Access vouchers go on sale in early January

STUMP BEZOS

What percentage of all TikTok Shop sales happen on live streams?

[ Answer at bottom of email ]

💰 AI SHOPPING ASSISTANTS are REWRITING CHINESE ECOM

China's e-commerce landscape is experiencing a seismic shift that could preview the future of online retail worldwide.

After years of social selling dominance through platforms like Douyin and Xiaohongshu, younger Chinese consumers are increasingly bypassing influencers and turning directly to AI for product recommendations.

The Trust Migration: From Creators to AI

Chinese Gen Z and Alpha consumers are losing faith in creator content, viewing it as oversaturated with ads. Instead, they're consulting ByteDance's AI assistant Doubao, which now has over 170 million monthly active users. One student summed up the sentiment: "There are too many ads. I just want an honest answer."

The result? Doubao can provide complete product recommendations with purchase links in seconds, collapsing the entire shopping journey from discovery to checkout into a single interface. This is already wired directly into Douyin Mall, creating the world's most advanced AI-first commerce infrastructure.

What This Means for US Sellers:

The Rise of GEO (Generative Engine Optimization)

Traditional SEO optimized for search engines. GEO optimizes for AI recommendations. Brands must now create content that's structured, verifiable, and machine-readable, not just keyword-rich. As one expert puts it: "Beauty brands need to think like data companies."

AI Is Rewriting Product Visibility

Doubao recently ranked a niche mask from a store with just a few hundred followers above industry giants like Proya and La Roche-Posay. Why? The algorithm rewarded credibility and relevance over brand awareness. This levels the playing field if you generate strong trust signals, AI will push you forward.

Major Brands Are Going All In

L'Oréal, Estée Lauder, and Unilever are embedding generative AI across marketing, R&D, and retail operations. McKinsey projects GenAI could create $9-10 billion in annual value for the beauty industry alone. in 2026 These companies are using AI for:

The Western Wave Is Coming

While Western consumers remain more cautious about AI-driven shopping, the infrastructure is being built faster than most realize. This 2025 holiday season marks a turning point:

AI influenced $73 billion in global sales during the five-day Thanksgiving to Cyber Monday period alone. That's 22% of all holiday shopping now touched by AI in some form, according to Salesforce.

Major retailers launched significant AI shopping capabilities just in time for the holidays:

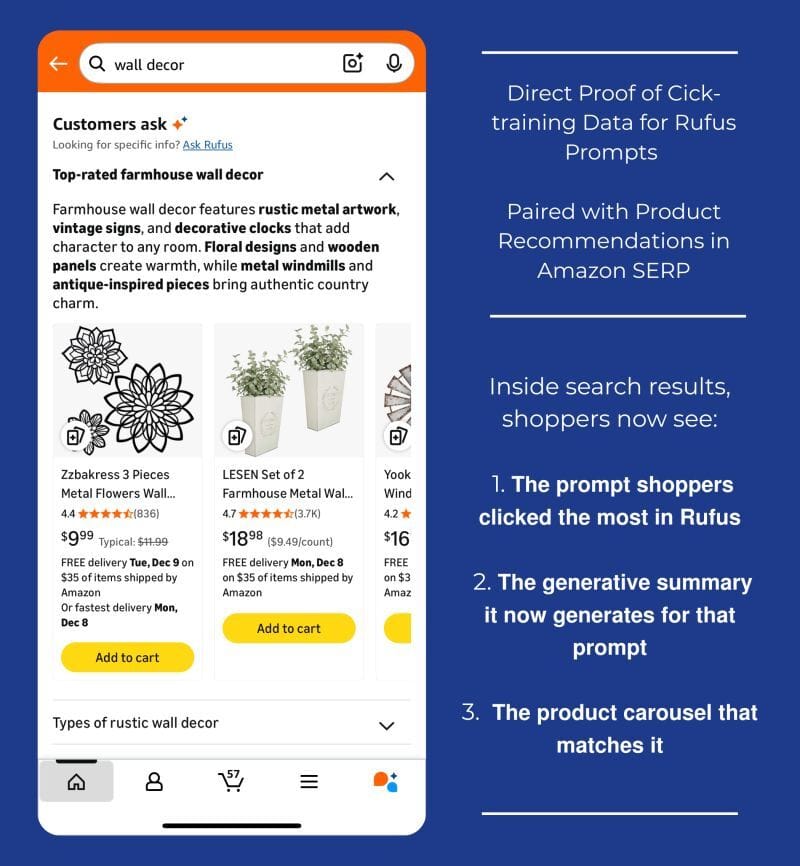

Amazon's Rufus now remembers customer information and can automatically purchase items when prices drop to desired levels through an "auto buy" feature

Walmart partnered with OpenAI to enable direct ChatGPT checkout for nearly everything on its website

Google's AI Mode can call local stores on your behalf to check product availability and includes a "buy for me" option that automatically completes purchases through Google Pay

Target's holiday AI gift finder responds to detailed prompts about recipient age and hobbies

OpenAI's ChatGPT launched instant checkout for Etsy, Shopify brands (Glossier, Skims, Spanx), and Target products

Google's vice president of consumer shopping called it "an expansionary moment for all of technology and for commerce."

The Bottom Line for US E-commerce Sellers:

The shift is no longer theoretical. Start preparing now:

Ensure your product information: ingredients, specifications, usage guidelines, and clinical claims are structured in formats that AI can easily ingest and recommend

Build authentic trust signals beyond paid advertising

Optimize for AI discovery, not just traditional search engines

Make your data machine-readable so AI assistants can accurately represent your products

The platforms that dominate tomorrow's commerce won't just rank products, they'll answer customer questions directly, and your brand needs to be part of that conversation.

China isn't just experimenting with AI commerce. It's already living in the future, and that future arrived in the US this holiday season. As one retail analyst noted: "The more retailers that launch these tools, the better they get, and the more that consumers get comfortable and start to seek them out."

Looking for help optimizing for AI. DragonFish, from Kevin King and Norm Farrar, does exactly that for ecommerce sellers. You can get on the waitlist here when new client spots open up.

🌎 INTERESTING STATS

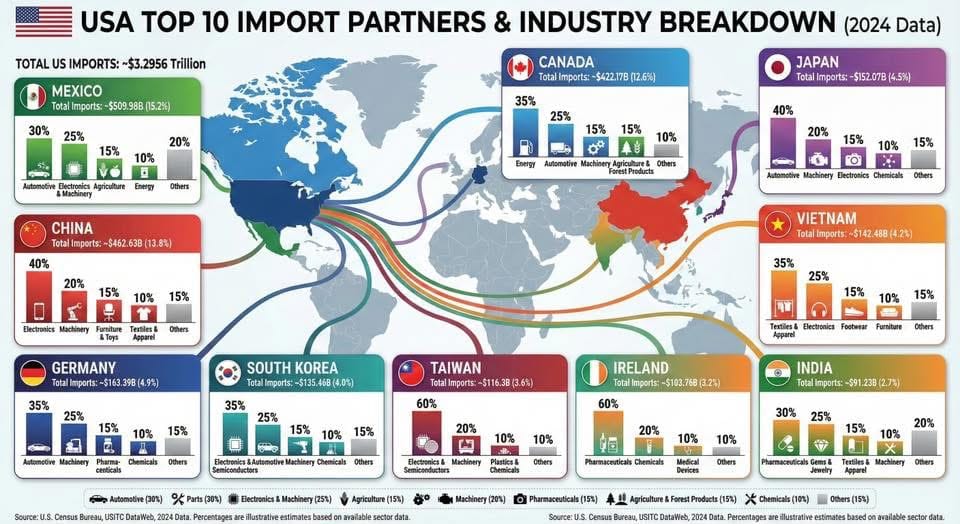

An interesting chart BDSS Dream 100 member Steve Simonson shared

NANO BANANA PRO GUIDE

This Nano Banana Pro guide is getting passed around the Amazon seller community like the town bicycle:

Google’s Nano Banana Pro AI is the first AI that big sellers and aggregators are using to generate high converting listing images for their top selling products

… and this guide (written by my buddy Chris Rawlings) shows you exactly how to use Nano Banana Pro to generate all your listing images (even the graphic design ones) with no graphic designer, no photographer, in minutes.

🇨🇳 CHINESE SELLERS FLEE AMAZON due to TAX CRACKDOWN

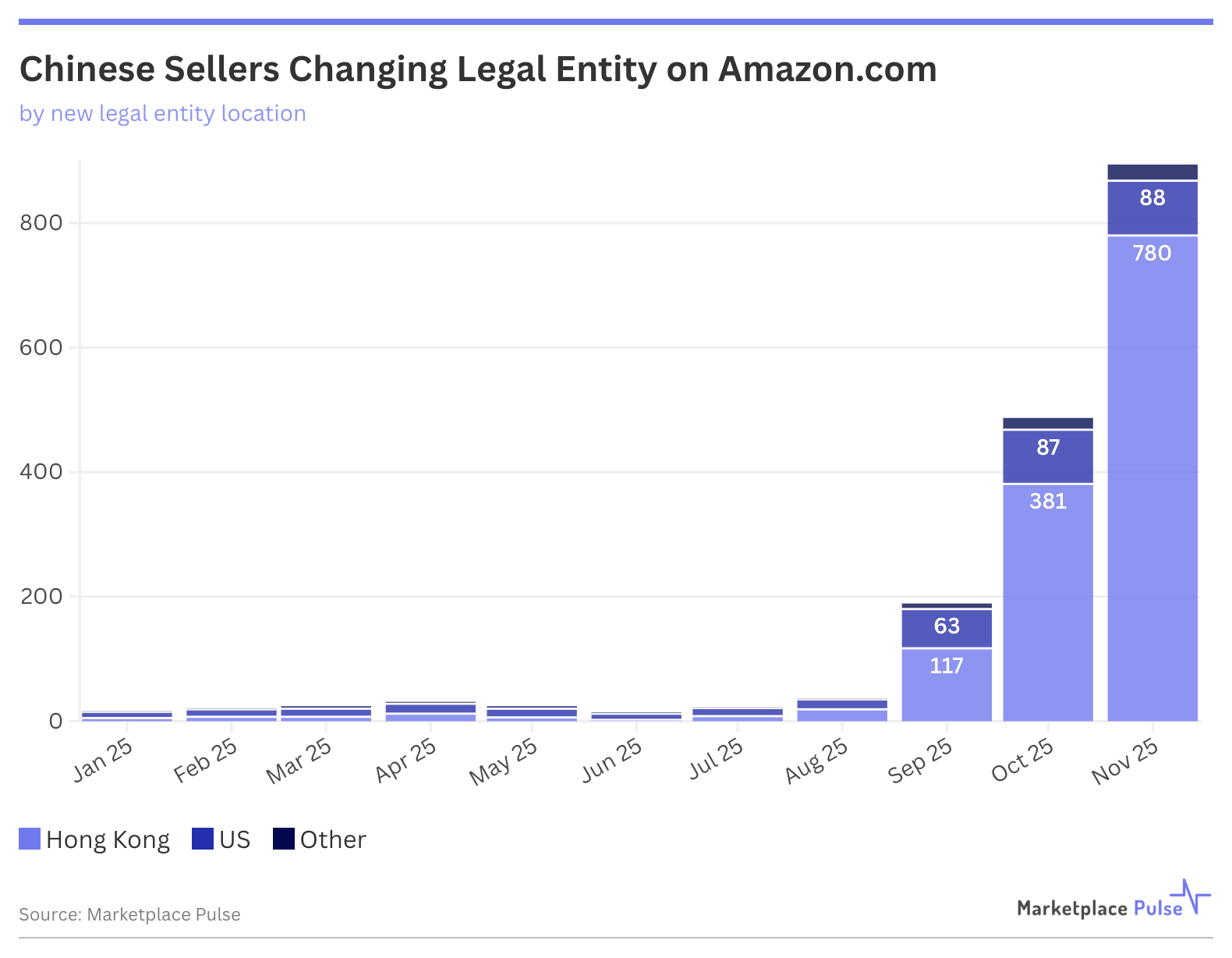

Over 3,000 Chinese sellers have relocated their Amazon businesses to Hong Kong since mid-2025, according to Marketplace Pulse. This dramatic surge signals a fundamental shift in how Beijing treats its e-commerce exporters.

While it’s still less than 1% of roughly 300,000 active Chinese sellers on Amazon, the exodus accelerated sharply after October 31, 2025, when China's State Council Order No. 810 forced platforms to submit the first quarterly reports on seller identity, transactions, revenue, and fees.

The Hong Kong Advantage — On Paper

The appeal is clear. Mainland China taxes resident enterprises on worldwide income at 25%, while Hong Kong's territorial system only taxes locally sourced profits at 8.25% on the first HKD 2 million, then 16.5% thereafter. No VAT. No sales tax. No capital gains tax.

Marketplace Pulse estimates that 75% of relocating sellers generate under $1 million annually, with another 19% in the $1-5 million range, precisely the cohort most vulnerable to margin compression from sudden tax enforcement.

But Relocation May Not Provide Real Protection

Chinese regulations target "China-based sellers" regardless of where they're registered. Under China's "Place of Effective Management" principle, authorities can claim tax jurisdiction over Hong Kong companies whose actual operations or controllers remain on the mainland.

Bloomberg reported that Chinese sellers commonly route goods through mainland firms to Hong Kong entities to sidestep corporate taxes, but information barriers are eroding under the Common Reporting Standard, which allows Chinese tax authorities to access Hong Kong bank account data for Chinese tax residents.

A Fiscal Shift with Competitive Implications

As Bloomberg observed, "China's need for fiscal revenue overpowers its desire to support smaller exporters who have been roiled by Donald Trump's new tariffs." For decades, Beijing treated international e-commerce entrepreneurs with leniency to grow global market share, helping Chinese sellers expand to over 50% of Amazon's active base.

Now, sellers amending filings to match platform data could face back taxes that "wipe out profit margins," Bloomberg reported.

For U.S. sellers who've long competed against Chinese operations leveraging structural tax advantages and regulatory arbitrage, this enforcement could finally level the playing field, not through Washington trade policy, but through Beijing's revenue needs.

🛠️ BDSN SOFTWARE TOOL of the DAY 🛠️

This vibe-coded tool is a fully functional, enterprise-grade tool that solves the biggest headache in Amazon PPC: Search Query Performance (SQP) analysis.

Traditionally, building something like this takes a product manager, a designer, two engineers, and 3 months. I did it was done in one hour using "Vibe Coding."

✅ Instant Ingestion: Drag & drop raw SQP files (no more 50MB Excel crashes).

✅ Auto-Categorization: AI instantly groups thousands of search terms into logical niches.

✅ The "Vibe" Matrix: A Bubble Chart visualizing High Volume vs. Low Share opportunities in seconds.

🎥 END of an ERA - FINAL AM/PM PODCAST HOSTED by KEVIN

The AM/PM podcast was the first podcast I listened to regularly when I started selling FBA on Amazon in 2015. In June 2022, I took over and hosted 183 weekly episodes.

After 9½ years, my contract with Helium 10 ended last week. No more AM/PM podcasts hosted my me, no more hosting Helium 10 Elite (but I do have my own monthly mastermind at BDSC for $9, and no more new versions of Freedom Ticket from me.

The first episode I hosted, #294, featured one of the co-founders of Helium 10, Manny Coats. This last episode features the other co-founder, Guillermo Puyol.

In this emotional final episode, Kevin welcomes Guillermo Puyol, the brilliant, behind-the-scenes architect who helped transform a small side project into one of the most influential software companies in e-commerce, co-founder of Helium 10.

Kevin and Gui go deep into the real origin story of Helium 10, to the creation of early Helium 10 tools like Scribbles and Frankenstein, to the unexpected momentum that led to hockey-stick growth … and ultimately, a life-changing exit.

Along the way, they share never-before-told stories:

Manny Coats nearly being “kidnapped”

Why the AM/PM Podcast existed before Helium 10

The infamous April Fools episode that caused chaos

The first Illuminati mastermind and the rise of Helium 10 Elite

The emotional whiplash after selling a company

And why both of them are now back in the startup trenches with AI

This episode is part history, part entrepreneurship masterclass, and part heartfelt goodbye as Kevin concludes his 3.5-year run as host, marking 180+ episodes.

Reach page 1 on Amazon simply by sending free products to Micro-Influencers

Use the platform Stack Influence to automate Micro-Influencer product seeding collaborations at scale (get thousands of collabs per month) and increase your Amazon ranking, generate UGC, and boost up your recurring revenue like never before.

Top Amazon brands like Magic Spoon, Unilever, and MaryRuth Organics have been able to get to #1 page positioning on Amazon and increase their monthly revenue as high as 13X in as little as 2 months.

Pay influencers only with products (stop negotiating fees)

Increase external traffic Amazon sales (get to top page rankings)

Get full rights image/video UGC (build your brand with authentic content)

100% automated management (don’t lift a finger to get influencer collabs at scale)

Don't believe it? Check out the results from the Blueland Micro Influencer campaign which generated a 13X ROI scaling up influencers on Amazon.

After successfully raising investment on Shark Tank, Blueland turned to Stack Influence to boost their Amazon sales and become a top selling listing using Micro Influencer marketing.

Increase your Amazon listings ranking for targeted keywords and multiply your organic recurring revenue in 2025!

Get 10% OFF by signing up this month

🗜️ CHATGPT 2ND LARGEST PRODUCT DISCOVERY PLATFORM

A seismic shift is underway in how consumers discover products online. According to new data from Euromonitor International, ChatGPT has surged to become the second most-visited product discovery destination in the United States, trailing only Amazon.

The behavioral change is clear: Shoppers are increasingly asking AI assistants for recommendations rather than typing queries into traditional search bars. This shift is redirecting billions of dollars in purchase intent away from conventional retailers and into conversational AI platforms.

Daily Visitor Traffic: Top Product Discovery Platforms

Platform | Daily Visits |

|---|---|

Amazon | 108.49M |

ChatGPT | 52.2M |

Walmart | 19.12M |

eBay | 16.59M |

Apple | 16.25M |

Home Depot | 8.15M |

Target | 7.61M |

CVS | 6.64M |

Best Buy | 5.1M |

Costco | 3.81M |

Kroger | 3.16M |

While this trend might feel intimidating, top SEO practitioners are already adapting. The key insight: Answer Engine Optimization (AEO) and Generative Engine Optimization (GEO) aren't separate disciplines, they're built on the foundation of strong traditional SEO practices.

Before chasing advanced AEO tactics, ensure your SEO fundamentals are rock-solid. Get the basics right first, and you'll be positioned to capitalize as conversational commerce continues its rapid growth.

The question every seller needs to ask: Is your brand ready for a world where product discovery starts with a conversation instead of a search bar?

🔥 MORE HOT PICKS 🔥

🥃 PARTING SHOT

“Failure is a lesson learned. Success is a lesson applied.”

✌🏼 See you again Thursday …

The answer to today’s STUMP BEZOS is

30% of all TikTok Shop sales happen on live streams