STUMP BEZOS

Trump is pushing India to open up its e-commerce market to American companies like Amazon and Walmart. How much is the annual GMV of e-commerce in India?

[ Answer at bottom of email ]

Liran Hirschkorn is the latest inductee into the Billion Dollar Dream 100.

It was early 2017 in Atlanta, Georgia. I was at the Seller Labs Resonate conference hosted by Jeff Cohen, and there was a guy sitting at the hotel lounge bar laying down wood about Amazon strategies.

That was my first time meeting Liran, and I was impressed. He was a seller at the time, having exited a life insurance firm in 2014 to focus on e-commerce.

He would later go on to found Incrementum Digital in 2020 based on his selling experience, growing it to one of the top PPC and branding agencies now with a roster of over 140 Amazon brands.

Now an “OG” in the space, he along with Brandon Young, used to set people straight in the early day Amazon Seller Facebook groups. He was actively providing advice, and would call out scammers and bullshitters.

For several years, Liran would never leave a dm or question unanswered - he was always ready to serve other sellers. He is known for his commitment to integrity, honesty and transparency in business practices.

He’s a proud husband and father, and while he has stepped back bit and does not speak as much at events anymore, his impact and legacy remains. The influence he has had on a lot of sellers has changed lives.

Please welcome Liran to the elite BDSS Dream 100 (see the others here).

🔭 YOU GOTTA SEE THIS

Microsoft CEO Satya Nadella discusses the future of technology, predicting the decline of traditional apps and the rise of AI-powered agent experiences.

🇨🇳 FRIDAY END of ERA for LOW COST CHINESE SHIPMENTS

Tomorrow the De minimis exemption for shipment of under $800 no longer applies to China. The current tariff rate, or a per-postal-item duty of $100 through 6/1 and $200 beyond 6/1 will apply. This effectively eliminates a lot of low value shipments sent directly from China to the USA. According to Yale and UCLA economists, 48% of shipments under that $800 threshold went to the poorest zip codes in the US

Temu and Shein products sourced from China will be hit with a high tariff plus a $100 fee per postal item starting on Friday. Shein jacked up the cost of one item—thick kitchen cleaning towels—by 377%, from $1.28 to $6.10, between April 24 and April 25.

Temu has started adding “import charges” of about 145% in response to the tariffs.

The fees, which began cropping up over the weekend, cost more than the individual products consumers are buying and can more than double the price of a typical order.

For example, a summer dress sold on Temu for $18.47 will cost $44.68 after $26.21 in import charges are added to the bill, a 142% surcharge, a CNBC analysis shows. A child’s bathing suit priced at $12.44 will cost shoppers $31.12 when the $18.68 import charge is taken into account, a staggering 150% fee. A handheld vacuum cleaner listed at $16.93 now costs $40.11 when factoring in an import charge of $21.68, which is a roughly 137% markup.

Temu has been promoting products that ship from local warehouses over those that ship directly from China. That trend has only ramped up as the company hikes prices and adds extra fees.

For example, a scan of Temu’s “lightning deals” page on Monday showed more than 75% of the products offered had a “local” tag on them. When consumers click on the items, a bright green banner with the words “no import charges” is highlighted at the top.

Check all the latest tariffs and rule with this Tariff Tracker

Tariffs Trigger a 60-65 % Collapse in China-to-US Ocean Freight—Empty Shelves Could Bite by Late June

Imports out of China have fallen off a cliff since the White House slapped a 145 % duty on virtually all Chinese goods in early April. Flexport data show bookings from China to the U.S. West Coast are down roughly 60-65 % just three weeks after the tariffs hit, and carriers have “blanked” (canceled) about 80 sailings—almost 60 % more than the worst month of the 2020 crunch.

The Port of Los Angeles, America’s main gateway for Chinese cargo, expects one-third fewer vessel calls next week than a year ago. That drop represents roughly 45 % of LA’s normal throughput, putting a deep dent in the consumer-goods pipeline.

Port Executive Director Gene Seroka warns retailers have “five to seven weeks” of inventory cushion left—after that, choice will shrink and prices are likely to rise.

Big-box CEOs from Walmart, Target, and Home Depot are already flagging risks of spot shortages and higher price tags to the Administration. Even if tariffs are rolled back, a sudden restart could jam ports not designed for stop-start surges, further delaying restocks.

Treat the next 60 days as a live-fire stress test. Sellers who diversify supply, secure space, and plan price moves today will be the ones with inventory—and buybox control—when competitors run dry.

Turning your Amazon PPC actually profitable means installing a PPC Data Loop.

Tap here to see if you qualify to have Sophie fix your PPC

and install a PPC Data Loop into your brand

🌎 STATS YOU SHOULD KNOW

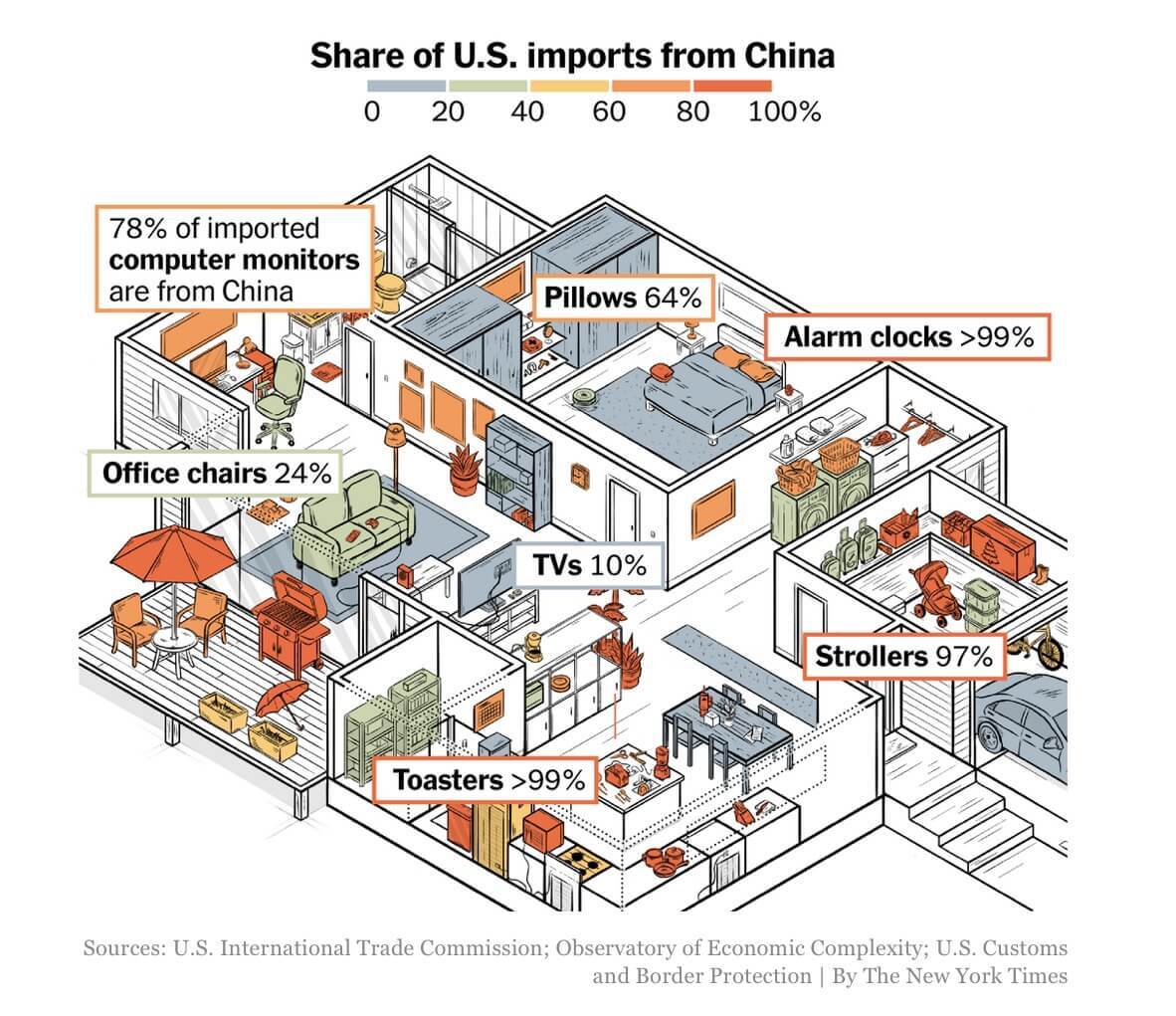

The New York Times took a look at every day common objects in the rooms of the average US household, and showed what percentage of items come from China.

Click here to zoom in and see a lot more items than what is shown below.

If you are a mid 7-figure or above seller, you are invited to join us at this exclusive dinner.

It’s happening May 20 at Urban Hill in Salt Lake City, Utah, the night before the Pattern Accelerate 2025 conference begins with 2,000 people from the most successful e-com brands in the world in attendance.

You can register for the dinner here (no charge):

The power of networking at this dinner will be off the charts.

Plus, if you would like to join me at the conference, you can use code KEVIN15 to save 15% off the ticket price.

Checkout the line up of speakers, including Daymond John, Neil deGrasse Tyson, Destaney Wishon, Scott Needham, Rob Hahn and many more of the biggest e-com and DTC moves and shakers, many you don’t see at other Amazon events.

🛍️ OPENAI TURNS CHATGPT into a SHOPPING ENGINE

What’s new?

Product cards inside ChatGPT. When a user’s query shows buying intent (“best gifts for a gamer”), ChatGPT now returns shoppable product recommendations—complete with images, price ranges and outbound links. OpenAI stresses these are not ads, but organic results chosen by its model.

Shopify checkout strings spotted. Developers found new code (“

buy_now”, “shopify_checkout_url”, shipping + rating fields) that point to a native Shopify purchase flow embedded in ChatGPT. Shoppers could complete checkout without ever leaving the chat.Discovery-first crawler. Any merchant’s catalog can surface—so long as you allow the new

OAI-SearchBotinrobots.txt. OpenAI is also opening a product-feed wait-list for richer data ingestion.

Don’t block the bot. Check every brand domain’s

robots.txttoday—User-agent: OAI-SearchBotshould be allowed.Clean your catalog. Structured attributes, consistent variant naming, and rich review data will likely influence ChatGPT ranking—just like they already power Amazon’s Cosmo & Rufus models.

Mirror listings outside Amazon. A Shopify mini-site (or other feed-friendly DTC CMS) gives you a second bite at discovery while Amazon handles FBA fulfillment.

Expect AI-native ads next. Microsoft’s Copilot and Perplexity already let users buy in-chat; Amazon is piloting “Buy for Me.” Treat this as a signal that conversational commerce is the next battleground—optimize now or pay higher ad rents later.

Bottom line: Conversational AI is morphing from a research helper into a full-funnel marketplace. The sooner your product data is ready for machines—not just humans—the better you’ll rank whether the cart lives on Amazon, Shopify, or inside ChatGPT itself.

75% of shoppers don’t go past the first page of Amazon when searching. How do you outrank your competitors?

To beat out your competitors in 2025 it’s necessary for Amazon brands to heavily invest in external traffic strategies.

One of the best external traffic platforms is Stack Influence which uses A.I. and a dedicated community to automate thousands of collaborations per month to help you increase your Amazon external traffic, generate UGC, and scale your recurring revenue like never before.

Top Amazon brands like Magic Spoon, Unilever, and MaryRuth Organics have been able to get to #1 page positioning on Amazon and increase their monthly revenue as high as 13X in as little as 2 months.

Pay influencers only with products (stop negotiating fees)

Increase external traffic Amazon sales (get to top page rankings)

Get full rights image/video UGC (build your brand with authentic content)

100% automated management (don’t lift a finger to get influencer collabs at scale)

Don't believe it?

Check out the results from the Blueland Micro Influencer campaign which generated a 13X ROI scaling up influencers on Amazon.

After successfully raising investment on Shark Tank Blueland turned to Stack Influence to boost their Amazon sales and become a top selling listing using Micro Influencer marketing.

Increase your Amazon listings ranking for targeted keywords and multiply your organic recurring revenue in 2025!

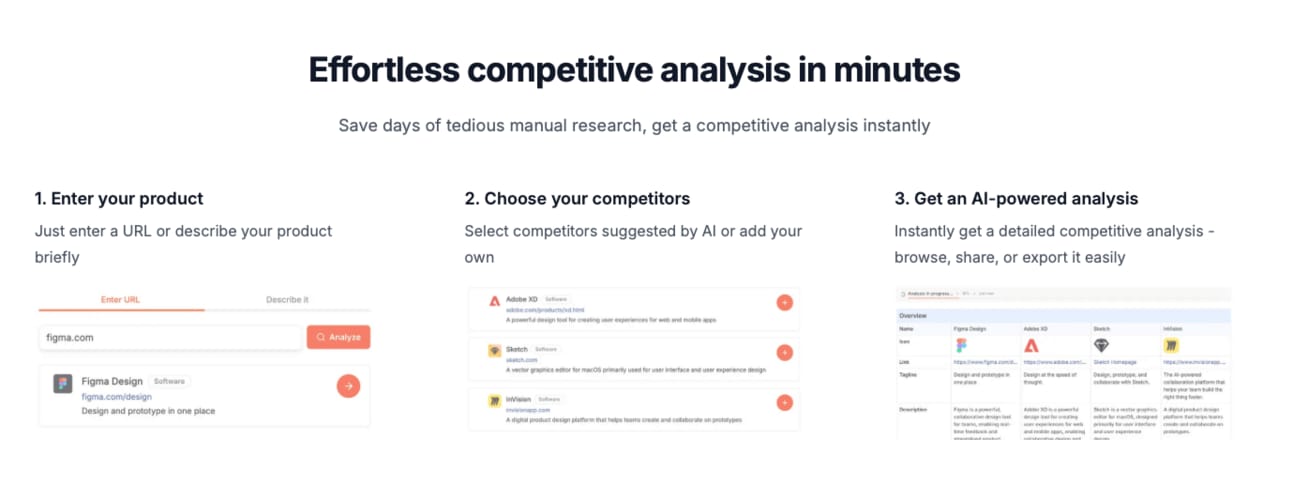

⚒️ 1-CLICK SPY EXPOSES AMAZON RIVALS’ SECRETS

This AI tool isn’t built only for Amazon, but it slots neatly into your launch, pricing-and-positioning and competitor-monitoring workflows.

One-click competitive landscape – drop in your product’s URL (yes, you can paste an Amazon ASIN page) or a short description and the AI instantly suggests rival products/brands, then builds a side-by-side report.

How you could use it: Saves the 20-50 hours you’d normally spend hopping between Helium 10, Keepa charts, and Google hunting for off-Amazon intel. Use the time to optimize your listing or film TikTok content instead.100 + data-point comparison – messaging hooks, feature matrices, pricing tiers, review sentiment, target personas, funding history, market-size estimates, and a full SWOT for every competitor.

How you could use it: Lets you spot the gap: e.g., if every top competitor leans on “sugar-free” but nobody mentions “adaptogen-powered,” you’ve just found a differentiator for your bullet points and A+-contentOngoing tracking & AI summary emails – schedule a fresh scrape weekly, bi-weekly, or monthly; the tool flags pricing moves, new feature launches, or messaging tweaks.

How you could use it: Early-warning system: notice a rival’s sudden 20% price drop or BSR spike before your PPC costs climb. You can react (coupon, reprice, or run external traffic) before sales slip.

Day-to-day Amazon use cases:

Listing optimization: Borrow your competitors’ highest-converting value propositions and review language to craft benefit-rich bullets and storefront copy.

Price & bundle decisions: Check how competitors structure tiered bundles or subscribe-&-save discounts so you can price to win margin and Buy-Box share.

Launch prep: Before a new SKU goes live, run Competely to uncover missing features or unaddressed pain points you can highlight in your hero image and video.

Agency/client reporting: If you manage multiple brands, bulk-generate analyses to back up strategy decks with hard numbers instead of gut feel.

Outside-Amazon expansion: Because the crawl pulls data from brand sites and social channels, you get ideas for DTC positioning, influencer networks, and ad angles you can mirror off-platform.

Competely.ai is a lightweight, AI-powered competitor-intelligence assistant.

It won’t replace Helium 10’s keyword depth or sales estimates, but it does fast-forward the “who am I really up against and how do I beat them?” step—so you can adjust pricing, creative, and launch strategy before the market tells you the hard way.

🔥 MORE HOT PICKS 🔥

🥃 PARTING SHOT

“Winners focus on winning. Losers focus on winners. You never receive hate from above, only from below, because winner have their eyes on the goal.”

✌🏼 Have a great weekend.

See you again on Monday.

The answer to today’s STUMP BEZOS is

About $125 billion of e-commerce is done annually in India