from those who've already walked the path and using the right tools to execute effectively.

🔥 MORE HOT PICKS 🔥

🥃 PARTING SHOT

“The best sellers don't chase trends, they build machines.”

✌🏼 Have a great weekend.

See you again on Monday.

The answer to today’s STUMP BEZOS is

76% of X (Twitter) users are bots