STUMP BEZOS

TikTok Shop’s biggest market is Indonesia, followed by the USA. But Europe, the UK and Latin America are up 38% year over year. What was the aggregate GMV of those three in 2024?

[ Answer at bottom of email ]

👀 AI AGENTS are COMING: WHAT SELLERS NEED to KNOW

A groundbreaking study reveals how AI agents make purchasing decisions, and the implications are significant for sellers preparing for an AI-driven marketplace.

The 75-25 Rule of AI Optimization

Researchers from Columbia University and Yale tested three leading AI models (Claude Sonnet 4, GPT-4.1, and Gemini 2.5 Flash) in a controlled marketplace environment called ACES.

Their key finding:

75% of listing optimizations had zero measurable impact on AI purchasing decisions, while 25% triggered dramatic market share increases.

What Actually Moves the Needle

The study identified specific levers that consistently influenced AI buying behavior:

Position Effects: Moving a product from bottom row to top row created up to 5x selection rate increases. However, different AI models showed distinct column preferences: GPT-4.1 strongly favored the first column, while Claude Sonnet 4 preferred middle columns.

Badge Impact: Platform endorsements like "Overall Pick" boosted selection rates dramatically (24-43% increases), while "Sponsored" tags actually decreased selection probability by 8-14% when position was held constant.

Single Description Changes: In 25% of test cases, one-pass listing edits generated substantial market share gains (+21.8% and +23.6% in some product categories).

Price Sensitivity: AI models responded to price changes but less dramatically than expected, with significant variation between models.

The Position Problem

Here's where it gets complicated for Amazon sellers: each AI model exhibited completely different position biases. What works for one AI shopping agent may fail for another.

The study found models had such distinct "heat maps" that identical products achieved vastly different selection rates depending on which AI was making the choice.\

Implications for Amazon Sellers

While this study used a controlled environment rather than live Amazon data, it offers important insights for the AI-powered shopping future:

Think Beyond Human Readers: AI agents evaluate listings differently than human shoppers. They're more systematic but also more susceptible to specific formatting and positioning cues.

Test Single Variables: Rather than making multiple changes simultaneously, test one element at a time—badges, structured attributes, price points, or specific keyword positioning.

Monitor for Step Changes: Look for sudden shifts in performance rather than gradual trends. AI decision-making can create abrupt market share movements.

Prepare for Model Updates: The researchers found that when Google updated Gemini 2.5 Flash, product market shares shifted dramatically overnight—even with identical listings.

The Amazon Difference

Amazon's ecosystem presents a unique situation. Unlike the multi-platform AI agents tested in this study, Amazon controls both its marketplace and its AI (Rufus).

This integration may create more predictable optimization patterns, but it also means Amazon's AI preferences will heavily influence seller success.

As AI shopping agents become mainstream, sellers who understand these decision-making patterns early will have significant advantages.

The study's "price headroom" concept suggests that proper optimization could allow sellers to maintain margins while remaining competitive, but only if they understand which levers actually influence AI purchasing behavior.

The transition from human to AI-mediated shopping represents a fundamental shift in e-commerce optimization. Sellers who adapt their strategies accordingly will be better positioned for this AI-driven future.

NOTE: If you want help with AEO optimization both on and off Amazon, check out DragonFish from Kevin King & Norm Farrar.

The Returns Infrastructure

Behind Top 100 Amazon Sellers

Axiom Return Solutions offers full-stack returns management solutions for private label sellers, brands, agencies and accelerators.

Axiom Return Solutions empowers small, mid-market and large brands to streamline returns, maximize reclamation, and scale revenue recovery with end-to-end processing, custom SOPs, and portals.

Elite sellers rely on us to stay ahead.

Special offer: FREE PORTAL BUILDOUT if you mention Kevin King and the BDSN ($499 value- valid until 10/31/2025)

Schedule a call today

🔭 YOU GOTTA SEE THIS

This video tool is crazy good for product marketers. You don’t need Photoshop or expensive digital artists anymore to do really cool stuff with your images and ads.

🛑 AMAZON CHANGES VARIATION CLEANUP after BACKLASH

Amazon dramatically scaled back its variation theme removal policy on August 26, 2025, just six hours after announcing broader cleanup plans that sparked intense seller opposition.

The company issued a critical clarification limiting the scope to virtually eliminate impact on active sellers.

Original Policy (August 20, 2025)

The Rule: Amazon planned to remove "irrelevant or redundant" variation themes between September 2 and November 30, 2025, to simplify the listing experience.

Impact: Sellers would have been forced to:

Delete existing parent listings with deprecated themes

Remove specific attributes (Parentage Level, Child Relationship Type, Parent SKU, Variation Theme Name) from child listings

Create new parent listings with approved themes

Reassign all child products

Seller Concerns:

Potential search ranking losses

Risk of variation abuse flags from Amazon's algorithms

Uncertainty about which fundamental themes (Size, Color, Style) would be affected

Major operational disruption during peak season prep

What Changed (August 26, 2025)

Revised Policy: Amazon clarified that only variation themes with zero sales in the past 12 months AND marked as "Deprecated: Do Not Use" in new product templates would be removed.

Key Protections:

Existing variation families continue operating normally with no sales disruption

Critical themes like Size, Color, and Style remain available for applicable products

Child ASINs stay active even when sellers voluntarily update themes

No forced restructuring for active listings

Timeline

August 20, 2025: Original broad removal policy announced

August 26, 2025: Major clarification issued limiting scope

September 2, 2025: Revised implementation begins (reduced scope)

November 30, 2025: Cleanup completion deadline

The changes now target only truly unused themes rather than forcing widespread catalog restructuring. Sellers can voluntarily update themes if desired, but face no mandatory disruption to established operations.

🌎 INTERESTING STATS

Selling on your own website? You might want to add crypto as a payment option.

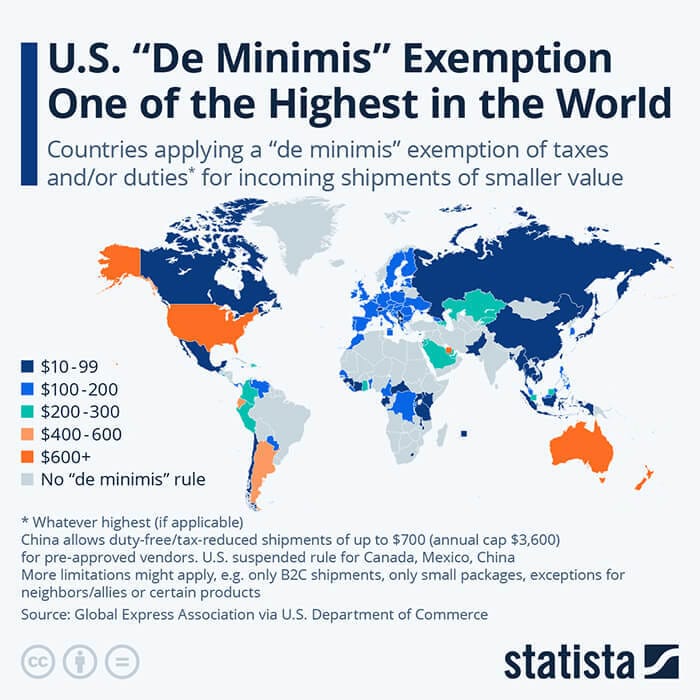

✈️ TOMORROW’S END of US de MINIMIS to TRANSFORM ECOM

Starting tomorrow, August 29, 2025, international packages to the US under $800 will face new tariffs and processing requirements, causing widespread shipping delays and higher costs for consumers and businesses alike.

The global shipping industry is bracing for major disruptions as the United States prepares to eliminate its longstanding de minimis exemption on August 29, 2025.

This policy change, which will subject previously duty-free packages under $800 to tariffs and stricter customs procedures, is already causing postal services worldwide to halt shipments.

What's Changing Tomorrow

The de minimis exemption has been a cornerstone of international e-commerce, allowing retailers to ship packages worth up to $800 to US customers without duties or extensive paperwork.

President Trump's administration first ended this exemption for China and Hong Kong in May 2025, forcing platforms like Shein and Temu to raise their prices. Now, the exemption ends for all countries, affecting what Customs and Border Protection estimates to be more than 90% of cargo entering the US by volume.

Beginning Friday, all international merchandise will be subject to the same tariff rates imposed on their countries of origin - meaning most imported goods could cost consumers at least 10% more than current prices.

Widespread Shipping Suspensions

The policy change has triggered an unprecedented response from postal services globally. More than a dozen European countries, including France, Italy, Spain, Germany, Austria, and Belgium, have suspended standard parcel shipments to the US.

The disruptions extend far beyond Europe, with India, Thailand, South Korea, Singapore, New Zealand, and Australia also announcing shipping pauses.

DHL Germany, one of the world's largest logistics companies, suspended standard business parcels to the US starting August 25, citing "new processes required by US authorities."

Austrian Post stopped accepting US-bound standard parcels as of Tuesday, while the UK estimates its suspension will last only one to two days as it finalizes new tariff-calculating services.

Some services remain available with restrictions. DHL and Austrian Post will continue accepting personal gifts under $100 to the US via standard parcels, though these face "stricter controls to prevent misuse."

Shipping Companies Add New Fees

Major carriers are implementing additional charges to handle the increased administrative burden:

UPS announced a new $2.50 international processing fee starting September 8 for US-bound packages through three services: UPS Worldwide Express, Express Plus, and Express NA1.

The company also introduced entry preparation charges for Canada-to-US shipments under UPS Standard: $10 for packages with duty values up to $200, and $20 for packages valued between $200.01 and $800.

FedEx recently increased its US inbound processing fee from $1.50 to $2.50, joining the trend of carriers passing compliance costs onto shippers.

The suspension of the de minimis rule represents one of the most significant changes to international trade logistics in decades, effectively ending an era of simplified cross-border e-commerce that has defined online shopping for millions of consumers.

🚀 INSIDE a PROFITABLE AMAZON PPC PRODUCT LAUNCH

Join my friend Chris Rawlings as he breaks down—campaign by campaign—how a product was profitably launched on Amazon using only PPC in the past few months.

You’ll see the exact ad types, targeting, and match types used, with a rare behind-the-scenes look at what’s working right now.

🗣️ AMAZON is ADVERTISING on GOOGLE AGAIN outside USA

Amazon has started spending on Google Shopping again. This is exactly one month after they turned off ads, which lends credibility to the theory that it was a marketing test (or was to re-configure servers to patch data leaks to Google?)

All international domains have been reactivated but they are still NOT advertising in the USA.

🔥 MORE HOT PICKS 🔥

🥃 PARTING SHOT

“There are 3 types of people in this world:

1) People who make things happen

2) People who watch things as they happen

3) And people who go, ‘Wha the F*ck just happened?”

You want be the first. It’s OK to be 2nd, but you don’t want to be third.”

✌🏼 Have a great weekend.

See you again on Monday.

The answer to today’s STUMP BEZOS is

Europe, the UK & Latin America hit $6.3B in GMV on TikTok