STUMP BEZOS

How much annual purchasing power has been lost per potential customer in the past year due to tariff pass-throughs?

[ Answer at bottom of email ]

👀 2026 E-COM TRENDS: WHAT AMZ SELLERS NEED to KNOW

Publicis Commerce just dropped their 2026 predictions report, and three major themes stand out for marketplace sellers:

1. Agentic Commerce is Here (Whether We're Ready or Not)

The biggest shift? AI agents are moving from research tools to actual shopping assistants. ChatGPT's Instant Checkout rollout marks the beginning of conversational AI driving revenue, not just helping people decide what to buy.

The catch: While consumer adoption may lag expectations in 2026, the brands building expertise in "agentic engine optimization (AEO)" NOW will dominate in 2027 and beyond. This means optimizing your product data, content, and checkout infrastructure for AI discovery.

Regional note: This is rolling out unevenly. Germany still can't complete purchases in ChatGPT yet, while the US is seeing early traction. Get your basics in place: structured catalogs, clean feeds, and parseable product data.

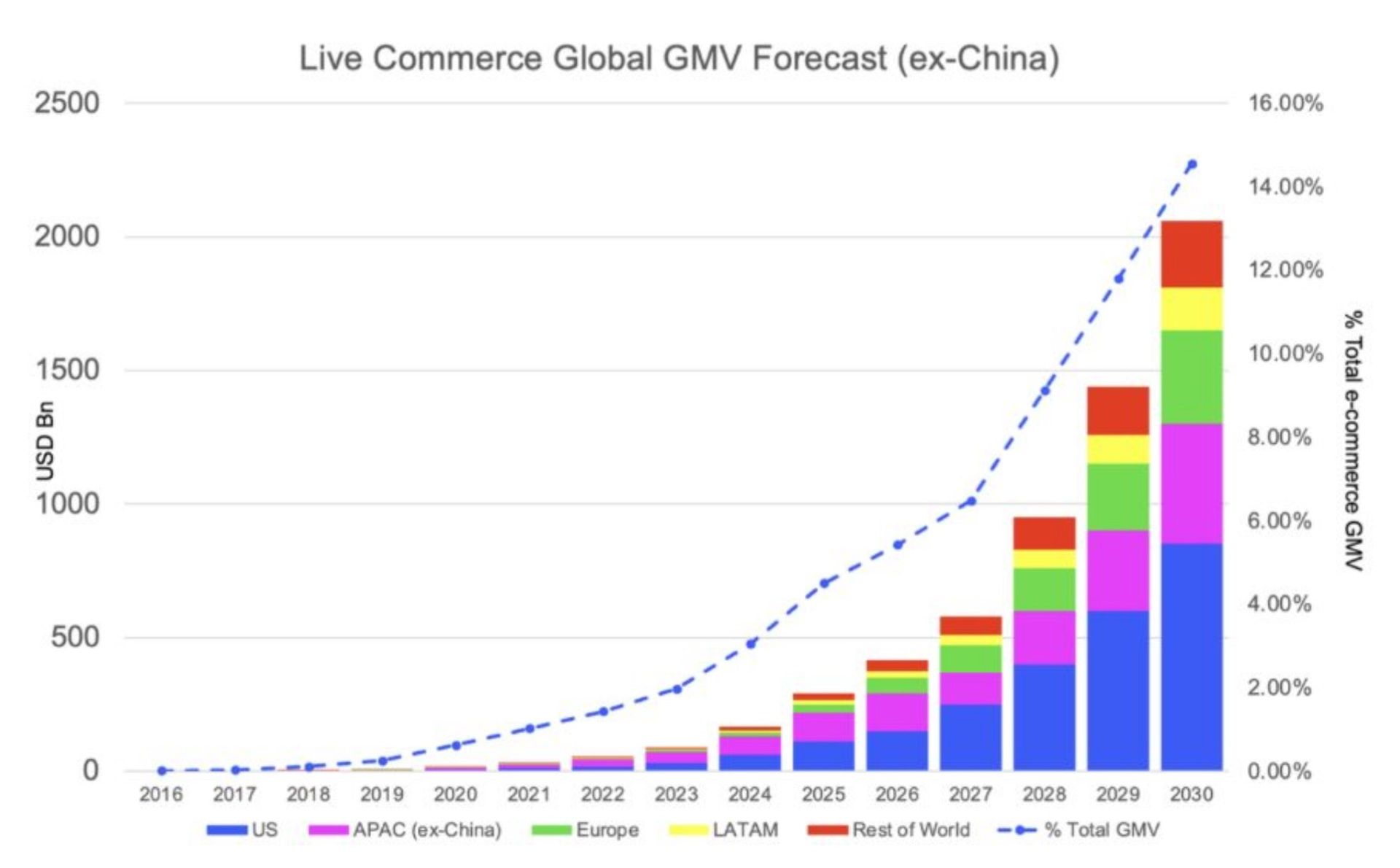

2. Social Commerce Becomes an Operating System

TikTok Shop is now the fastest-growing retailer in human history. Social commerce is shifting from "nice to have channel" to core operating reality, especially for CPG brands reaching younger demographics.

Key developments for 2026:

Influencer affiliates will drive massive sales, particularly in APAC

Content quality matters more than ever as AI takes over optimization levers

TikTok will become a top retail media network for CPG brands

Brands must establish clear affiliate guidelines to protect brand equity

The ecosystem of creators, affiliates, and peer networks will drive more purchase decisions than traditional ads.

3. Retail Media Faces Its Reckoning

After years of explosive growth, retail media is entering a scrutiny phase. Brands are demanding clearer incrementality, stronger measurement standards, and provable ROI.

The measurement paradox: Retail media has been "immensely measurable but phenomenally unmeasured." Expect real progress in 2026 as IAB sets clearer definitions and LLMs make it easier to unlock insights from data lakes.

Sponsored ads aren't dying: Despite predictions that agentic shopping will kill sponsored products, expect disruption rather than extinction. The catch? Smaller result sets, lower ad loads, and higher CPCs.

New competition: Non-traditional "commerce media networks" from travel, financial services, telecom, and transportation will explode in 2026, fighting for non-endemic advertiser dollars.

Other Trends Worth Watching

Personalization at scale: Generic shopper journeys are dead. Hyper-personalization becomes essential for retailers to defend against AI disintermediation

Physical contextual targeting: Smart stores, airplane seats, hotel TVs, and rideshare screens will enable sophisticated real-world targeting

Streaming consolidation: Watch for reduced retailer-streamer partnerships as retail data becomes ubiquitous in DSPs

Emotion still matters: As everyone chases AI efficiency, brands that understand the emotional drivers of purchase decisions will stand out

The pace of change is accelerating faster than most commerce marketers have adapted.

The winners in 2026 will be those who:

Optimize for AI discovery NOW (even if adoption is slow)

Meet shoppers on social platforms with authentic content

Demand real measurement from retail media investments

Build personalized experiences that AI agents can't easily disintermediate

Don't wait for the final form to emerge. Start building the capabilities today.

Turn your Amazon PPC into a PROFITABLE GROWTH ENGINE in 5 days with The Profitable PPC Challenge - the largest digital Amazon PPC training event in the world.

Here’s the agenda for Day 3 of The Profitable PPC Challenge:

10 example breakdowns of AI PPC Video ads that outperform human ads

Step by step how to use Nano Banana Pro to CTR-hack through mass-split testing

Rufus optimization checklist

How to rank for cheap using Sponsored Brand Video

Full PPC campaign walkthrough on 5 profitable 8 figure Amazon brands

Secure your $27 early bird ticket here now (every prior event has sold out)

🔭 YOU GOTTA SEE THIS

If you teach, coach, sell information, or run an online business, this episode is a wake-up call.

In this episode of Marketing Misfits, Norm Farrar and Kevin King speak with Dan Ashburn, co-founder of Titan Network, to break down how AI, agentic systems, personal brand, and community are reshaping marketing, e-commerce, and education at a speed most businesses are not prepared for.

Dan explains why creators, educators, and consultants who don’t integrate AI into real-time execution will end up like Blockbuster, while those who do will build the next Netflix.

This is a deep, practical conversation about what’s actually changing, what still matters, and where the real leverage is right now.

🌎 INTERESTING STATS

📚 ANALYZE YOUR COMPETITORS QUICKLY with this SOP

Jo Lambadjieva has created a valuable SOP that shows e-commerce sellers how to turn a slow, guesswork-heavy social media competitor analysis into a fast, AI-powered growth playbook that can be run in under an hour instead of an entire day.

It helps you uncover not just the obvious rivals, but the “hidden” brands your customers already follow and buy from, and then turn those insights into a sharper content and ad strategy.

What this SOP actually does

Helps you move from scattered manual research (Googling, scrolling feeds, asking around) to a structured, repeatable AI workflow for competitor discovery and review.

Uses AI to generate a categorized list of direct, indirect, and attention-share competitors your audience engages with, including brands you’ve likely never heard of.

Guides you through pulling out what’s working for those brands (content types, hooks, posting cadence, platforms) so you can benchmark your own social strategy and spot gaps.

Why as an e-commerce seller you should care

Social competitor activity directly shapes what your shoppers see, expect, and buy, often in real time, so ignoring it means flying blind while others set the standard.

Systematic competitor analysis reveals which platforms, angles, and offers actually drive engagement and sales in your niche, instead of relying on gut feel.

For ecommerce brands, using these insights in your content and ad strategy is linked with higher engagement and more effective campaigns, because you’re aligning with proven audience preferences.

You get step-by-step prompts and structure instead of vague theory, so you can literally plug in your niche and start seeing useful competitor intel today.

🛠️ BDSN SOFTWARE TOOL of the DAY 🛠️

Algofuse is an AI-driven experimentation and personalization platform for ecommerce brands that automatically creates, launches, and optimizes on-site A/B tests to grow conversion and revenue.

It helps teams quickly test product pages, pricing, messaging, and UX flows without heavy dev work, and uses machine learning to identify winning variants and continuously improve performance.

🤖 AI AGENTS COULD HANDLE 25% of E-ECOM BY 2030

The shift from curiosity to commerce

Remember when ride-sharing and Airbnb felt sketchy? Bain predicts AI agents buying products for us will follow the same adoption curve, going from "no way" to "of course" faster than expected.

The numbers

$300-500B market by 2030 in the US alone

15-25% of total e-commerce influenced or completed by AI agents

30-45% of consumers already using generative AI for product research

$3B in Black Friday sales already influenced by AI agents (Salesforce data)

What "agentic commerce" actually means

Purchases initiated, influenced, or completed by AI agents—not just AI-assisted search. Think: AI fully handling transactions from decision to checkout, not just answering questions.

The adoption timeline

Early movers (happening now): Commodity purchases with clear specs

"Cheapest 4-pack of Energizer AA batteries delivered tomorrow"

Price/availability/convenience optimization

Impact zone: Multi-brand retailers face disruption first

Later adopters: Considered purchases requiring trust

Apparel, home goods, travel

Higher emotional investment = slower AI adoption

The seller imperative

Leading retailers are determining their agentic strategy now. The winners will:

Own as much data as possible

Control fulfillment infrastructure

Maintain checkout relationships

Most consumers aren't comfortable with full AI purchasing yet, but the infrastructure is being built today. By 2030, AI will touch most online shopping. Retailers and brands who wait to respond will be playing catch-up in a fundamentally restructured marketplace.

🔥 MORE HOT PICKS 🔥

🥃 PARTING SHOT

"We will compete with technology, but win with people. We will be people-led and tech-empowered."

✌🏼 Have a great weekend.

See you again on Monday from the Driven Quarterly Mastermind.

The answer to today’s STUMP BEZOS is

$1,257 in annual purchasing power lost per customer