STUMP BEZOS

According to a study by DataWeave, how much on average have prices on Amazon risen this year for consumers?

[ Answer at bottom of email ]

👀 AMAZON & GOOGLE LAUNCH AI SHOPPING AGENTS

The 2025 holiday shopping season marks a fundamental shift in e-commerce: for the first time, major platforms are deploying AI agents that don't just recommend products, they complete purchases with your money while you sleep.

Both Amazon and Google rolled out agentic shopping features within days of each other, timing their launches precisely ahead of Black Friday. These aren't incremental improvements to search or recommendations. They're autonomous agents that monitor prices, make decisions, and execute transactions on your behalf.

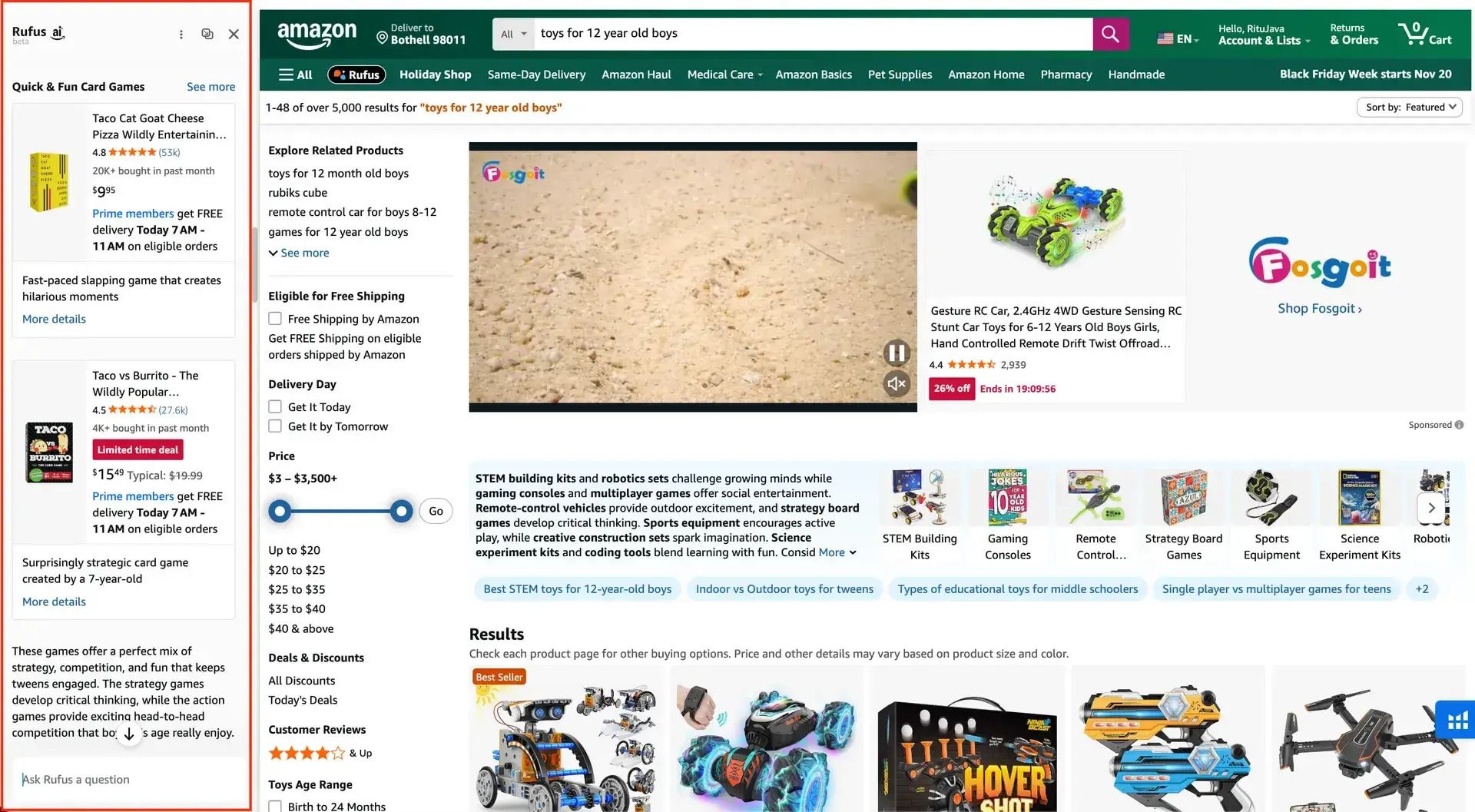

Amazon's Rufus Goes From Assistant to Buyer

Amazon quietly embedded a powerful new capability into Rufus, its AI shopping assistant. The feature allows shoppers to set price thresholds for specific products, and Rufus will automatically complete the purchase when those conditions are met.

Here's the workflow:

Find a product you want on Amazon

Tap the Rufus chat bubble and type something like "Buy these headphones when they're 30% off"

Confirm your pricing criteria and check the "Auto Buy" box

Rufus monitors the price every 30 minutes

When your threshold hits, Rufus completes the purchase automatically

You get a confirmation email with 24 hours to cancel

The feature launched just 10 days before Black Friday, a strategic move that positions Rufus as the perfect tool for deal-hunting during the year's most chaotic shopping period.

But Amazon made another significant change: Rufus now occupies permanent sidebar real estate on product pages, mimicking the layout of tools like Atlas and Comet. Instead of being a chat feature you manually invoke, Rufus now sits alongside your browsing session, actively thinking and taking actions in real-time.

This gives Rufus an insurmountable advantage over external shopping assistants like ChatGPT Shopping or Perplexity. Rufus sees your cart, your browsing history, your wish lists, and your complete account behavior. Outside players are just guessing from publicly available data. Rufus operates with full context.

The numbers back this up: Amazon reports that 250 million people have used Rufus this year, with users 60% more likely to complete purchases. Internal projections suggest Rufus will drive $10 billion in additional sales, that's billion with a B.

Google's Multi-Pronged Shopping Offensive

Google took a broader approach, rolling out four distinct AI shopping features simultaneously:

Conversational Shopping in AI Mode

Google's AI Mode in Search now handles shopping queries through natural language conversation. Ask for "cozy sweaters for happy hour in warm autumn colors" and you'll see shoppable images with prices, reviews, and inventory data. Need to compare moisturizers for your skin type? You'll get a comparison table with review insights about how products actually feel on skin.

The system is powered by Google's Shopping Graph—50 billion product listings, with 2 billion updated every hour. This scale ensures fresh inventory data across merchants.

Shopping in the Gemini App

The Gemini app can now move beyond text suggestions to provide actual shopping recommendations with product listings, comparison tables, prices, and purchase links. Available to all U.S. users, it turns brainstorming sessions ("Black Friday deals under $100") into actionable shopping lists.

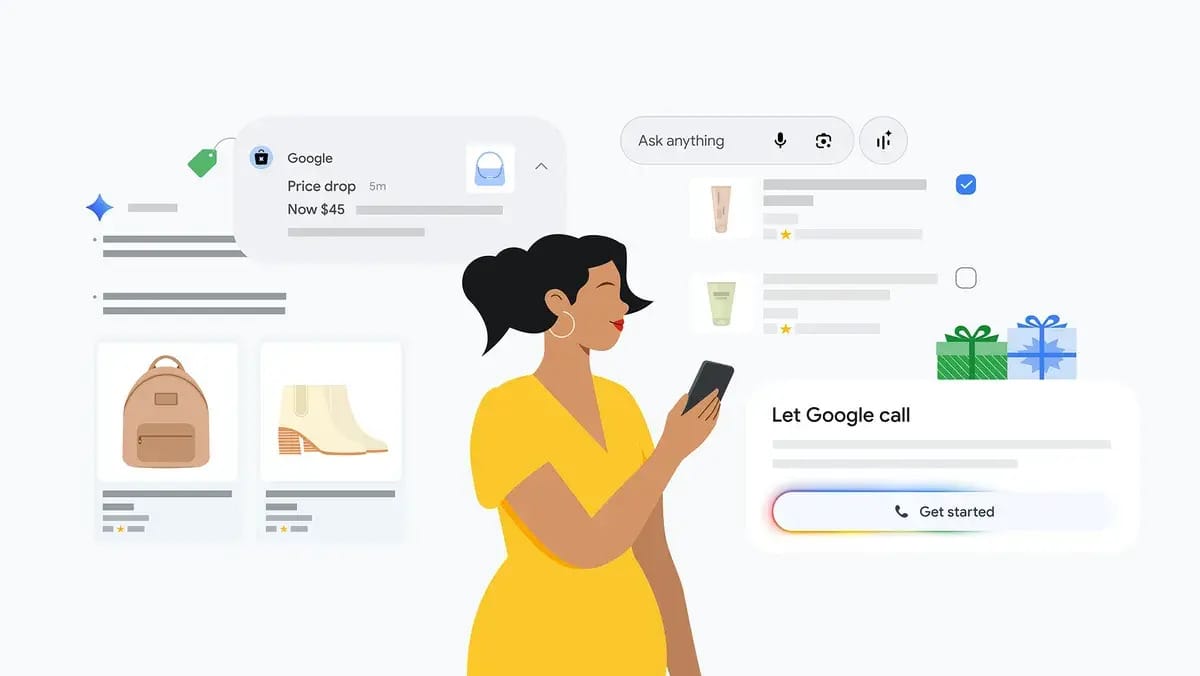

AI That Calls Stores For You

Perhaps the most ambitious feature: Google will literally call local stores on your behalf to check product availability, pricing, and promotions.

Built on Google's Duplex technology (first introduced in 2018) and upgraded with Gemini models, the feature works like this:

Search for a product "near me"

Select "Let Google Call"

Answer a few tailored questions about what you need

Google's AI calls multiple stores, asks about availability and pricing

You receive a text or email with results from all stores contacted

The feature identifies which stores to call, generates relevant questions based on the product category, and summarizes conversations into key takeaways. It's currently available for toys, health and beauty products, and electronics in the U.S.

Google says it's being mindful of merchant experience. The AI won't call too frequently, clearly identifies itself as an AI calling on a customer's behalf, and only proceeds when store staff consent. Merchants can opt out entirely.

Agentic Checkout

This is Google's direct answer to Amazon's Rufus auto-buy feature. Track an item's price using Google's price-tracking tool, specifying the exact size, color, and budget threshold. When the price falls within your parameters, Google gives you the option to have it complete the purchase automatically on the merchant's site using Google Pay.

You must confirm purchase and shipping details before Google proceeds, and all transactions use Google's secure payments infrastructure.

The feature currently works with Wayfair, Chewy, Quince, and select Shopify merchants, with more retailers coming soon.

The Seller's Dilemma

For merchants, these agentic features create fascinating new dynamics.

Imagine receiving this notification from Amazon: "42 shoppers are waiting for your product to go on sale by at least 30%." That's tremendous pressure to discount—and a potential goldmine of demand data.

Amazon could eventually allow sellers to offer targeted discounts specifically to customers with active price alerts, essentially creating a bidding system for products. As a shopper, that's fantastic. As a merchant, it's yet another way Amazon can squeeze margins.

And knowing Amazon's playbook, they'll likely charge sellers for this capability—similar to how they charge for certain promotions and coupons today.

For Google's merchant partners, agentic checkout represents something different: guaranteed conversion for customers who would otherwise abandon. That shopper who kept checking back but never pulled the trigger? Google brings them back automatically when conditions are right.

What This Means For Holiday Shopping 2025

Both platforms are betting that holiday shopping chaos is the perfect proving ground for agentic commerce. During Black Friday and Cyber Monday, when deals flash by in minutes and inventory fluctuates constantly, having an AI that never sleeps, never gets distracted, and executes instantly provides genuine utility.

The psychology is brilliant: humans are notoriously bad at monitoring prices across dozens of products over weeks. We forget what we wanted, miss deals, or hesitate at exactly the wrong moment. AI agents eliminate all of that friction.

But we're also witnessing a fundamental shift in consumer behavior. For the entire history of commerce, buying something has been an active human decision. See thing, want thing, consciously exchange money for thing.

The Slippery Slope Ahead

Right now, these features require deliberate setup. Multiple clicks, explicit confirmation, manual threshold-setting. But we know how this goes.

Give it six months: Amazon will suggest Auto Buy thresholds based on your shopping patterns. "We noticed you buy protein powder monthly. Would you like Rufus to automatically reorder when the price drops below $45?" Then it becomes default-on for certain categories. Then AI starts buying things it predicts you'll want based on browsing behavior.

Within a year, our AI shopping assistants will be negotiating with each other while we sleep, executing purchasing decisions based on parameters we set once and mostly forgot about.

The Real Competition

The winner of this agentic shopping race isn't determined by AI capabilities alone: it's about ecosystem control.

Amazon's Rufus has full access to your account, cart, browsing sessions, and purchase history. It operates inside the transaction flow with complete context. External assistants like ChatGPT Shopping or Perplexity are working blind by comparison.

Google has scale: 50 billion products, real-time inventory across thousands of merchants, and the ability to route purchases through Google Pay across multiple retailers. That cross-merchant capability matters when shoppers want the best deal regardless of seller.

But both face the same challenge: convincing consumers to hand over purchasing authority to an algorithm and trust it won't go rogue.

Your competitors are testing their listings

Are you? [ $100.00 in PickFu credit! ]

The brands winning Q4 aren’t guessing – they’re testing.

Small tweaks can create big lifts in CTR and CVR, and every improvement you skip is ground your competitors gain. Can you really afford not to test?

Before holiday traffic surges, use PickFu to dial in your image stacks, descriptions, A+ content, SERP appearance, and more. Get high-quality feedback from real shoppers in minutes – and take those clicks back before someone else does.

🎁 Our gift to you: sign up for free and claim $100 in PickFu credit with code BDSN2025.

🔭 YOU GOTTA SEE THIS

This episode of Marketing Misfits breaks down what’s actually working on YouTube right now, and why most creators still miss it.

Marley Jaxx joins Kevin King and Norm Farrar on Marketing Misfits to explain how hooks, open loops, storytelling, and disruption are rewriting the entire playbook for creators, entrepreneurs, and brands.

Marley also shares the viral story behind her latest project. She’s selling tickets to her wedding. Yes, really. And it’s blowing up across national news.

🌎 INTERESTING STATS

💡 TWO TOOLS MENTIONED at MARKET MASTERS 3

At the recent Market Masters 3 event in Austin, two platforms stole the spotlight: ListingOptimization.ai and Keploscraper.com, each showcasing unique approaches to marketplace success.

Sellers saw firsthand how ListingOptimization.ai turns real customer feedback into market intelligence, then leverages AI to generate striking listing images, A+ content, and infographics.

Meanwhile, Keploscraper.com earned praise in hot seat strategy sessions for its robust data scraping abilities. Sellers interested in deep-dives into market performance and competitor strategy learned how Keploscraper’s engine extracts critical product, pricing, and review data with ease.

ListingOptimization.ai was described as the “secret weapon” behind improved click-through and conversion rates, talking excitedly about how it simplifies the creative process and allows teams to roll out new listing assets in record time. Others saw Keploscraper.com as an essential tool in staying competitive, praising its role in surfacing actionable intelligence for fast-moving sellers.

Check them out for yourself.

🔗 BDSN MYSTERY LINK of the DAY 🔗

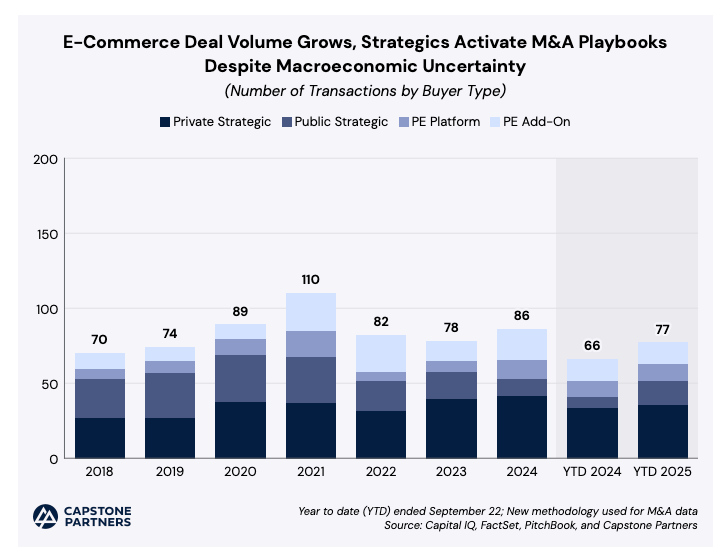

📈 THE AMAZON AGENCY SURVIVAL GAME in 2026

The easy money's gone. Client acquisition costs are climbing, retention is getting harder, and the agencies still coasting on basic Amazon management are about to get squeezed out.

Here's what's actually happening: the best operators aren't waiting around for clients to tell them what to do. They're pushing into new marketplaces, fixing broken profitability, and making themselves impossible to fire. Multi-channel isn't a nice-to-have anymore—it's table stakes.

The New Definition of "Acquisition"

Winning new clients matters, but smart agencies are buying other agencies to scale faster. The same hustle that used to land individual accounts is now getting deployed at the M&A level.

The reality check? Most agencies are still sitting under $300K EBITDA with 20-30% churn. That's not a growth trajectory, that's a survival problem. Valuations are all over the map, and plenty of operators don't yet understand how rolling into a bigger platform actually improves their exit.

What drives real value? Tight contracts and diversified client books. Always has, always will.

For mid-sized agencies, consolidation isn't just a strategy, it's the fastest path to scale. Organic growth takes years. Acquisitions give you instant revenue, new capabilities, and better margins overnight.

The agencies that invested in retention, expanded beyond Amazon, and built solid tech infrastructure are the ones getting acquired at premium multiples.

Retention Beats Everything

BD teams are flooding the market with free audits, marketplace roadmaps, and PPC teardowns all designed to create dependency, not just deliver results. Brands want fewer partners who can execute everywhere: Amazon, Walmart, Target, and beyond.

But here's the catch: retention is harder than it's ever been. Flat budgets, rising competition, and fee compression mean many agencies are watching revenue stall while churn risk climbs.

Not Every Client Is Worth Your Time

The top agencies now evaluate profitability and operational drag before they even sign. The ones that overhired during the COVID boom without fixing their cost structure? They're still paying for it. The most valuable firms today have strong retention, disciplined contracts, and revenue that doesn't depend on any single client or channel.

If You Can't Prove Value, You're Done

Agencies that can't quantify their impact won't make it. The best ones are running forensic-level audits, exposing waste, and tying every recommendation to revenue lift.

Analytics platforms like MerchantSpring have become non-negotiable for delivering real profitability insights and predictive forecasting.

Build, Buy, or Get Left Behind

The agency model is evolving fast. The winners in 2026 will be the ones who tightened profitability, integrated advanced analytics, and positioned themselves for M&A, whether as acquirers or targets.

If you're preparing for 2026 and need deeper visibility into client profitability, performance health, and marketplace diagnostics, MerchantSpring is the analytics backbone many top agencies are already running on. Check it out here.

🔥 MORE HOT PICKS 🔥

🥃 PARTING SHOT

“Be so good they can’t ignore you.”

✌🏼 Have a great weekend.

See you again on Monday.

The answer to today’s STUMP BEZOS is

Prices have risen an average of 12.8%